20/6/2017 RM1,200.00

7/7/2017 RM1,800.00

26/7/2017 RM1,000.00

28/8/2017 RM3,000.00

If you have 20k on hand now , what will you do? please advice (all comments are welcome)

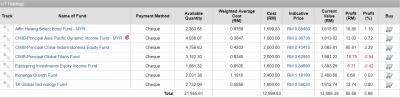

Attached thumbnail(s)

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Sep 7 2017, 11:48 PM Sep 7 2017, 11:48 PM

Return to original view | Post

#21

|

Junior Member

236 posts Joined: Dec 2011 |

|

|

|

|

|

|

Sep 8 2017, 07:35 AM Sep 8 2017, 07:35 AM

Return to original view | Post

#22

|

Junior Member

236 posts Joined: Dec 2011 |

QUOTE(T231H @ Sep 8 2017, 03:37 AM) attached image is the same as yours only changed to % of allocation for better understanding of current allocation.... thanks for your advice sir . i will maintain around 25 ~ 30% of my fund in malaysia market . i am just wondering whether should i (i) put in cash management fund and wait for chance [of course we cant time the market], (ii) use the money DCA every month or (iii) invest it nowmy uneducated guess of tikam tikam pick is ....with 20K new fund add in some % to emerging mkt bond emerging mkt equity global eq after adding this new 20K...the current % of allocation will affected....you need to review it before adding any.... ohh, then it will become a pokemon collection btw, any fund pick of yours on global eq? TA GTF is consider as global eq right? |

|

|

Sep 25 2017, 01:25 PM Sep 25 2017, 01:25 PM

Return to original view | Post

#23

|

Junior Member

236 posts Joined: Dec 2011 |

Selling Off TA GTF

Buying In CIMB Greater China Buying In KAF Vision Fund ----------------------------- Current Portfolio Consists of CIMB Greater China CIMB Global Titan CIMB Asia Pacific Dynamic Income Fund KGF East spring Investments Equity Income Fund KAF Vision Fund AHSBF CIMB China-India-Indonesia |

|

|

Sep 25 2017, 08:49 PM Sep 25 2017, 08:49 PM

Return to original view | Post

#24

|

Junior Member

236 posts Joined: Dec 2011 |

QUOTE(MUM @ Sep 25 2017, 01:31 PM) AHSBF = ~11.26%CIMB Asia Pacific Dynamia Income Fund = ~13.25% CIMB China India Indonesia = ~13.25% CIMB Global Titans = ~14.57% KGF = ~16.56% Eastspring Investments Equity Income Fund = ~11.25% CIMB Greater China = ~13.24% KAF Vision = ~6.62% |

|

|

Sep 25 2017, 08:53 PM Sep 25 2017, 08:53 PM

Return to original view | Post

#25

|

Junior Member

236 posts Joined: Dec 2011 |

QUOTE(Avangelice @ Sep 25 2017, 02:29 PM) very China and Malaysia centric port and multiple overlap of funds. AHSBF = ~11.26%Personally I would do this. KGF 15% AHSBF 30% cimb greater china 10% cimb global titan 15% ditch cimb India indo China in lieu of manulife India 10% Rhb emerging market bond 10% Rhb cash management fund 10% for monthly DCA CIMB Asia Pacific Dynamia Income Fund = ~13.25% CIMB China India Indonesia = ~13.25% CIMB Global Titans = ~14.57% KGF = ~16.56% Eastspring Investments Equity Income Fund = ~11.25% CIMB Greater China = ~13.24% KAF Vision = ~6.62% Above is the % of the funds in my portfolio , wont go for any manulife funds because personally investing in that company through an agent before i know FSM this platform. quite confidence on both of malaysia (being undervalued) and china market. hopefully GE will boost up malaysia market, although the historical date shows that GE wouldn't boost up the malaysia market. hahah anyway thanks for your advice |

|

|

Sep 26 2017, 05:35 PM Sep 26 2017, 05:35 PM

Return to original view | Post

#26

|

Junior Member

236 posts Joined: Dec 2011 |

market is in the correction period?

This post has been edited by walkman660: Sep 26 2017, 05:36 PM |

|

|

|

|

|

Sep 28 2017, 01:28 PM Sep 28 2017, 01:28 PM

Return to original view | Post

#27

|

Junior Member

236 posts Joined: Dec 2011 |

QUOTE(Avangelice @ Sep 28 2017, 11:41 AM) Xuzen what do you currently hold in your port? Manu india dropped another 1.3x % again today if I am not mistakenas of now mine looks like this [attachmentid=9180941] I'm thinking to switch India to something else but don't know where ADD On after much deliberation I chose to sell all my India exposure with a profit of 4xxx will begin using the said funds to DCA into Global Tech and RHB EMF to add on, what is ur IRR for that particular fund This post has been edited by walkman660: Sep 28 2017, 01:31 PM |

|

|

Sep 28 2017, 02:11 PM Sep 28 2017, 02:11 PM

Return to original view | Post

#28

|

Junior Member

236 posts Joined: Dec 2011 |

QUOTE(Avangelice @ Sep 28 2017, 01:57 PM) not a finance guy and I still have a problem with the xcel sheet. https://www.lendingmemo.com/xirr-calculator/ , here you go . but 30% return in 1 and half year , pretty good !!all I know is that I held it for a year and a half and my return is 30% with a profit of 4k plus. |

|

|

Oct 12 2017, 10:38 PM Oct 12 2017, 10:38 PM

Return to original view | IPv6 | Post

#29

|

Junior Member

236 posts Joined: Dec 2011 |

|

|

|

Oct 13 2017, 07:41 AM Oct 13 2017, 07:41 AM

Return to original view | IPv6 | Post

#30

|

Junior Member

236 posts Joined: Dec 2011 |

|

|

|

Oct 13 2017, 07:42 AM Oct 13 2017, 07:42 AM

Return to original view | IPv6 | Post

#31

|

Junior Member

236 posts Joined: Dec 2011 |

|

|

|

Oct 13 2017, 09:58 AM Oct 13 2017, 09:58 AM

Return to original view | IPv6 | Post

#32

|

Junior Member

236 posts Joined: Dec 2011 |

QUOTE(MUM @ Oct 13 2017, 07:51 AM) when you calculate the ROI why you used the NET amount invested and not the GROSS amount? the net invested amount in my excel file actually is just for my reference (what is my return IF there is no sales charge), which is not show on the screenshot |

|

|

Oct 13 2017, 11:58 AM Oct 13 2017, 11:58 AM

Return to original view | IPv6 | Post

#33

|

Junior Member

236 posts Joined: Dec 2011 |

QUOTE(2387581 @ Oct 13 2017, 10:45 AM) I think sooner or later the exact amount will mess up...because that is what happened to me Dun think so, hahaha. my excel actually very simple, with other tab consist of roi and it of each fund in my portfolioNow I regret I didn't take up accounting in my high school. |

|

|

|

|

|

Oct 13 2017, 05:32 PM Oct 13 2017, 05:32 PM

Return to original view | IPv6 | Post

#34

|

Junior Member

236 posts Joined: Dec 2011 |

https://ufile.io/cco0j

anyone need simple version of excel file can download from the link above , pm me if have any doubt |

|

|

Oct 13 2017, 05:50 PM Oct 13 2017, 05:50 PM

Return to original view | IPv6 | Post

#35

|

Junior Member

236 posts Joined: Dec 2011 |

|

|

|

Oct 13 2017, 08:38 PM Oct 13 2017, 08:38 PM

Return to original view | IPv6 | Post

#36

|

Junior Member

236 posts Joined: Dec 2011 |

QUOTE(i1899 @ Oct 13 2017, 06:18 PM) Thanks for sharing. Highly appreciated, especially for the Managed Portfolio. U need to type in the current value of the managed portfolio in the website MANUALLY to track the latest IRRHave you updated IRR of managed portfolio today? If yes, then, IRR of my DIY 60-40 portfolio (17.3%, counted from 01/01/17) is still higher than Managed Portfolio IRR (13.1%, counted from 13/06/17). But, i think it is worth to pay the difference for more time for other things. I would like to understand more about managed portfolio before jump in. Appreciated if you can sharing this kind of info. 1. Normally, how many switching were performed in a month. 2. The switching is for re-balancing (bond to Equity/ equity to bond) or restructure (Global EQ to Global EQ of other fund house)? |

|

|

Nov 1 2017, 10:11 PM Nov 1 2017, 10:11 PM

Return to original view | IPv6 | Post

#37

|

Junior Member

236 posts Joined: Dec 2011 |

|

|

|

Nov 1 2017, 11:06 PM Nov 1 2017, 11:06 PM

Return to original view | IPv6 | Post

#38

|

Junior Member

236 posts Joined: Dec 2011 |

|

|

|

Nov 2 2017, 01:47 PM Nov 2 2017, 01:47 PM

Return to original view | IPv6 | Post

#39

|

Junior Member

236 posts Joined: Dec 2011 |

QUOTE(xuzen @ Nov 2 2017, 11:45 AM) Yah, thereabout.... slightly bigger, 2.5 Yr. Thank you for ur words, it makes me motivated.The other significant asset is my KWSP port which is double than this cash port. I don't have properties, I don't flip prop. My wealth comes purely from salary in which I spend less than I earn, then invest the rest. I save, then invest using DCA, i.e., the regular Joe method. I still have 20 more years thereabout till retirement. If I have started much younger, in my twenties, I would be in a much better position now. I only started to be financially savvy in my mid 30's. I wasted ten years of time in my twenties. Having said this, I do notice some of these people who join the forum are much younger. Kudos to them to be financially savvy at such a young age. Let me tell you young people, it is worth it.... Delayed gratification is worth it! Watch your risk, let the return take care of itself.... Xuzen I am 23 this year and start investing in UT thru agent when I am 20 years old. Only started invest in FSM june this year. Alone in this road because most of my friend still duno the importance of investment / passive income, but I believe in 5 to 10 years later, my life will be definitely better than them Happy investing to all investors in this thread !! |

|

|

Nov 2 2017, 11:35 PM Nov 2 2017, 11:35 PM

Return to original view | IPv6 | Post

#40

|

Junior Member

236 posts Joined: Dec 2011 |

|

| Change to: |  0.0452sec 0.0452sec

0.38 0.38

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 10:59 PM |