QUOTE(xuzen @ Nov 3 2017, 12:31 PM)

See what I mean? When you use large data set, now you will not be so " shiok " sendiri....

Newbies, be warned.

Because I see these noobs, like only five mths or six months data set, get IRR double digit = so high = shiok sendiri. Have to bring them down to reality a bit.

Xuzen

Chill, I also aim 6 - 10% IRR only since I plan to invest in long term, it is hard to maintain 2digits IRR for long term for sureNewbies, be warned.

Because I see these noobs, like only five mths or six months data set, get IRR double digit = so high = shiok sendiri. Have to bring them down to reality a bit.

Xuzen

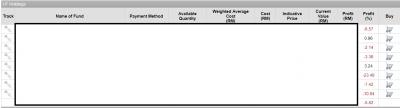

But the fact is, FSM managed portfolio team is doing good so far

Nov 3 2017, 12:38 PM

Nov 3 2017, 12:38 PM

Quote

Quote

0.0586sec

0.0586sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled