Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

SUSDavid83

|

Aug 7 2017, 04:55 PM Aug 7 2017, 04:55 PM

|

|

QUOTE(xuzen @ Aug 7 2017, 04:49 PM) Dow is made up of 30 top giant conglomerate in NYSE. A better broader gauge should be the S&P 500. (made up of 500 American companies) Russel's 3000 anyone? Xuzen Russel 3000 is meant for mid to small cap indices right? |

|

|

|

|

|

SUSDavid83

|

Aug 15 2017, 09:37 AM Aug 15 2017, 09:37 AM

|

|

Today rebound already.

Nikkei 225 up > 1%

|

|

|

|

|

|

SUSDavid83

|

Aug 15 2017, 04:12 PM Aug 15 2017, 04:12 PM

|

|

QUOTE RM0.00 AffinHwangAM: Convenient, quick & free! Invest online via JomPAY.

Enter JomPAY code 4689 (UTF)/ 9563 (PRS), Ref-1: 12 digit NRIC. Ref-2: 10 digit HP no. Anybody received this SMS? |

|

|

|

|

|

SUSDavid83

|

Aug 15 2017, 08:54 PM Aug 15 2017, 08:54 PM

|

|

QUOTE(theevilman1909 @ Aug 15 2017, 08:36 PM) good they have strict process.. but so easy to "bailout" certain "organization" using our $$  The term they used is investment. Wrong investment strategy used to invest in FGV. |

|

|

|

|

|

SUSDavid83

|

Aug 18 2017, 08:20 AM Aug 18 2017, 08:20 AM

|

|

Jualan Murah

For 1 day only!

|

|

|

|

|

|

SUSDavid83

|

Aug 30 2017, 09:52 AM Aug 30 2017, 09:52 AM

|

|

NK missile launch fissiled.

US market up.

Asia ex Japan flat.

|

|

|

|

|

|

SUSDavid83

|

Sep 26 2017, 08:09 PM Sep 26 2017, 08:09 PM

|

|

My portfolio is bleeding!  KLCI dropped for 6 days straight! |

|

|

|

|

|

SUSDavid83

|

Oct 17 2017, 10:20 PM Oct 17 2017, 10:20 PM

|

|

Portfolio laggard is still AmAsia Pacific REITs - Class B (MYR).

ROI since February 2017: 2.5%

IRR: 4.0%

Underperformed against Affin Hwang Select Asia Pacific (Ex Japan) REITS and Infrastructure Fund & Manulife Investment Asia-Pacific REIT Fund

I'm thinking of selling it off.

|

|

|

|

|

|

SUSDavid83

|

Oct 19 2017, 08:27 AM Oct 19 2017, 08:27 AM

|

|

QUOTE(yklooi @ Oct 19 2017, 08:05 AM) you think Amreit is bad for you? I have both of this in my port......   but YTD Ponzi still wins...luckily for me... will Ponzi continue to lose its magic touch?.....  will see if I should abandon it next July..... in the meantime will have to content with it for my portfolio's ROI drag  algozen don't have Ponzi 1.0  for newbies reading this.....got the hints?    I got Ponzi 1.0 too which I bought it few years back. I'm comparing AmAsia Pacific REITs - Class B (MYR) against the two funds which have roughly similar mandate. |

|

|

|

|

|

SUSDavid83

|

Oct 19 2017, 08:39 AM Oct 19 2017, 08:39 AM

|

|

QUOTE(yklooi @ Oct 19 2017, 08:35 AM) yea...I got Ponzi 1.0 few years back too.... was and had been a good performer in the port. hope that the current performance is just a temporarily affair..... GO PONZI GO GO GO my current battle cry. I think they have explained the underperformance of Ponzi 1.0 Soft closing + wrong choice of stock + too many cash holding. |

|

|

|

|

|

SUSDavid83

|

Oct 19 2017, 08:54 AM Oct 19 2017, 08:54 AM

|

|

QUOTE(yklooi @ Oct 19 2017, 08:48 AM) that means it will be a temporarily things after having rectified those known "mistakes"? I hope so...will see in the next six months For Ponzi 1.0 yes. They're modifying the strategy already. Effects may come few weeks/months later. There're 2 articles from FSM covering this fund/sector if I remembered correctly. |

|

|

|

|

|

SUSDavid83

|

Oct 19 2017, 11:35 AM Oct 19 2017, 11:35 AM

|

|

Am I seeing this but Titanic Fund is not really moving much when US market keeps on hitting or breaking all time high?

|

|

|

|

|

|

SUSDavid83

|

Oct 20 2017, 10:41 AM Oct 20 2017, 10:41 AM

|

|

QUOTE(atyt1985 @ Oct 20 2017, 10:24 AM) Hi all sifus, newbie here appreciate if you could advise me on this. I have an enquiry on income distribution. Lets say for example income distribution on Eastspring Investment dynamic fund is on June 2018. If you buy 3000 units on July 2017 will the income distribution return is the same compare to if you buy 3000 units on May 2018 or will it be pro rated? The distribution is paid based on number of units held by ex-date. Let's say 5 cents per unit (final) |

|

|

|

|

|

SUSDavid83

|

Oct 27 2017, 09:04 PM Oct 27 2017, 09:04 PM

|

|

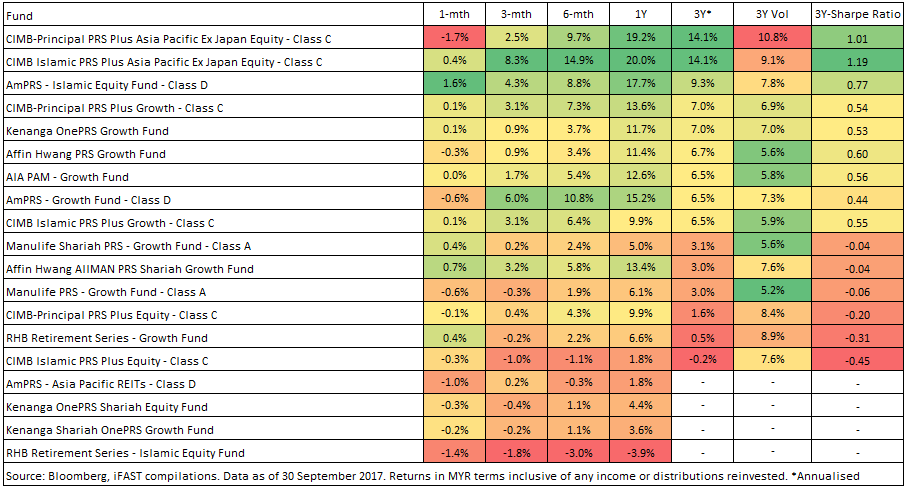

Idea Of The Week: PRS Funds’ Performance Review [25 October 2017]URL: https://www.fundsupermart.com.my/main/resea...ober-2017--9012Note: The table for PRS Growth Fund is wrongly attached. Correct image:  This post has been edited by David83: Oct 27 2017, 09:05 PM This post has been edited by David83: Oct 27 2017, 09:05 PM

|

|

|

|

|

|

SUSDavid83

|

Oct 27 2017, 11:00 PM Oct 27 2017, 11:00 PM

|

|

QUOTE(leong321 @ Oct 27 2017, 10:58 PM) any sifu here know when will fsm have lower sale charges? like merdeka promotion and recommneded list update promotion Next year January/February for the annual event. |

|

|

|

|

|

SUSDavid83

|

Oct 30 2017, 03:27 PM Oct 30 2017, 03:27 PM

|

|

I just billed for platform fee today. LOL

|

|

|

|

|

|

SUSDavid83

|

Oct 31 2017, 01:42 PM Oct 31 2017, 01:42 PM

|

|

Dumped AmAsia REIT two weeks ago!

|

|

|

|

|

|

SUSDavid83

|

Nov 3 2017, 03:37 PM Nov 3 2017, 03:37 PM

|

|

QUOTE(Vk21 @ Nov 3 2017, 03:35 PM) I remember reading fundsupermart magazine long time ago. Do they still have it? If yes, where can we get? I don't think they're printing it anymore. |

|

|

|

|

|

SUSDavid83

|

Nov 5 2017, 09:45 PM Nov 5 2017, 09:45 PM

|

|

QUOTE(Jitty @ Nov 5 2017, 09:20 PM) Hi all sifus, Just into UT investment. Should i put 50k to my cimb relationship manager to run it for me? Or should I do it myself using FSM? currently she recommended to me affin hwang and cimb Asia Pac. All sifus, please advise newbie me. FSM charge 0.8% per transaction? How much your CIMB Relationship Manager charges you? 3%? |

|

|

|

|

|

SUSDavid83

|

Nov 5 2017, 09:56 PM Nov 5 2017, 09:56 PM

|

|

QUOTE(Jitty @ Nov 5 2017, 09:53 PM) she told me depends on funds. ranging from 2.5%-3.5%. FSM is 0.8%-1% right? 1.75% standard rate. 0.8% is promotional rate for specific fund or event. |

|

|

|

|

Aug 7 2017, 04:55 PM

Aug 7 2017, 04:55 PM

Quote

Quote 0.0483sec

0.0483sec

0.85

0.85

7 queries

7 queries

GZIP Disabled

GZIP Disabled