Digital Economy: Downgrade to neutral, but long-term growth story remains intact

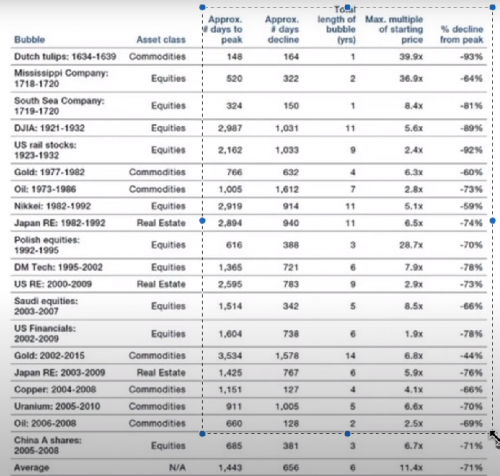

Digital Economy: Downgrade to neutral, but long-term growth story remains intactSince our last update, the share prices of digital economy stocks have risen by close to 40%. With valuations near an all-time high, we have decided to

downgrade the sector’s star ratings from

3.0 Stars “Attractive” to 2.5 Stars “Neutral”, although we

remain extremely positive on its long-term growth prospects.In line with our star rating methodology, we have decided to downgrade the digital economy from 3.0 Stars “Attractive” to 2.5 Stars “Neutral”. Having said that, we would like to reassure investors that this does not mean that the digital economy is out of favour. Even though valuations might not be as attractive as they were before, the long-term growth story of this sector remains intact.

Investors who have bought into the tech sector during the better part of 2020 would have likely made decent profits already, and

we recommend that they consider taking some profits off the table but continue to retain some exposure to this sector. It is our belief that asset allocation should always reflect economic reality, and the reality is this: the world that we live in is increasingly digitalised. Not only has digital technologies penetrated our everyday lives, they have also disrupted whole industries.

Going forward, we believe the digital economy is here to stay, and that Internet companies will make up a larger part of the global economy. It is for this reason we recommend investors to include the digital economy as part of their

core allocation.

jangan panic, jangan panic.......top up aje

my public AI tengah potong steam, top up aje, top up aje.....

Jan 12 2021, 11:09 PM

Jan 12 2021, 11:09 PM

Quote

Quote

0.0612sec

0.0612sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled