QUOTE(berrycoo~ @ Oct 3 2021, 04:03 PM)

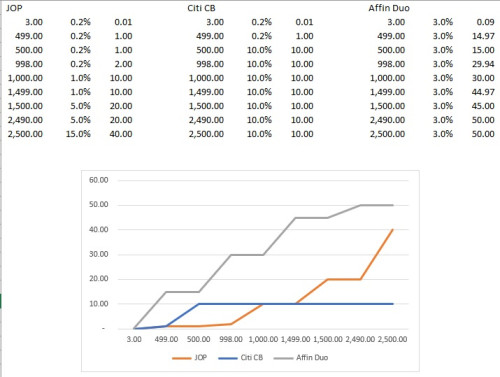

Hi, any credit card recommendation for insurance auto debit? Previously using SCB JOP but this months onwards no longer eligible. Other than Affin duo (already max out), is there any card better than FC Barcelona in terms of cashback?

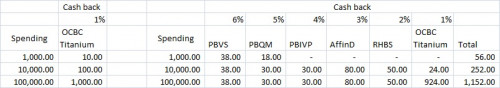

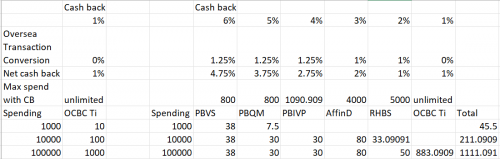

u could go PBQM --> Bigpay --> insurancealthough there were some reports on the reliability issue on bigpay

alternatively, charging the insurance with Affin Visa and convert other expense to other cards?

QUOTE(rocketm @ Oct 3 2021, 07:57 PM)

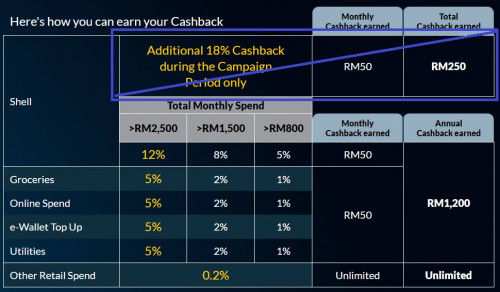

May I know what is the CC for 5% cashback (rm50 cap), maybe I can consider.

For MBB and PBB Duo card, there will be 2x SST for each card that will be charge to me during card activation, is this correct? Are they both able to request for annual fee and SST waive through CS.

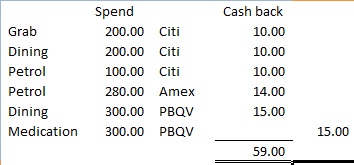

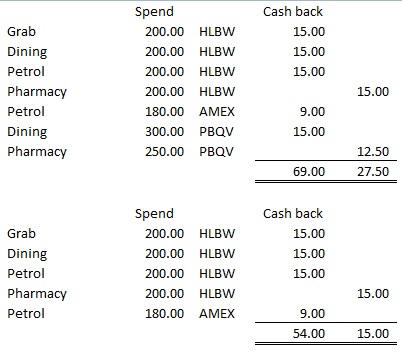

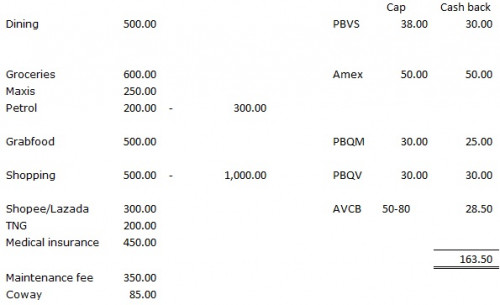

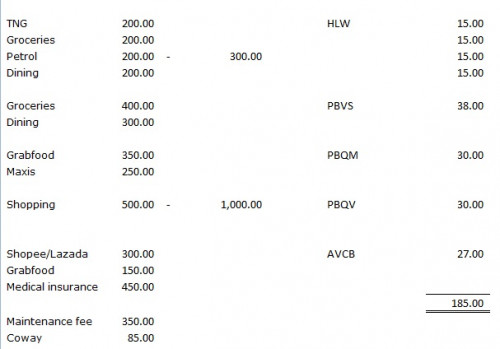

for MBB Amex, except for certain transactions, other spendings on weekend will be eligible for 5% cashback (i.e. RM 200 petrol, actual cost = RM 190)For MBB and PBB Duo card, there will be 2x SST for each card that will be charge to me during card activation, is this correct? Are they both able to request for annual fee and SST waive through CS.

maximum cashback for Amex is RM 50 per calendar month (or equivalent to RM 1,000 spending) and will be credited in the following month

the catch is, the acceptance of Amex (although lazada and shopee are starting to accept Amex)

u r right, the SST will be charged based on the number of cards, which will be RM 50

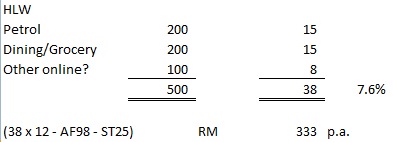

however, u should consider the cashback u will be entitled to

if your petrol, Unifi, etc expenses which could be paid by Amex on weekend exceed RM 1,000 a year, it is quite easy to breakeven the SST

none of them charge annual fee

Public Quantum Visa and Mastercard, on the other hand, are more widely accepted. They are capped at RM 30 each card per month but pay attention to the spend category.

This post has been edited by 1mr3tard3d: Oct 4 2021, 10:30 AM

Oct 4 2021, 10:26 AM

Oct 4 2021, 10:26 AM

Quote

Quote

0.2121sec

0.2121sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled