QUOTE(MUM @ Dec 3 2021, 04:09 PM)

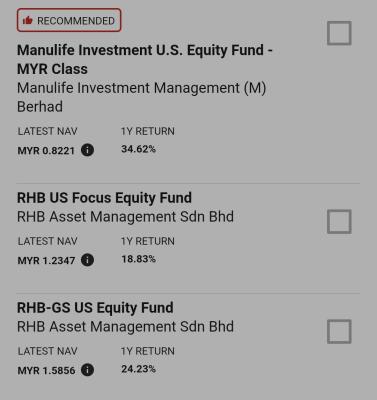

can get individual China fund and another india fund

or China-India Fund (as per RHB)

not necessary have to get those XXX Emerging Markets funds that contain India & China inside it + some other emerging markets,....

As holding individual funds of China and India means we need to have bigger war chest to ensure there are sufficient ready cash to topup whenever during market down turns

As I try to reduce buy and sell transactions to minimize the fund charges.

This post has been edited by ehwee: Dec 3 2021, 04:30 PM

Dec 3 2021, 04:28 PM

Dec 3 2021, 04:28 PM

Quote

Quote

0.0709sec

0.0709sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled