Outline ·

[ Standard ] ·

Linear+

Credit Cards Recommendation for Credit Cards V4, Please post according to Format stated

|

fruitie

|

Mar 29 2025, 06:31 PM Mar 29 2025, 06:31 PM

|

Rise and Shine

|

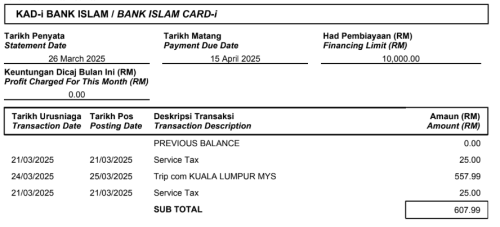

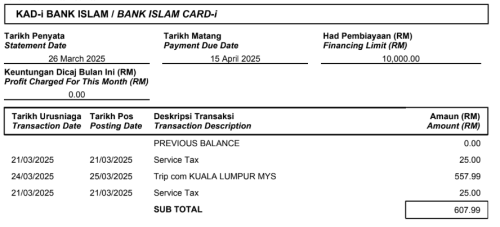

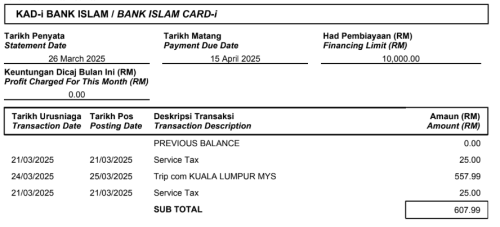

QUOTE(Noob Boy 1996 @ Mar 29 2025, 05:50 PM) Hey guys, I just receive my Bank Islam Visa Platinum credit card and spend on trip.com but didnt receive any cashback in the monthly statement despite meeting the minimun spending requirement RM500. Anyone know what happen?  Read the product details, when the cash back will be credited. Some follows calendar month, some follows statement month. |

|

|

|

|

|

fruitie

|

Apr 7 2025, 12:24 PM Apr 7 2025, 12:24 PM

|

Rise and Shine

|

QUOTE(nexus2238 @ Apr 7 2025, 12:17 PM) UOB One Classic used to be THE recommendation for your use case. But it apparently was not open for new application anymore. From Maybank, consider: Maybank Islamic Petronas Ikhwan Visa Gold - 8% cb for spending at PETRONAS stations on Saturday & Sunday and 1% cb for spending at PETRONAS stations from Monday till Friday, capped at RM50 per month Maybank Islamic Ikhwan Mastercard Gold - 5% cb on petrol and groceries on Friday and Saturday, capped at RM50 per month Maybank 2 Gold - Amex 5% cb for all purchases (except for government bodies and utilities) on weekends, capped at RM50 per month Also for Maybank, both Maybank 2 Gold and Ikhwan are considered as two entities - conventional and Islamic. Hence, for income below RM 36k per annum can only apply for two issuing banks. In this case, if apply for both of these cards, they are not able to apply for another bank until the income exceeds RM 36k per annum. |

|

|

|

|

|

fruitie

|

Apr 8 2025, 02:16 PM Apr 8 2025, 02:16 PM

|

Rise and Shine

|

QUOTE(ableze_joepardy @ Apr 8 2025, 02:06 PM) can explain how to do this? Go to bill payments on Lazada or Shopee, choose UniFi and pay directly with AmEx Ikhwan. |

|

|

|

|

|

fruitie

|

May 22 2025, 03:24 PM May 22 2025, 03:24 PM

|

Rise and Shine

|

QUOTE(virgoguy @ May 22 2025, 03:14 PM) Really speechless with the bank Provided EA form, EPF statement and yet said without payslip and employment confirmation letter cannot process the application. This is ridiculous! how the hell am I gonna dig back the physical employment confirmation letter back in 15 years ago Employment confirmation letter is not the probation confirmation letter, nothing for you to dig back all the way to 15 years ago.  Just get your HR to give you a letter to confirm you are currently working for the company. It is a standard letter that all companies can issue. |

|

|

|

|

|

fruitie

|

May 22 2025, 03:43 PM May 22 2025, 03:43 PM

|

Rise and Shine

|

QUOTE(virgoguy @ May 22 2025, 03:41 PM) is it the requirement for CC application now a day? as I understand the past CC applications, 1 EPF or 1 EA Form settled Some banks can be quite strict, it is not a standard document. I had the same issue when I applied for Alliance bank. |

|

|

|

|

|

fruitie

|

Jun 1 2025, 11:52 AM Jun 1 2025, 11:52 AM

|

Rise and Shine

|

I don’t fly for work so much these days compared to before Covid and even that I had a company credit card to use. Ironically, all my business class tickets were redeemed from 2022 onward.  Every time I always redeem a single business class ticket hence it’s achievable for me. Can’t say the same if with family. So far, I have redeemed 10 times and only business class tickets ranging from Asia to Europe. To me, to redeem one economy class ticket is a waste. The strategy is you need to know how the expenses work and from there you can plan accordingly. I changed all my cash back cards (though I still have them) to airmiles cards. Cash back I only stick to Maybank. The rest I will use airmiles cards. |

|

|

|

|

|

fruitie

|

Jun 2 2025, 10:54 PM Jun 2 2025, 10:54 PM

|

Rise and Shine

|

QUOTE(Ramjade @ Jun 2 2025, 10:47 PM) But the banks charge like 3% for all overseas transaction if you are chasing miles and using it for overseas transaction. So just bear with it? Yes. The service charge is pretty negligible vs the amount I pay for my tickets under redemption. |

|

|

|

|

|

fruitie

|

Jun 3 2025, 01:51 AM Jun 3 2025, 01:51 AM

|

Rise and Shine

|

QUOTE(Ramjade @ Jun 3 2025, 01:21 AM) I was trying to avoid the charge. But if you spend like 100k, 3% it is like 3k. Well, I may only pay less than RM 500 for a business class ticket instead of full payment more than 10k. I guess worth it. I never really bother about those charges to be honest. |

|

|

|

|

|

fruitie

|

Jul 16 2025, 12:00 PM Jul 16 2025, 12:00 PM

|

Rise and Shine

|

QUOTE(adele123 @ Jul 16 2025, 11:26 AM) Paying bills like unifi, mobile phones as well. I was checking the mbb ikhwan website, there is no exclusion for Utilities, so paying TNB works too. Cannot pay bills via M2U using Ikhwan AmEx as it won’t be counted as cash back. Obviously, TNB also won’t be considered into cash back. |

|

|

|

|

|

fruitie

|

Jul 16 2025, 02:58 PM Jul 16 2025, 02:58 PM

|

Rise and Shine

|

QUOTE(adele123 @ Jul 16 2025, 02:55 PM) I see. my bad. but TNB website accepts amex though. wont it count? ya, then wont work for unifi, but major telcos accepts amex on their website/portal? should still work right? No, TNB is utilities so no cash back. Yes, if using their respective telco apps can get cash back. For UniFi can use Shopee or Lazada and pay directly with AmEx. This post has been edited by fruitie: Jul 16 2025, 03:00 PM |

|

|

|

|

|

fruitie

|

Jul 23 2025, 03:17 PM Jul 23 2025, 03:17 PM

|

Rise and Shine

|

QUOTE(LYNshop @ Jul 23 2025, 03:15 PM) i see, as i know if high spender like 10-20k per month only worth to invest on airmiles right? not too sure on this, which card would u recommend if focus on points? usually usage more on dining, retails etc. yeah looks like quite hassle to keep track if using multiple card to utilize the cashbacks. which card would u recommend if focus more on points? It depends on your needs. Some people don't go holidays, so accumulate airmiles also useless. For me, I love travelling in business class, so miles to me are important. |

|

|

|

|

|

fruitie

|

Jul 23 2025, 03:36 PM Jul 23 2025, 03:36 PM

|

Rise and Shine

|

QUOTE(LYNshop @ Jul 23 2025, 03:30 PM) which card do u recommend if were to maximize airmiles benefits? It is getting harder now. No more nice cards and I haven't really studied yet after the revision. I currently have HLB VI, Ambank Enrich VI, Alliance VI, UOB VI and UOB PRIV Miles Elite. I already cancelled CIMB TWE, M2Premier, SCB Journey. |

|

|

|

|

|

fruitie

|

Jul 23 2025, 03:53 PM Jul 23 2025, 03:53 PM

|

Rise and Shine

|

QUOTE(LYNshop @ Jul 23 2025, 03:49 PM) yeah the latest revision really bad, especially for the Alliance VI. it looked like a perfect all in one card lol. btw how do u waive the UOB AF ? wanted to get UOB, but has high AF on the zenith card. and is it true, since u have many cards, will also affect your future car/house loan? I didn't get to waive yet because I was given with free AF for 2 years or 3 years when I applied. Zenith is the card I'm still considering. I might even consider AmEx Plat which has RM 3k+ AF if I manage to maximize my spending. I used to have more >30 cards, now only around 22 cards or something. Never had issues with loans. However, my last hire purchase loan was in 2020 and mortgage loan in 2017 but that time I had > 30 cards. |

|

|

|

|

|

fruitie

|

Jul 23 2025, 04:10 PM Jul 23 2025, 04:10 PM

|

Rise and Shine

|

QUOTE(LYNshop @ Jul 23 2025, 04:03 PM) great to know that. im guessing you're using some cards just for lounge? whats ur main daily usage card? probably just follow u  I hardly use for lounge because I always travel in business, so lounge is provided.  However, if I need to, I used to use CIMB TWE PPF but now UOB mostly for normal PPL. I travel from KLIA most of the time, hardly from KLIA2. |

|

|

|

|

|

fruitie

|

Jul 23 2025, 04:20 PM Jul 23 2025, 04:20 PM

|

Rise and Shine

|

QUOTE(LYNshop @ Jul 23 2025, 04:17 PM) nice man, CIMB TWE too overpowered for me haha. will apply the petronas VI first, and see how. Petronas Islamic VI is a good card, I plan to get it too. |

|

|

|

|

|

fruitie

|

Jul 23 2025, 04:31 PM Jul 23 2025, 04:31 PM

|

Rise and Shine

|

QUOTE(LYNshop @ Jul 23 2025, 04:25 PM) i think u probably have all the available cards already. haha. which card gets u the most points for ur miles collection so far? It was CIMB TWE before the revision, now UOB (for KF) and Alliance VI (EM), but again it got revised. I forgot that I also have the AmEx KF Plat for KrisFlyer. This post has been edited by fruitie: Jul 23 2025, 04:32 PM |

|

|

|

|

|

fruitie

|

Jul 23 2025, 05:10 PM Jul 23 2025, 05:10 PM

|

Rise and Shine

|

QUOTE(LYNshop @ Jul 23 2025, 05:00 PM) mainly the UOB VI or PME? PME, but to me, both are almost the same. |

|

|

|

|

|

fruitie

|

Jul 23 2025, 07:24 PM Jul 23 2025, 07:24 PM

|

Rise and Shine

|

QUOTE(LYNshop @ Jul 23 2025, 06:09 PM) alright will try to apply that as well. how do u juggle on all ur cards AF? lets say if we dont hit the minimum spend to waive, stiill can call to waive AF? Alliance told me that can just call and waive it, not too sure is it true.(for the VI) It depends, some don’t allow so have to cancel. Some banks may retain, some may not. So apply again next time. |

|

|

|

|

|

fruitie

|

Aug 18 2025, 06:10 PM Aug 18 2025, 06:10 PM

|

Rise and Shine

|

QUOTE(Lego Warfare @ Aug 18 2025, 11:10 AM) Is there a period gap needed to reapply again? For example MBB KF annual fee hits, then you cancel the card. Can you reapply for the card again 1 week after cancellation to still get the 1st year free AF waiver?  6 months but approval is up to their discretion. One week of course cannot, they will just reinstate the old card and need to pay for AF. |

|

|

|

|

|

fruitie

|

Sep 18 2025, 10:25 AM Sep 18 2025, 10:25 AM

|

Rise and Shine

|

QUOTE(adamhzm90 @ Sep 18 2025, 10:19 AM) Does cashbacm include ewallet topup? No. |

|

|

|

|

Mar 29 2025, 06:31 PM

Mar 29 2025, 06:31 PM

Quote

Quote 0.2619sec

0.2619sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled