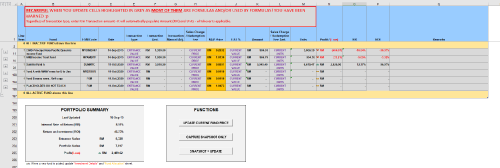

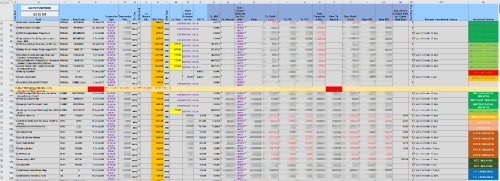

My used-to-be-simple excel became a monster now

So far it can:-

- mass update/track FSM Malaysia/FSM Singapore/FSM Hong Kong/Worldwide stock markets/manual portfolio without API support i.e. StashAway (just..type..manually)

- multi-Currency support + mass update - track fund performance in home currency (MYR?) and native currency (e.g. HKD for HK funds, USD for NYSE stocks, ...). Also support cases when "trade" currency are different than fund native currency (FSM HK's favourite....

)

- decimal point config for calculations (FSM MY use 2 decimal, FSM HK use 4 decimal)

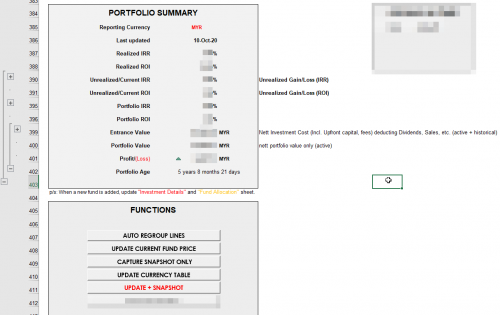

- flexible reporting by changing currency

- stock dividends support

- snapshot (to track performance)

- auto lines grouping (usually broken after pasting new rows hence need to regroup)

- portfolio age

Have been adding stuff here and there since 2015 but didn't really have the time to make it user friendly (except for myself

) hence didn't publish it.

Plus I have no idea how to support existing users to migrate over (painlessly).

Anyone interested to take over the "deployment"?

2015

» Click to show Spoiler - click again to hide... «

2020

» Click to show Spoiler - click again to hide... «

AIYH Btw I've updated the previous release with

idyllrain's patch

here.

This is the new URL to download the fresh template - if you could help me to replace my previous link ^^ (just add 'b' behind the bitly)

Old Link:

https://bit.ly/polarzbearzPortfolioSummary2New Link:

http://bit.ly/polarzbearzPortfolioSummary2bi click the new link but it link me to the old file ....

Sep 12 2020, 12:43 PM

Sep 12 2020, 12:43 PM

Quote

Quote

0.0707sec

0.0707sec

0.71

0.71

7 queries

7 queries

GZIP Disabled

GZIP Disabled