QUOTE(lin00b @ Dec 14 2024, 12:14 PM)

for affin duo, what do they mean by this?

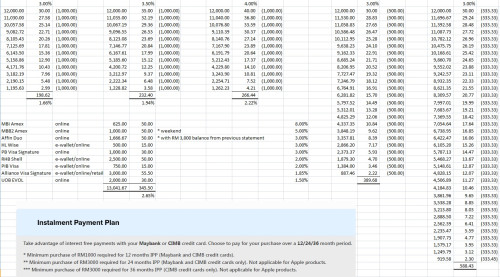

"Cash back is capped at up to RM50 per month with following Previous Balance in AFFIN DUO Visa Cash Back credit card statement:

if i clear by outstanding end of every month, do i still get to have 50CB?

and can i only take up the CB (Visa) and not the points (mastercard)?

unfortunately no, they come in pair

previous balance = statement balance of your previous month statement / opening balance of current month

in short no, your previous balance is not affected by payments unless you made advance payment prior to the statement date

as your ewallet/online + utility is around RM 1k, i do not see the need to go for RM 50 cash back (there are ways to increase statement balance transfer/easy cash, etc)

QUOTE

On "allergy to AF", i just dont like the hassle of calling and requesting for a waiver that is up to the goodwill of the bank..

fyi, the annual fee waiver of UOB can be done via phone IVR, which means it involves dialing numbers only

no guarantee, but i have never got rejected be4

QUOTE

also, the total CB is not that high ..

HL Wise max CB = 60/mo = 720/yr - AF98 - SST 25 = 597/yr

UOB One plat max CB = 60/mon = 720/yr - AF195 - SST25 = 500/yr

compared with

RHB Shell max CB = 100/mo = 1200/yr - SST25 = 1175/yr

CIMB Ptronas VS max CB = 120/mo = 1440/yr - SST25 = 1415/yr

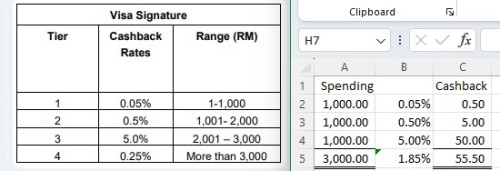

Maybank VS max CB = 88/mo = 1056/yr - SST25 = 1031/yr

RHB VS : max CB = 190/mo = 2280/yr - SST25 = 2255/yr (but 1200 of that is overseas so spending pattern is not that good a match)

not sure how you did the maths

Affin Duo + HL Wise + UOB One = RM 310 + RM 597 + RM 500 = RM 1,407/yr, without taking into account of adding MBI Ikhwan Mastercard to cover the excess

I would pick UOB One Classic over Platinum though

which is why I mentioned earlier regarding

r u looking for highest cash back or minimum number of card? QUOTE(-LoVe- @ Dec 15 2024, 03:05 PM)

3. Card required for: CASHBACK -mainly online transactions, Insurance, Dining and "other" categories not covered by my current cards / other categories once my other cards' cashback are capped or not eligible for cashback, preferably no min. spend per transaction and high effective cashback

4. Existing credit cards (if any): CIMB CB master(plan to cancel this), RHB Shell Visa, HL Wise.

6. Others:

Monthly Spending pattern:

Online: 2k (Lazada & others)

Dinning 500

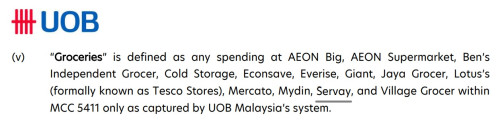

Groceries 500 (mostly AEON)

Insurance 500

Pharmacy 1k

Utilities: 350

Petrol ZERO

for online, u may have a look at

PB VS,

UOB EVOLfor insurance and utilities,

Affin Duodining & grocery, hopefully

M2Gold/Plat is handy in your area

for pharmacy, perhaps

Affin Duo + or

PQ Visa - only

Jun 12 2024, 01:10 AM

Jun 12 2024, 01:10 AM

Quote

Quote

0.1976sec

0.1976sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled