QUOTE(dasecret @ Mar 17 2017, 06:55 PM)

Oh ya hor, you read chinese; but i find mandarin articles about investment very hard to digest, when I try to read those on FSM SG or FSM HK; can go nuts

And I actually had 11 years of mandarin education

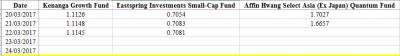

Yeah, this fund pale in comparison of its peers

Actually there's a lot of potential for those IFA (independent financial advisors) as well; untapped market compared to klang valley. And when your competitor is PM, easy peasy la; Just need to deal with AMLA requirements carefully

Is just like u read financial reports in Chinese, we are not native enough to read professional stuff like we used to be expose in English And I actually had 11 years of mandarin education

Yeah, this fund pale in comparison of its peers

Actually there's a lot of potential for those IFA (independent financial advisors) as well; untapped market compared to klang valley. And when your competitor is PM, easy peasy la; Just need to deal with AMLA requirements carefully

When I follow financial market news, in Chinese, will be a nightmare, but trying to cope and improve Chinese proficiency in professional field

Mar 17 2017, 07:09 PM

Mar 17 2017, 07:09 PM

Quote

Quote

0.0408sec

0.0408sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled