QUOTE(1mr3tard3d @ Jul 17 2025, 11:06 AM)

e-money / online banking mainly replace cash / cheque.cc is credit business. competition is BNPL.

20% growth rate for card business is very good.

Credit Cards Recommendation for Credit Cards V4, Please post according to Format stated

|

|

Jul 17 2025, 12:44 PM Jul 17 2025, 12:44 PM

Return to original view | Post

#41

|

Senior Member

4,195 posts Joined: Sep 2012 |

|

|

|

|

|

|

Jul 23 2025, 08:23 AM Jul 23 2025, 08:23 AM

Return to original view | Post

#42

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(LYNshop @ Jul 22 2025, 02:39 PM) 1. Annual Income: RM120K to RM180K and above Can consider CIMB Petronas VI-i2. Free Lifetime Annual Fee: YES . (But understand that most good cards have annual fees, preferred waivable with MAX 50-60k spending) 3. Card required for: Want a better local spend daily usage card. 4. Existing credit cards (if any): Currently using Maybank MANU card for daily needs. 5. Interested in CC from: looking for a premium good looking card, with better daily spending benefits. (points or cashbacks). 6. Others: Have alliance VI, and ambank VI for lounges benefits. Since Alliance VI has nerfed the daily benefits, will just keep those for lounges benefits. no annual fee. 4x PPL access per year. cb:  This post has been edited by nexus2238: Jul 23 2025, 08:24 AM |

|

|

Jul 23 2025, 01:05 PM Jul 23 2025, 01:05 PM

Return to original view | Post

#43

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(LYNshop @ Jul 23 2025, 12:01 PM) ahh thanks! if you monthly spend is RM4-6k, with combination of cc, it is quite easy to get 3% to 4% cb per month.but i dont pump petronas, sadly. anyways, does cashback benefit alot? or should just focus on points? That's RM120 (3% of 4k) to RM240 (4% of 6k) cb per month. Some find it appealing, some find it troublesome to play. It's your personal preference lah |

|

|

Jul 28 2025, 08:54 AM Jul 28 2025, 08:54 AM

Return to original view | Post

#44

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(Pebbie @ Jul 27 2025, 09:20 AM) 1. Annual Income: 60K Yes, if you aims for lounge access, AEON Gold is very easy, just make sure you spend RM500 30 days before / after lounge access.2. Free Lifetime Annual Fee: Yes, or easy to reach like 1 swipe per month 3. Card required for: general use, with lounge access 4. Existing credit cards: - M2C AMEX - UOB World : plan to cancel in 2026, once the 3 years AF waiver period is up. - Alliance VI : applied back in april. plan to cancel once i receive promo gift. - Alliance VCC : earn point by reloading tng > convert point to tng. any better use beside one-off purchases? 5. Interested in CC from: aeon gold, for easy to reach AF waiver and lounge access. looking for general daily use card with lounge access to replace nerfed alliance VI. spending that new card will cover groceries : 500-1000 utilities : 300 insurance : 500 dining/others : 500 The following don't have lounge access, but give you cb looking at your spending pattern: Bank Islam Platinum - dining, grocery, online (utilities > POS Online > SPlater > cc) Affin DUO - autobill (Insurance) Bank Rakyat Explorer Platinum - lounge access, cb for hotels / airlines. |

|

|

Jul 28 2025, 08:59 AM Jul 28 2025, 08:59 AM

Return to original view | Post

#45

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(Wolgie @ Jul 26 2025, 09:35 AM) 1. Annual Income: RM100K above Affin DUO - 3% cb capped at RM30, e-wallet, autobill2. Free Lifetime Annual Fee: YES or easily waive annual fee 3. Card required for: Want a better local spend daily usage card. 4. Existing credit cards (if any): MBB 2Card Amex: using online only, physical card faulty. lol. Not call replace yet. (donno free replace or not) MBB 2Card Visa: keep only CIMB Petronas P: (CB60+60) everymonth CIMB CashRebate: (CB30) everymonth PBB VS Sign: (CB30) everymonth PBB MasterQ: Normal use (Because No annual fee) PBB Gold: Normal Use (Because No annual fee) UOB One Card: (CB10+10+10sometime), grocery always no full, as SABAH no popular supermarket in UOB list 5. Interested in CC from: looking for ewallet or other use can get cashrebate or points. or replace what i can get more rebate 6. Others: Just Apply Aliance Virtual, being reject. Bank Islam Platinum - 3% cb capped at RM30 - online, dining, grocery (no restriction to which supermarket). Affin DUO+ - 3% cb capped at RM50, contactless spend (can use in any supermarket as long as you keep each charge < RM250) This post has been edited by nexus2238: Jul 29 2025, 09:29 AM |

|

|

Aug 18 2025, 08:02 AM Aug 18 2025, 08:02 AM

Return to original view | Post

#46

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(Duckies @ Aug 16 2025, 01:38 PM) Hi, this Bank Islam Platinum online spending..does it include e-wallet reload? Or just Spaylater only? Sorry, I am NOT SURE about whether e-wallet reload is eligible for cb for Bank Islam Visa Platinum.Never try it. Affin DUO give cb for e-wallet reload. This post has been edited by nexus2238: Aug 19 2025, 08:29 AM |

|

|

|

|

|

Sep 4 2025, 09:03 AM Sep 4 2025, 09:03 AM

Return to original view | Post

#47

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(lis_elle @ Sep 4 2025, 08:33 AM) 1. Annual Income: RM72K Can consider Bank Rakyat Platinum Explorer2. Free Lifetime Annual Fee: Yes or with minimal amt of spendings 3. Card required for: (i) Travel as I travel average once monthly domestic for work, for lounge access or Golden Lounge (ii) Anymore good cashback card? 4. Existing credit cards (if any): UOB One Card (max cb already) Affin Duo Card (max cb already) Public Quantum HSBC Amanah Visa 5. Interested in CC from: Preferably none from the banks above, but if same banks I guess also possible Hopefully can get sifus here for recommendations, the plethora of cards out there can be very confusing. Thx so much 5% cb for all airlines and hotel spend. cap at RM1k per year. 3x access per year to all PPL in Malaysia For cb card, can consider Bank Islam Visa Platinum 3% cb for online, auto billings, grocery, dining. cap at RM30 per month min spend RM500 per month for cb. Also MBB Ikhwan Visa - 8% cb for online spend, cap at RM50. MBB 2C Amex - 5% cb for weekend spend, cap at RM50. This post has been edited by nexus2238: Sep 8 2025, 08:09 AM |

|

|

Sep 18 2025, 08:25 AM Sep 18 2025, 08:25 AM

Return to original view | Post

#48

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(putraheight @ Sep 17 2025, 03:11 PM) 1. Annual Income: min rm60k If you are looking for cb from shopee shopping, maybe consider:2. Free Lifetime Annual Fee: yes 3. Card required for: Cashback = spending 70% on shopee, 30% on grocery 4. Existing credit cards (if any): no 5. Interested in CC from: maybank shopee 6. Others: sole proprietor (means income not fix), have Form B ready, 'empty' CCRIS report because never get loan / cc before. My question: I actually want the Maybank shopee credit card. Do you think i should apply that first (with fd pledge) even it'll most probably be rejected? Or should I just start with other bank which is less strict? which card should i start? Thank you so much. Maybank Ikhwan Amex Platinum - 8% cb cap at RM50 for online spend, ie spend RM625 get RM50 cb. As others has posted, apply directly with Maybank Card Centre. Apply via Maybank website has higher chance of getting rejected. This post has been edited by nexus2238: Sep 18 2025, 08:26 AM putraheight liked this post

