good luck!

QUOTE(annoymous1234 @ Nov 7 2017, 01:25 PM)

Ultimate Discussion of ASNB (47457-V)发 8ight 发, Wholly owned subsidary of PNB (38218-X)

|

|

Nov 7 2017, 02:27 PM Nov 7 2017, 02:27 PM

Return to original view | Post

#21

|

Senior Member

1,229 posts Joined: Jul 2011 |

Yes MyASBN...make sure have registered ur phone number with MyASBN and u have active online banking with TAC/OTP number registered.

good luck! QUOTE(annoymous1234 @ Nov 7 2017, 01:25 PM) |

|

|

|

|

|

Nov 7 2017, 03:18 PM Nov 7 2017, 03:18 PM

Return to original view | Post

#22

|

Senior Member

1,229 posts Joined: Jul 2011 |

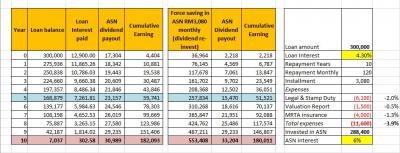

Guys, i received all quotation and indicative bank loan interest, for study option of re-finance property to invest in ASBN.

Below is the details Excel spreadsheet, for "300k re-finance loan @ 10 years repayment" vs "force saving the same amount of loan installment without re-finance" I did not see much difference in earning...and the risk factors is higher... i have cancel my re-finance application today, and decided to do force saving every month. hope this could gives us some idea about "investing in ASBN by property re-financing" if anyone could not understand the table below, feel free to ask This post has been edited by veera77: Nov 7 2017, 03:21 PM Attached thumbnail(s)

|

|

|

Nov 7 2017, 05:14 PM Nov 7 2017, 05:14 PM

Return to original view | Post

#23

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 7 2017, 07:32 PM Nov 7 2017, 07:32 PM

Return to original view | Post

#24

|

Senior Member

1,229 posts Joined: Jul 2011 |

AS1M statement for ending Sept 2017 emailed today by ASNB.

|

|

|

Nov 8 2017, 11:09 AM Nov 8 2017, 11:09 AM

Return to original view | Post

#25

|

Senior Member

1,229 posts Joined: Jul 2011 |

Basically adding asbn is like ‘main tikam’.

Both at asbn counter and MyASBN online, u have to tell/enter ur desire amount and try...if successful u proceed with payment, otherwise try again and again till u get.. My advise, try first with RM100 at MyASBN, and get use with this process...then u can try bigger amount as your wish.. Good luck ! QUOTE(annoymous1234 @ Nov 8 2017, 12:05 AM) |

|

|

Nov 8 2017, 12:52 PM Nov 8 2017, 12:52 PM

Return to original view | Post

#26

|

Senior Member

1,229 posts Joined: Jul 2011 |

wondering younger generation know what is 'tikam game'..

what we learn during our primary school..very useful now |

|

|

|

|

|

Nov 8 2017, 02:30 PM Nov 8 2017, 02:30 PM

Return to original view | Post

#27

|

Senior Member

1,229 posts Joined: Jul 2011 |

all depends your risk appetite...

ASNB is low risk investment...as of now, for non-bumi fixed-price funds, 6% is the floor return...no need to monitor fund price or NAV...peace of mind if u feel could afford higher risk...put half in ASBN and half in higher risk fund...but again depending your age...older u are, avoid high risk investment.. QUOTE(eddyooi @ Nov 8 2017, 01:49 PM) |

|

|

Nov 8 2017, 05:04 PM Nov 8 2017, 05:04 PM

Return to original view | Post

#28

|

Senior Member

1,229 posts Joined: Jul 2011 |

typical behaviour

- guard behave more than officer. - nurse behave more than doctor - clerk behave more than manager @KoYuKii, nicely tell him that you simply want to try your luck..its ok if you don't get... i used to get same dialogue from guard/reception staff..but i just tell them...i;m simply want to trying my luck QUOTE(KoYuKii @ Nov 8 2017, 04:59 PM) ya the 1 tekan no giliran 1.. This post has been edited by veera77: Nov 8 2017, 05:09 PMme:(show him the application form that i've filled) hello, saya nak buka akaun guard: tu tetap punya dah habis...tinggal turun naik me:ooohh..yaka? |

|

|

Nov 9 2017, 12:20 AM Nov 9 2017, 12:20 AM

Return to original view | Post

#29

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 9 2017, 11:14 AM Nov 9 2017, 11:14 AM

Return to original view | Post

#30

|

Senior Member

1,229 posts Joined: Jul 2011 |

Yes, nowadays developers are struggling to sell houses especially semi-D and bungalows, and giving unbelievable discounts..

Its a bargain time for rich people...but for average people is big dream.. ASBN could give better return than property in long run if follow monthly force-saving method, assuming like u paying bank installment every month...eg. monthly RM3k in ASBN...after 10yrs, u r half millionaire. QUOTE(Ramjade @ Nov 9 2017, 06:31 AM) |

|

|

Nov 9 2017, 03:10 PM Nov 9 2017, 03:10 PM

Return to original view | Post

#31

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 9 2017, 11:06 PM Nov 9 2017, 11:06 PM

Return to original view | Post

#32

|

Senior Member

1,229 posts Joined: Jul 2011 |

Hi bro...u hv very valid question..let me try to explain

In the comparison, the basis is not 300k, but the basis is paying RM3,080 monthly for next 10yrs...which is RM370k. So, to answer your question, the actual basis is paying RM370k over 10 yrs, with “loan and invest” compared to “no loan, but invest by force-saving, by assuming u have taken the loan” Option 1 Eventhough i could get 300k loan, but there is upfront fees i have to pay...one-time cost abt 12k to obtain this 300k. 300k-12k = 288k, which is the actual amount which i can invest in ASNB. Thats why on Day 1, my loan value is 300k but ASNB investment value is 288k. Then i work out the spreadsheet assuming mortgage interest 4.3% and ASBN dividend 6% (assume both constant over 10 years) Option 2 I don’t take loan, instead invest every month RM3,080, which is the same amount i pay to bank if i took the loan. Which is forced-saving method. In this option, i not need to worry about BLR movement and ASBN dividend trend. Risk free option. Conclusion “Taking loan, invest, pay refinance installment of RM3,080” could gives almost same return after 10 yrs, compared to “No loan, invest RM3,080 monthly in ASBN”. By the way, i might miss some important variable as i only did quick spreadsheet by considering basic variable only. QUOTE(plumberly @ Nov 9 2017, 06:30 PM) Interesting comparison. This post has been edited by veera77: Nov 9 2017, 11:20 PMBut .... if the purpose is to decide which option to go for, then I feel that the comparison is not comparing apple with apple. Why? Different basis for the 2 options, both should have the same amount of money at the start. Say DTrump has RM30k in hand. Should he go for the: a. ASX loan and keep the RM30k in FD or ASX or b. invest that RM30K with monthly contributions? This to me is a fair comparison, I think. My 1.5 cents. |

|

|

Nov 9 2017, 11:13 PM Nov 9 2017, 11:13 PM

Return to original view | Post

#33

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

|

|

|

Nov 9 2017, 11:36 PM Nov 9 2017, 11:36 PM

Return to original view | Post

#34

|

Senior Member

1,229 posts Joined: Jul 2011 |

A bit off-topic, but for your info..only for self-employed, home-makers, working overseas, or anyone who not getting caruman majikan every month.

In Budget 2018, under KWSP’s Skim Persaraan 1 Malaysia, from 2018-2022, govt will top-up 15% on top of your contribution..but there is cap (RM250/year). If u do backward calculation, RM250/15% = RM1,667 Mean, contribute every year RM1,667 (monthly RM140)...u get RM250 (15%) + KWSP dividend (5-6%)..which is total return of 20% per annum, for next 5 yrs. But u have to go to KWSP and register under Skim Persaraan 1Malaysia first. Only if u are eligible. http://www.kwsp.gov.my/portal/en/general/1...-savings-scheme This post has been edited by veera77: Nov 9 2017, 11:46 PM |

|

|

Nov 10 2017, 10:35 AM Nov 10 2017, 10:35 AM

Return to original view | Post

#35

|

Senior Member

1,229 posts Joined: Jul 2011 |

Sure bro..ha ha..hope we could discuss more other topics in future...

QUOTE(plumberly @ Nov 10 2017, 09:11 AM) Sorry, my 1.6 cents ... There is a difference between the monthly RM3080 for option 1 and RM3080 for option 2. In option 2, one will have to work to earn that RM3080. In option 1, it is self generating. Suggest to close here, agree to disagree. Otherwise we will replying till the cow comes home. Ha. All the best! |

|

|

Nov 10 2017, 02:04 PM Nov 10 2017, 02:04 PM

Return to original view | Post

#36

|

Senior Member

1,229 posts Joined: Jul 2011 |

Dear AOL24,

pls find spreadsheet 200k@30yrs assumption -4.5% loan rate - 6% dividend tae - no upfront fee - dividend re-investment/compounding i try to upload excel sheet for you, but its not allowed in lowyat forum. QUOTE(AOL24 @ Nov 10 2017, 12:23 PM) Scenario might be different for those who opt to go for longer loan tenure. Maximise the 30 years. Would you be willing to run the same numbers? Based on the current loan rates. I'm thinking of getting a RM 200K loan once I start working. Attached thumbnail(s)

|

|

|

Nov 10 2017, 05:17 PM Nov 10 2017, 05:17 PM

Return to original view | Post

#37

|

Senior Member

1,229 posts Joined: Jul 2011 |

No specific conclusion @tonytyk. Just an illustration only..

After did few spreadsheet studies, personally i feel, doing monthly contribution into ASBN is preferable option than taking loan. Keep your financial credit score, for other essentials investment such as property, education, unexpected situation. QUOTE(tonytyk @ Nov 10 2017, 03:40 PM) |

|

|

Nov 10 2017, 08:22 PM Nov 10 2017, 08:22 PM

Return to original view | Post

#38

|

Senior Member

1,229 posts Joined: Jul 2011 |

Difficult to say bro...if both loan interest rate (4.5%) and ASBN dividend (6%) spread, which is now (1.5%) unchange or the spread widen further...than its ok to take loan and put in ASBN.

But if the spread narrow down or in worst case, goes negative..then we must react fast...withdraw ASBN money and settle the loan. So, many risk associated in this option. But if investor understand fully the risk and know how the handle the risk. Then its very fine. Again, taking big loan in early career..might cause difficulty in obtaining home loan...bcoz lower credit score..unless bank willibg to consider ur ASBN saving/dividen as asset/income. So its fully depending on individual. Difficult to generalize. QUOTE(tonytyk @ Nov 10 2017, 07:52 PM) |

|

|

Nov 11 2017, 10:49 PM Nov 11 2017, 10:49 PM

Return to original view | Post

#39

|

Senior Member

1,229 posts Joined: Jul 2011 |

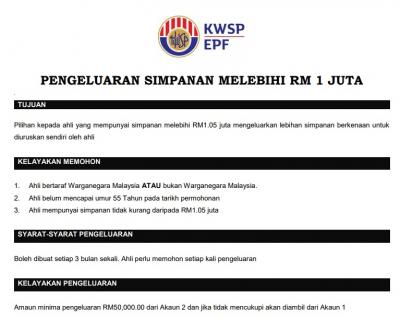

1. Regarding EPF 1 juta...actually there is option to withdraw if u have more than 1 juta...e.g let say ur EPF balance 1.2 juta...then u can withdraw 200k..even u r below 55 yrs old...

if u decided to keep all 1.2 juta...u still will get dividend for 1.2 juta http://www.kwsp.gov.my/portal/member/withd...han-rm1-million 2.0 Regarding dividend...EPF will credit dividend until age 100 yrs old http://www.kwsp.gov.my/portal/documents/10..._19.07.2017.pdf This post has been edited by veera77: Nov 12 2017, 03:25 PM Attached thumbnail(s)

|

|

|

Nov 13 2017, 03:24 PM Nov 13 2017, 03:24 PM

Return to original view | Post

#40

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

Topic ClosedOptions

|

| Change to: |  0.3598sec 0.3598sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 02:38 PM |