QUOTE(dotadellpro @ Feb 27 2018, 05:54 PM)

I am sure they can make time for you...why not call them to ask , then tell us?FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Feb 27 2018, 05:56 PM Feb 27 2018, 05:56 PM

Return to original view | Post

#1041

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Feb 28 2018, 04:11 PM Feb 28 2018, 04:11 PM

Return to original view | Post

#1042

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(infested_ysy @ Feb 28 2018, 04:07 PM) Would you guys recommend any of the top unit trusts listed here? i think many forummers here has 4 of the top 5 funds in that listhttps://www.imoney.my/unit-trust-investments |

|

|

Feb 28 2018, 04:35 PM Feb 28 2018, 04:35 PM

Return to original view | Post

#1043

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(5p3ak @ Feb 28 2018, 04:31 PM) For those holding this fund which is winding up soon what fund will you switch to? if i am not mistaken....i1899 did mentioned United Global Quality Equity fd sometime back.......https ://www.fundsupermart.com.my/main/fundinfo/Eastspring-Investments-Global-Leaders-MY-Fund-MYPRUGLL can try to have a look then tell us what you think... |

|

|

Mar 1 2018, 11:14 AM Mar 1 2018, 11:14 AM

Return to original view | Post

#1044

|

Senior Member

5,143 posts Joined: Jan 2015 |

LIST OF UNIT TRUSTS - NEWLY APPROVED & SUSPENDED FROM THE EPF-MIS https://www.fundsupermart.com.my/main/resea...or-2018-19-9467 |

|

|

Mar 2 2018, 11:59 AM Mar 2 2018, 11:59 AM

Return to original view | Post

#1045

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(xuzen @ Mar 2 2018, 11:33 AM) ...... Action perform in Feb 2018: Sold RHB EMB & Esther Bond and went back to the motherly embrace of Asnita Bond. ...... FSM HK are going heavy into EM Bond and neutral on short term bond https://secure.fundsupermart.com.hk/fsm/art...-Feb-2018-14463 well they do make mistakes too.. https://secure.fundsupermart.com.hk/fsm/art...-Analysis-14520 will see how it goes for this time.... Attached thumbnail(s)

|

|

|

Mar 5 2018, 05:21 PM Mar 5 2018, 05:21 PM

Return to original view | Post

#1046

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(MUM @ Mar 5 2018, 05:10 PM) see how much % they have in RHB EMB fd in the port then multiply by the drops.... just checked....for the last 3 months, their moderately aggressive port...it has 3.5% EMBis the % significants for the ...hahaha? many forummers had EMB last year too but their port did well too for last year.... so it that fund dropped 10% nav ...then it just impacted 0.35% of the port ROI |

|

|

|

|

|

Mar 6 2018, 08:29 AM Mar 6 2018, 08:29 AM

Return to original view | Post

#1047

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Mar 9 2018, 10:09 AM Mar 9 2018, 10:09 AM

Return to original view | Post

#1048

|

Senior Member

5,143 posts Joined: Jan 2015 |

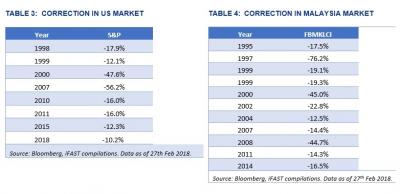

looks like not every 10 years there is a correction...but very possibility every 3 years on average....

https://www.fundsupermart.com.my/main/resea...ncertainty-9473 but in the longer term charts....just see how All Ords price index goes after every crisis... https://www.fundsupermart.com.my/main/resea...ned-9-Feb--9391 just hope this time is not that "BIG" crash KIM and trump had been behaving lately..... will China send in KIM to settle with Trump on this time too? Attached thumbnail(s)

|

|

|

Mar 13 2018, 07:06 PM Mar 13 2018, 07:06 PM

Return to original view | Post

#1049

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Mar 22 2018, 12:32 PM Mar 22 2018, 12:32 PM

Return to original view | Post

#1050

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Mar 22 2018, 12:36 PM Mar 22 2018, 12:36 PM

Return to original view | Post

#1051

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Mar 22 2018, 11:08 PM Mar 22 2018, 11:08 PM

Return to original view | Post

#1052

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Feliex @ Mar 22 2018, 10:12 PM) To all Sifu here, I have a question. Should I make initial invest RM1000 or RSP, deduct each month rm200 which one would you suggest? Thanks Do You Really Need RM10K For A Unit Trust Portfolio? https://www.fundsupermart.com.my/main/resea...July-2015--6123 |

|

|

Mar 23 2018, 01:11 PM Mar 23 2018, 01:11 PM

Return to original view | Post

#1053

|

Senior Member

5,143 posts Joined: Jan 2015 |

It’s easy to lose your cool when every one around you is heading for the exit and hitting the panic button.

Even the savviest investors are guilty of letting their emotions get the better of them and allow fear or greed drive their overall investment decision. If you are feeling particularly angst or nervous about your investments, this could mean some level of mismatch between your investment goals, risk-tolerance and your current portfolio allocation. This could warrant a reassessment of the level of risk you are taking in your portfolio and if you are comfortable with your asset-allocation target (% equities, % bonds). For example, if you are seeking a steady income stream and maybe have a weaker appetite to stomach large market gyrations or swings in your portfolio returns, then perhaps an aggressive portfolio that is tilted towards equities may not be suitable for such a risk-averse investor. On the flipside, an investor seeking aggressive growth and returns should be able to stomach larger fluctuations in their portfolio. It’s all about setting expectations that has to also be realistic. Higher potential returns come with higher risk. That’s a given, but investors often forget this important maxim of investing. Then again, higher risk is not necessarily a bad thing. What's important is that investors are comfortable with their portfolios and the level of risk they are taking. http://affinhwangam.com/positioning-in-a-market-correction/ |

|

|

|

|

|

Mar 26 2018, 06:36 PM Mar 26 2018, 06:36 PM

Return to original view | Post

#1054

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Feliex @ Mar 26 2018, 04:25 PM) Any funds introduces? Im just choosing Use the Chart center to compare?.-Eastspring Investments Dinasti Equity Fund -Affin Hwang Select Asia (Ex Japan) Opportunity Fund It shows the perfornance trends n risk reward ratio too. Click at the individual fact sheet to see its coverage? |

|

|

Mar 28 2018, 07:45 PM Mar 28 2018, 07:45 PM

Return to original view | Post

#1055

|

Senior Member

5,143 posts Joined: Jan 2015 |

I would say .....timely....

"Is Market Overreact To Trade War Risk? .....March 28, 2018 In this article, FSM are going to discuss what are the possible scenarios and impacts should it happen in the near future. https://www.fundsupermart.com.my/main/resea...-War-Risk--9585 2 days left for the 0.8%SC funds.... next month...most probably the lipper awarded funds promo.... |

|

|

Mar 30 2018, 12:15 PM Mar 30 2018, 12:15 PM

Return to original view | Post

#1056

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(MUM @ Mar 29 2018, 11:43 PM) "....investors need to be more discipline in order to ride through the period of increasing volatility. Keep the points I made earlier in mind: “rebalance your portfolio should market overshoot;” “follow an asset allocation strategy that aligns with your risk profile,” and lastly “don’t time the market but stay invested and focus on market valuation”.Here’s How To Ride The Waves Of Market Volatility.....March 30, 2018 With the recent escalation in volatilities across global equities, FSM look to share with investors how they could ride out uncertainties and stay invested in the investment universe. https://www.fundsupermart.com.my/main/resea...Volatility-9590 |

|

|

Mar 31 2018, 03:18 PM Mar 31 2018, 03:18 PM

Return to original view | Post

#1057

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(gotham11 @ Mar 31 2018, 11:15 AM) Hi all, newbie here.. Wanted to invest using Epf money to those Epf linked fund thru fsm. Looking at e spring small cap.. Any advise? the cummulative returns of this fund since 30 July 2015 till 29 Mar 2018 is less or about same than the cummulative returns of EPF rate.......is that is ok with you?QUOTE(ykit_88 @ Mar 31 2018, 01:37 PM) FSM did have an article about India recently...https://www.fundsupermart.com.my/main/resea...n-Equities-9532 Attached thumbnail(s)

|

|

|

Apr 1 2018, 12:28 PM Apr 1 2018, 12:28 PM

Return to original view | Post

#1058

|

Senior Member

5,143 posts Joined: Jan 2015 |

Is Market Overreacting To Trade War Risk?

Is China The Biggest Loser? Not China, but probably the US farmer, consumer and the US economy would take a harder hit if trade war were to happen. According to several research results, the 25% of tariffs on $60 billion of Chinese imports is likely to hit the China GDP growth rate only by about 0.1% to 0.15%. Hence, the impact is believed to be minimal to the second largest economy in the world. https://www.fundsupermart.com.my/main/resea...-War-Risk--9585 |

|

|

Apr 1 2018, 07:50 PM Apr 1 2018, 07:50 PM

Return to original view | Post

#1059

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Tham @ Apr 1 2018, 06:07 PM) I am new to unit trusts, but one experienced investor told Q: What kind of charges do I have to pay?me that putting your money in bond funds, where the average returns are 2 to 5 percent, is quite pointless. yes, but to some people (if you refer to the FD threads), there are still many people opt for that,...maybe they had their own very valid reasons too..... also there are data shown, compiled that shown that for a 20 years (1988 ~ 2008), for a certain portfolio composition, those that has a higher bond assets in the port did do much better than those that holds higher EQ You would be far better off putting your money in the EPF. EPF has lock in period and there is a limited amount of money where one can self contribute per year....some would suggested go for ASNB Fixed priced funds, they are much more flexible. Also there are some UTs funds that can gives better returns than EPF over a period of time...... I agree with him. Even the moderate funds, with average dividends of 6 to 10 percent, are not very feasible either, after deducting for all those fees they charge, and moreover with the inherent risks involved with unit trusts. do note that, the extra few % over certain rate will have a big impact to the end results over a long period of time.....btw, UTs does not gives dividends, they gives dividend distribution, which by the way are of no use....refer to post 12924 for reason why....and except the sales charges which one can feel it, all other fees that they charged are pro rated calculated in the daily NAVs in which one does not see or feel it....see below A: There are 2 types of charges. One is the sales charge and the other is the annual expense of the fund. The normal sales charge for most equity funds are around 7%. However, at Fundsupermart, the advantage is that most equity funds are sold at around 1.75% sales charge. The sales charge is applied at purchase. The annual expense of the fund is what is charged to the fund. This includes the fund manager's annual management fee, and other administrative fees that are incurred in the running of the fund. You do not really need to fork out additional money to pay for the annual management charge to the fund manager. They will actually deduct it from the Net Asset Value of the fund daily, and the published price will take into account of the pro-rated annual management charge. more here.... https://www.fundsupermart.com.my/main/faq/0...stribution-1083 This post has been edited by T231H: Apr 1 2018, 08:25 PM Attached image(s)  |

|

|

Apr 1 2018, 08:27 PM Apr 1 2018, 08:27 PM

Return to original view | Post

#1060

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(WhitE LighteR @ Apr 1 2018, 08:23 PM) https://www.fundsupermart.com.my/main/resea...lio-Returns-566 |

| Change to: |  0.0744sec 0.0744sec

0.37 0.37

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 02:00 PM |