|

|

|

Sep 18 2025, 12:05 PM Sep 18 2025, 12:05 PM

Return to original view | Post

#49

|

Senior Member

4,195 posts Joined: Sep 2012 |

|

|

|

Sep 19 2025, 08:42 AM Sep 19 2025, 08:42 AM

Return to original view | Post

#50

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(Gaza @ Sep 18 2025, 03:00 PM) 1. Annual Income: >RM200k Downgrade your MBB 2C to Platinum, then for the Amex (5% cb cap at RM50 for weekend spend) you can do utilities / phone bills > POS Online > Spaylater > Amex (just pay early on weekend).2. Free Lifetime Annual Fee: Yes or can waive with spending/swipes 3. Card required for: Cashback on utilities/phone bills/grab food... or cashback card that have high RM cashback ceiling without many diff categories 4. Existing credit cards (if any): RHB Visa Cashback (using this for utilities/groceries/grab food, but too many categories and only RM10 cashback per category) - willing to cancel if can find something better CIMB Petronas Visa Infinite (for petrol/cigarettes and dining) - something like this card for utilities/phone/grab food would be great Maybank Ikhwan Amex Platinum (for shopee/spaylater) Maybank 2 Premier - planning to cancel this before my next card anniversary date 5. Interested in CC from: Open to any... Polished bank app would be a plus, my prev experience using Stan Chart app felt very clunky. Edit: Monthly credit card spending usually around RM8-10k per month (excluding occasional/emergency spending). CIMB card requires RM4k min monthly spend, Maybank Amex requires around RM600+ spend to get full cashback, so roughly have around another RM4k spend to use on another card. Thanks For card that don't have many diff categories, can consider Affin DUO+ (just activate Visa), 3% cb cap at RM50 for any contactless (wave at terminal without pin) spend. Or Bank Islam Visa Platinum, 3% cb cap at RM30 for any spend on online (eg grab) / auto-bill / groceries / dining each calendar month, min spend RM500 per calendar month. |

|

|

Oct 16 2025, 08:34 AM Oct 16 2025, 08:34 AM

Return to original view | Post

#51

|

Senior Member

4,195 posts Joined: Sep 2012 |

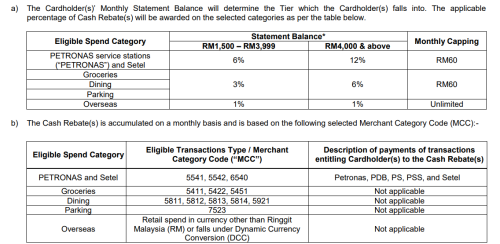

QUOTE(jutamind @ Oct 14 2025, 11:07 PM) Anyone using Bank Islam Visa Platinum cashback card? I don't understand how their cashback is calculated. Lodged a Complaint since mid Sep and until now, not a single call back or email to fix the issue. I have been using Bank Islam Visa Platinum for > 6 months.Aug bill total: 677.44, closing bal: 658.84, cashback 18.6 Sep bill total: 744.78, closing bal: 724.74, cashback 20.04 Oct bill total: 1003.92 closing bal: 979.77, cashback 24.15 I was assuming it's 3% of total bill amount but calculations seems off. Anyone has any idea how the cashback is calculated? cb is on time every month at 10th of the month @ 3% of spend of previous month. cb cyble is based on calendar month, not statement date. just stating the obvious - only online / auto-billing / grocery / dining spend is entitled for cb. Need more details from you Haloperidol and jwgs0010 liked this post

|

|

|

Nov 20 2025, 08:49 AM Nov 20 2025, 08:49 AM

Return to original view | Post

#52

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(jwgs0010 @ Nov 19 2025, 08:58 PM) Can anyone confirm below? I got different answer from Bank Islam thru 2 calls and 1 email I can only answer regarding Bank Islam Visa Platinum-i.Please find the details below: 1. Current Credit Card Statement Date - Your current statement date is 14th of every month. 2. Statement Date Cycle Options - For Bank Islam credit cards, the statement date is fixed. Your cycle runs from 15th of the previous month to 14th of the current month. 3. Cashback or Point Calculation Basis - Cashback and point calculations are based on the statement cycle, not the calendar month. 4. Reflection of Cashback and Points - Cashback and points earned during a cycle will be reflected in the next statement after the cycle ends. 1. Current Credit Card Statement Date - mine is 25th of each month. 2. Statement Date Cycle Options - maybe the bank meant they cannot allow you to choose statement date cycle? 3. Cashback or Point Calculation Basis - cashback for Visa Platinum-i is calculated on calendar month basis, eg 1st Oct to 31st Oct. 4. Reflection of Cashback and Points - cashback for the whole month of October appear on 10th of November in Bank Islam apps, so forth. This post has been edited by nexus2238: Nov 20 2025, 08:51 AM jwgs0010 liked this post

|

|

|

Nov 25 2025, 10:18 AM Nov 25 2025, 10:18 AM

Return to original view | IPv6 | Post

#53

|

Senior Member

4,195 posts Joined: Sep 2012 |

Bank Muamalat is not listed as credit card issuer in Bank Negara website. How unprofessional can this bank be I received my 15th Nov cc statement via email on 16th Nov, but till today (25th Nov) the same statement still does not appear on website. Their whole backend is not ready for influx of new cc clients, in my opinion |

| Change to: |  0.2626sec 0.2626sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 11:30 AM |