Attached thumbnail(s)

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jun 12 2023, 12:15 AM Jun 12 2023, 12:15 AM

Return to original view | IPv6 | Post

#2141

|

All Stars

14,927 posts Joined: Mar 2015 |

|

|

|

|

|

|

Jun 20 2023, 05:00 PM Jun 20 2023, 05:00 PM

Return to original view | IPv6 | Post

#2142

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(melondance @ Jun 20 2023, 04:54 PM) I've asked a question regarding Qualified Interest Income (QII) for FSMOne platform. Since FSM had responded you, it would be interesting and informative to get the response to your latest query as highlighted too.Dear FSMOne, May I know if owning ETF like iShares 20+ Year Treasury Bond ETF (TLT) on your platform, will you/ your broker help us to claim the Qualified Interest Income (QII)? Which means that the 30% Dividend Withholding Tax can be claimed back yearly for qualified ETF. https://www.ishares.com/us/literature/tax-i...-final-2023.pdf Reply: Please be informed that generally most of the US ETFs will subjected to 30% withholding tax. However if the ETF consists of municipal, note, debt or long-term capital gain then it will entitle for the tax exemption. If the ETFs is entitle for 0% withholding tax, our custody will refund to us upon annual reclassification of tax. Thereafter, we will process the refund payout to client cash account upon receive the confirmation of payment. ------------------------------------------------- Does that mean owning ETF like BND, TLT, TLH from iShares, we can expect some % of the dividend withholding tax credited back every year? |

|

|

Jun 23 2023, 12:13 PM Jun 23 2023, 12:13 PM

Return to original view | Post

#2143

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(Avangelice @ Jun 23 2023, 11:11 AM) I'm looking to parking my money into a stable fund like fixed income. Which one are you guys investing in? I'm can't stomach the volatility this year I think this year, ...funds roi are going up for most of my ut funds, much better performance than 2021, 2022....Hope it last and continue to go up since Covid19 ended.. I am putting some of my need to use money in AH fixed income after exiting my AH equity funds to collect some credit points |

|

|

Jun 23 2023, 12:31 PM Jun 23 2023, 12:31 PM

Return to original view | IPv6 | Post

#2144

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(Avangelice @ Jun 23 2023, 12:18 PM) Which AH fixed income may I ask? Been away from UT scene I lost track. BTW all the old guards like xuzen all gone dy I noticed I took that with emphasis more on collecting credit points and for short term use.This post has been edited by MUM: Jun 23 2023, 12:32 PM Attached thumbnail(s)

|

|

|

Jul 6 2023, 10:21 AM Jul 6 2023, 10:21 AM

Return to original view | IPv6 | Post

#2145

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(ccschua @ Jul 6 2023, 10:14 AM) currently fsm pays 3.5% for parking facility, isnt this is better than putting in the bank saving account earning a miserable 0.5% ? what is the catch of parking facility in fsm. If you want to compare that, ...some had mentioned in other treads that, there are other MM funds that pays more than FSM.. |

|

|

Jul 9 2023, 08:32 PM Jul 9 2023, 08:32 PM

Return to original view | IPv6 | Post

#2146

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(kimi0148 @ Jul 9 2023, 07:35 PM) What happens if the fund i buy through EPF withdrawal has become "Not Approved by EPF" after their yearly screening? Can I sell it? You can continue to holdYou can still sell cempedaklife, ahmadkhairil, and 1 other liked this post

|

|

|

|

|

|

Jul 12 2023, 07:53 AM Jul 12 2023, 07:53 AM

Return to original view | Post

#2147

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(titanic_crash @ Jul 12 2023, 07:42 AM) Hi all, need your advice This post has been edited by MUM: Jul 12 2023, 07:53 AMMy fund A is suspended (under EPF) and can't do DCA.. is it advisable to do the switching out to other fund? (do you need the investment mandate of that fund to be in your diversified portfolio? Example, if that fund is solely a malaysia equity fund and you only hv that fund that provides you coverage of Msia markets, ...then if you need msia to be in your portfolio too, then you can consider to keep it if the performance is on par with its peers) Is it profitable and how to calculate that? (In your FSM account, you can see if that fund is currently making profits or not) |

|

|

Jul 27 2023, 02:03 PM Jul 27 2023, 02:03 PM

Return to original view | Post

#2148

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(frankzane @ Jul 27 2023, 01:46 PM) Hi Sifus, I have few doubt and hope to get answers from the experts: 1. I read before somewhere in the thread saying that if IFast/FSMOne go bankrupt, our funds will go back to the fund house. Is this term written in any of IFast/FSMOne policies? attached image is from this site ... https://www.fsmone.com.my/support/frequentl...tUniqueKey=2444 2. Assuming no. 1 is true, what will happen if now the fund house/bank go into bankruptcy? 3. In any financial report of a fund, under the list of equities, the quantity invested in each companies, e.g. Gamuda Bhd 2,092,300; what is the 'unit' of these quantity? How can we translate that to the actual shares/lot of that company? Thanks in advance. Attached thumbnail(s)

frankzane liked this post

|

|

|

Jul 28 2023, 09:28 PM Jul 28 2023, 09:28 PM

Return to original view | Post

#2149

|

All Stars

14,927 posts Joined: Mar 2015 |

In the fsmone my website, under FAQs https://www.fsmone.com.my/support/frequentl...tUniqueKey=2900 Attached thumbnail(s)

Sitting Duck and LightningZERO liked this post

|

|

|

Aug 21 2023, 10:43 PM Aug 21 2023, 10:43 PM

Return to original view | Post

#2150

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(Sitting Duck @ Aug 21 2023, 07:36 PM) Based on my latest RSP of RM1k / USD214.65, the only fee charge was MY Stamp Duty of USD0.22 (0.1x% fee) which is awesome. Looks like the revised SC's definition is as ....Exchange rate was about ~4.65 on 15th of August. On another side note, got an email from FSM about "AmAsia Pacific REITs". "The purpose of the Unit Holders’ Meeting is to change the income distribution policy of the Fund to allow the Fund to declare distribution out of its capital and that FURTHER the Manager and/or the trustee of the Fund shall be authorised to do all such things necessary to give effect to the change of distribution policy of the Fund in accordance with the relevant laws, guidelines and the provisions of the Deed. " Isn't this something that's bad for the fund that they are paying dividend even if the fund isn't performing? "distribution paid out from net realised capital gains and net realised investment income brought forward is considered as distribution out of capital." This post has been edited by MUM: Aug 21 2023, 10:49 PM Attached thumbnail(s)

|

|

|

Aug 23 2023, 06:00 PM Aug 23 2023, 06:00 PM

Return to original view | Post

#2151

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(george_dave91 @ Aug 23 2023, 04:10 PM) Hi Sifus Most of the time, most investors invest in PRS funds is for the tax relief benefits.I’m planning to invest in PRS fund for the tax relief, but looking at most of the funds, the performance seems to be quite poor. Does anyone know of some decent PRS funds? So far the principal Islamic equity growth seems to be alright-ish The higher the tax bracket, the higher the benefits. If you are risk adverse, try PRS conservatives funds.. More stable returns |

|

|

Aug 24 2023, 08:01 AM Aug 24 2023, 08:01 AM

Return to original view | Post

#2152

|

All Stars

14,927 posts Joined: Mar 2015 |

|

|

|

Oct 22 2023, 12:14 PM Oct 22 2023, 12:14 PM

Return to original view | Post

#2153

|

All Stars

14,927 posts Joined: Mar 2015 |

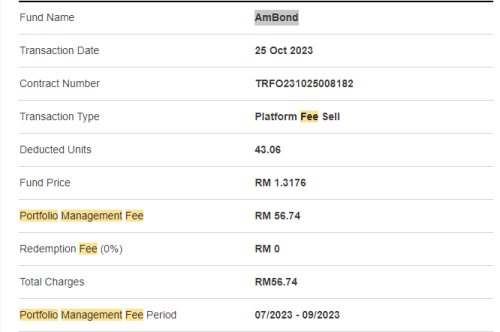

From that same link, ....

Mentioned, .... Important Note Please ensure that you have sufficient monies in the Cash Account (bond currency) by 22nd of the deduction month if you do not wish to pay using the following options. FSM reserves the rights to do ad-hoc platform fee reduction upon bonds redemption. |

|

|

|

|

|

Nov 21 2023, 01:15 PM Nov 21 2023, 01:15 PM

Return to original view | IPv6 | Post

#2154

|

All Stars

14,927 posts Joined: Mar 2015 |

Just 1 usd less for 1 000 usd. (0.1% extra)

For that rate, i will just not waste so much time looking around. Just like I go city center looking for car park. Some would go searching for free parking space, I would just pay rm5 per entry for the convenient and can start enjoying the shopping life This post has been edited by MUM: Nov 21 2023, 01:18 PM |

|

|

Dec 14 2023, 06:16 AM Dec 14 2023, 06:16 AM

Return to original view | Post

#2155

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(mastermindsos @ Dec 14 2023, 06:10 AM) Hi sifus, While waiting for responses, from your provided link, i found this. Hopefully it can provides you with some added info, while you wait for value added responses.I have a question about the platform management fee calculation. Based on the link, it says 0.5% per annum, charged on quarterly basis. https://www.fsmone.com.my/managed-portfolio...et-started/fees So for one quarter, wouldn't it be 0.5% / 4 = 0.125%? According to the invoice, my best performance fund is AmBond. If I have 1883 units, then how fsm come up with this number?  Under FAQs: How do I calculate Portfolio Management Fee? This post has been edited by MUM: Dec 14 2023, 06:19 AM mastermindsos liked this post

|

|

|

Feb 3 2024, 09:01 PM Feb 3 2024, 09:01 PM

Return to original view | Post

#2156

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(Sitting Duck @ Feb 3 2024, 08:24 PM) Hi All, While waiting for real value added responses from real sifus, I'm still confused what to answer in this question "Do you have Domestic Ringgit Borrowing". In BNM website, Domestic ringgit borrowing refers to any ringgit advance, loan, trade financing, hire purchase, factoring, leasing facilities, redeemable preference shares or similar facility in whatever name or form, except: •Trade credit terms extended by a supplier for all types of goods and services; •Forward exchange contracts entered into with licensed onshore banks; •One personal housing loan and one vehicle loan obtained from residents; •Credit card and charge card facilities; and •Inter-company borrowing within a corporate group in Malaysia. whereas the definition of Residents: Residents: •Citizens of Malaysia (excluding persons who have obtained permanent resident status of a territory outside Malaysia and are residing abroad); •Non-citizens who have obtained permanent resident status in Malaysia and are residing permanently in Malaysia; or •Persons, whether body corporate or unincorporated, registered or approved by any authority in Malaysia. So if I have 1 or more car loan/house loan from banks (not Resident), and I do invest ETF in overseas, does it mean I have choose Yes for "Domestic Ringgit Borrowing"? The definition is confusing to me since I'm not financial background. Anyone can help? Thank you I Googled and found this... https://www.fsmone.com.my/support/forms Attached thumbnail(s)

|

|

|

Feb 4 2024, 12:09 PM Feb 4 2024, 12:09 PM

Return to original view | Post

#2157

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(Sitting Duck @ Feb 4 2024, 12:05 PM) Now the question is that whether bank(s) falls under "Residents", since the defination of Resident is as below in BNM website: So is that bank licensed to operate in Malaysia?Residents: •Citizens of Malaysia (excluding persons who have obtained permanent resident status of a territory outside Malaysia and are residing abroad); •Non-citizens who have obtained permanent resident status in Malaysia and are residing permanently in Malaysia; or •Persons, whether body corporate or unincorporated, registered or approved by any authority in Malaysia. Well that is my understanding, which could be flawed. |

|

|

Feb 4 2024, 12:34 PM Feb 4 2024, 12:34 PM

Return to original view | Post

#2158

|

All Stars

14,927 posts Joined: Mar 2015 |

|

|

|

Mar 31 2024, 09:45 AM Mar 31 2024, 09:45 AM

Return to original view | Post

#2159

|

All Stars

14,927 posts Joined: Mar 2015 |

Just based on the available info posted, ..

Started with AUD $1000, upfront processing fees AUD$35 That is 3.5% (loss) Inj ust 1 month the losses is reduced to 2.54% Recovered 1%? Wow that could means 1 month 1%, 1 Yr can be 10-12%?? Ha ha good he he This post has been edited by MUM: Mar 31 2024, 09:56 AM |

|

|

Mar 31 2024, 12:58 PM Mar 31 2024, 12:58 PM

Return to original view | Post

#2160

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(loyalkkk @ Mar 31 2024, 12:53 PM) Hi, I’m planning to re-enter FSM unit trust investment. I left FSM right before the COVID-19. I used to buy all these UT in post no. 2. Are all this UTs still popular and hot to buy now? Uts listed in post 2, are 7 yrs old.At the point of time, should I enter? Or wait at CMF2? 🙏 Many things had changed since then. If you trusted FSM, try their current <1 Yr old "recommended fund lists. loyalkkk liked this post

|

| Change to: |  1.0591sec 1.0591sec

0.29 0.29

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 03:50 AM |