Someone going to blast Ramjade for waiting game again 😅

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Sep 22 2018, 04:11 PM Sep 22 2018, 04:11 PM

Return to original view | Post

#61

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

Someone going to blast Ramjade for waiting game again 😅

|

|

|

|

|

|

Sep 26 2018, 07:09 PM Sep 26 2018, 07:09 PM

Return to original view | Post

#62

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

|

|

|

Sep 27 2018, 10:52 AM Sep 27 2018, 10:52 AM

Return to original view | Post

#63

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

QUOTE(Ancient-XinG- @ Sep 27 2018, 08:53 AM) REITS I reenter to test market. but too bad. it's not performing. O, I see.India is residual from 2 years back. dint sell. just let it be. 25 global isn't just tech. global for me is united quality, tech, and bimb global dividend. Think it's good to have the 25% global split to 3 funds also for lesser volatility as they are now on peak return I also invest in india, although now it drop badly because of the depreciation of it's rupees But will still hold it and see |

|

|

Sep 27 2018, 09:40 PM Sep 27 2018, 09:40 PM

Return to original view | Post

#64

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

ASBN is launching two new funds, interesting one is asn equity 5, open for all Malaysian.

What do you guys think about this, worth while during this volatility period? |

|

|

Sep 28 2018, 10:31 AM Sep 28 2018, 10:31 AM

Return to original view | Post

#65

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

|

|

|

Sep 28 2018, 02:41 PM Sep 28 2018, 02:41 PM

Return to original view | Post

#66

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

Agree, don't know what happened to their management team.

Cimb investment is doing much better among my holding porfolio |

|

|

|

|

|

Sep 28 2018, 04:06 PM Sep 28 2018, 04:06 PM

Return to original view | Post

#67

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

QUOTE(WhitE LighteR @ Sep 28 2018, 03:58 PM) Agreed. Ha, seems now is the hard time for most investors unit trust no no, real estate no no, stocks headache, reit uncertain, P2P high risk base on current economy China and Asia in general still looks bad. Malaysia seems trying to get better but still can go either way too. US I safest bet but what if it's the top already? So might not be wise to go in too... Conclusion stay out? may be just epf, asm and bond funds is better bets This post has been edited by ehwee: Sep 28 2018, 04:07 PM |

|

|

Sep 28 2018, 06:26 PM Sep 28 2018, 06:26 PM

Return to original view | Post

#68

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

QUOTE(smokymcpot @ Sep 28 2018, 05:52 PM) Haha, interesting opinions zero SC? no point buying today then tomorrow drop 1%Just wondering, if you were given zero sales charge, would you still bite the bullet and purchase a fund or just wait it out for a better time and forgo the zero sales charge? I believe apac stock market even china main land haven't bottom yet, better wait till the Trumpy election dust settle This post has been edited by ehwee: Sep 28 2018, 06:26 PM |

|

|

Oct 1 2018, 05:43 PM Oct 1 2018, 05:43 PM

Return to original view | Post

#69

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

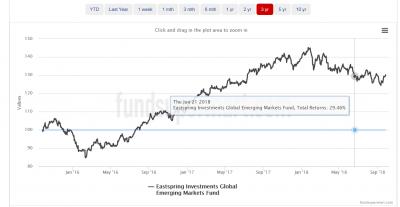

QUOTE(MUM @ Oct 1 2018, 11:27 AM) Promotion Ha, good definition indeed In marketing, promotion refers to any type of marketing communication used to inform or persuade target audiences of the relative merits of a product, service, brand or issue. The aim of promotion is to increase awareness, create interest, generate sales or create brand loyalty. https://www.google.com/search?q=promotion+o...chrome&ie=UTF-8 DEFINITION of 'Blanket Recommendation' A situation in which a financial professional or institution sends a recommendation to all clients to buy or sell a particular security or product, regardless of whether or not the particular asset is compatible with the client's investment goals, objectives and risk tolerance. Read more: Blanket Recommendation https://www.investopedia.com/terms/b/blanke...p#ixzz5Se8oJXYC currently Eastspring Emerging Fund is trapped at it 1 year low rang since mid June

for whom confidence of these countries's economy strength may be can considered give the promotion a look??

|

|

|

Oct 2 2018, 11:36 AM Oct 2 2018, 11:36 AM

Return to original view | Post

#70

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

Holding bond funds instead of just holding cash is a good choice now as it does stabilize my portfolio, help to reduce the loses

This post has been edited by ehwee: Oct 2 2018, 11:37 AM |

|

|

Oct 2 2018, 12:39 PM Oct 2 2018, 12:39 PM

Return to original view | Post

#71

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

|

|

|

Oct 5 2018, 04:27 PM Oct 5 2018, 04:27 PM

Return to original view | Post

#72

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

QUOTE(MUM @ Oct 4 2018, 05:49 PM) anyone noticed the Manu india for the past 1 month? QUOTE(Ancient-XinG- @ Oct 4 2018, 06:53 PM) very bad Manu India drop more than 11% since Sep till more US stock market and Nasdaq drop quite heavy yesterday too |

|

|

Oct 6 2018, 10:12 AM Oct 6 2018, 10:12 AM

Return to original view | Post

#73

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

|

|

|

|

|

|

Oct 7 2018, 02:30 PM Oct 7 2018, 02:30 PM

Return to original view | Post

#74

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

QUOTE(nexona88 @ Oct 7 2018, 12:55 PM) Slow slow can go into India Ya, if invest into India, it's better do it as long term invest, if one expect less than a year good return, pls looks else where.They among the biggest market in the world.. Population getting bigger by the year 😎 This post has been edited by ehwee: Oct 7 2018, 05:14 PM |

|

|

Oct 7 2018, 09:52 PM Oct 7 2018, 09:52 PM

Return to original view | Post

#75

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

QUOTE(Ancient-XinG- @ Oct 7 2018, 08:32 PM) is there something not right with the web page? usually when I logged out and wish to log in again, I will need to type in all id and password again. but this time around, when I clicked login, it login in automatically without type id and password. I confirm I don't have "remember my password" in my browser. anyone having the same issue? QUOTE(yklooi @ Oct 7 2018, 09:09 PM) no idea,...usually, after I logged out, I will click on FUND to go read the main site. The best practice every time after logout from fsm or online banking is straightly clear the browser cachethis is the 1st time I clicked "Login again" This is the best safety precautions This post has been edited by ehwee: Oct 7 2018, 09:52 PM |

|

|

Oct 9 2018, 11:46 AM Oct 9 2018, 11:46 AM

Return to original view | Post

#76

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

QUOTE(chongteck @ Oct 8 2018, 10:39 PM) Having around 10 funds, spread around all classes. For me I think instead of asking how many funds to hold, it's more important to ask how many sectors, countries or regions your funds are targeting to.Some people say too many. Is there any guide on how many funds are recommende to be kept as portfolio at any one time? :confused: How much holding ratio you plan for each of this sectors, countries or regions to balance up the total expect earnings return and risks you can take. For example, if you plan to invest 30% Malaysia 30% APAC 30% US 10% bond funds, then you can select one fund for each regions Or you can also invest in 2 or more funds that invest in the same regions like if 30% Malaysia, you can invest 10% each into Kenanga Growth, Eastspring small cap and Affin Hwang Select Opportunity fund to spread your holding risks on the particular regions May be i am wrong, but so far especially on volatility period like now my portfolio strategy did help to buffer the losses and maintain certain degree of earnings too. This post has been edited by ehwee: Oct 9 2018, 11:47 AM |

|

|

Oct 11 2018, 10:43 AM Oct 11 2018, 10:43 AM

Return to original view | Post

#77

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

A test for our risks holding power 🙄

Hold? Run? OR Invest some more LAGI !! Mari Mari, Banyak Rendah Now |

|

|

Oct 11 2018, 01:32 PM Oct 11 2018, 01:32 PM

Return to original view | Post

#78

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

Man, today market RED blood made me very exciting lol

This post has been edited by ehwee: Oct 11 2018, 01:33 PM |

|

|

Oct 11 2018, 01:40 PM Oct 11 2018, 01:40 PM

Return to original view | Post

#79

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

|

|

|

Oct 12 2018, 02:03 PM Oct 12 2018, 02:03 PM

Return to original view | Post

#80

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

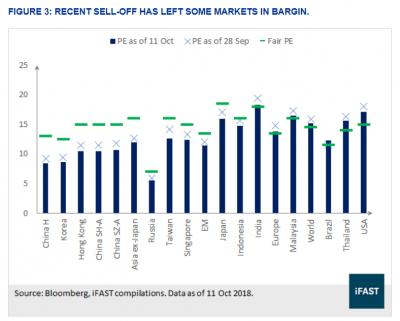

QUOTE(xuzen @ Oct 12 2018, 11:16 AM) Market drop drop drop... ada naik, mesti ada turun. Just like ocean tide, if there is no high tide and low tide, a lot of natural things in this world cannot jalan liao. Dear Padawan, be unmoving like the mountain. BTW, if you see our beloved TA tech drop 25% suddenly, don't panic, don't jump from top of Komtar tower ok? It is just a 4:1 unit split nia... stay calm and continue to DCA. And ... I did a quick look at the data, the fundamental does not change. This is all emotional thingy. I will deploy my FI protion into the same percentage, that is to say, to make my portfolio have: I) TA Tech @ 20% II) M'sia Large Cap @ 25% III) Selina Reits @ 25% IV) Asnita bond @ 30%. I am sure my Asnita bond % would have increase due to these few day's equities rout. Time to " sell high, buy cheap" .... Xuzen P/s I will never know when is the cheapest, but I know now is cheaper than previously. Some called this averaging down. QUOTE(MUM @ Oct 12 2018, 11:26 AM) with the rumuors abt the capital gain tax and this.... "...closer to home, Malaysian investors are caught in the midst of foreign tides and domestic quakes yet again (remember what happened in June?). The government has announced several measures that could affect bottom-line of numerous companies, encouraging stiffer competitions within the telco sector, and its plan to scale back its equity in listed Government-linked Companies (GLC). At this juncture, we think foreign investors are not looking back into Malaysia just yet, given that policy variability is still on the table and the lack of clarity on government’s direction pending Budget 2019, which is expected to be announced on 2 November. As government decides to scale back its equity holdings without further details on its move, local investors are left with fear of ending up in a “sinking ship”. As a result, many telco companies, including those with significant number of outstanding shares held by government entities, were battered heftily. The sell-off in US stocks overnight only exacerbated the pain." https://www.fundsupermart.com.my/main/resea...out-Today-10273 maybe it will be worth while to re algozen?

Ya, as shown on FSM latest article, Malaysian stock market PE is still hovering around its Fair PE. As compare to Mainland , HK and other APAC countries PE that where below their respective Fair PE, should we DCA into Malaysian funds merely due to last few days big droppings? May be holding our current Malaysian funds without topping up until our financial minister disclose the new Budget on coming early November is better option. This post has been edited by ehwee: Oct 12 2018, 02:03 PM |

| Change to: |  0.0662sec 0.0662sec

0.70 0.70

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 06:22 PM |