QUOTE(iampokemon @ Jan 2 2017, 05:41 PM)

Asides from currency and the risk rating, how would I judge if it is a good fund or not? Since everything is being managed by the fund manager. Reputation?

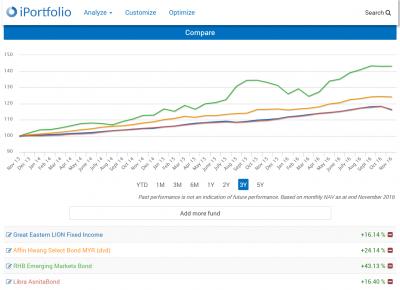

One way to assess is to compare the fund with its peer within the same league, for example affin hwang select bond fund is a fixed income fund invest in diverse sectors within asia ex japan region, compared some funds in the same league

Also, if you have some financial knowledge, you can also read their fund fact sheet or annual report to see what they invest into, and with some financial news, along with the performance peer comparison, you can understand why such such fund is performing or declining as a lot of factors comes into play to determine a fund's worthy

QUOTE(iampokemon @ Jan 2 2017, 05:47 PM)

Yup I just submitted my registration application for FSM and maybe test it out a little and see how it works. But if I'm not wrong, fundsupermart might charge a fee that would be much higher than the bank may offer.

Looking at this example here:

Fundsupermart's Discounted Initial Sales Charge* 0 %

Platform Fee (%)* 0.05% per quarter

Annual Management Charge* 1.5 %

Trustee Fee* 0.08% p.a of NAV

Other Significant Fees* Switching Fee: RM 25.00

Annual Expense Ratio ^ 1.68% (as of February 10, 2016)

Fundsupermart might charge an annual management charge of 1.68%. But let's say I put in Citibank, they only charge me a one time 2% charge and a relationship manager will be appointed to me, where I could always gets updates from them time to time.

Is my calculation correct based on this example?

(0) fund house is the party that managed the fund (i.e. Affin hwang select bond fund is managed by Affin hwang)

(1) Annual management charge is the charges charged by the fund house for mannaging the fund

(2) Trustee fee is the charges that charged for trustee institution to protect the fund money

(3) Switching Fee is the charges charged by fund house if you decide to switch between funds

(4) Annual expense ratio is the ratio that shows how much is the expense cost as compared to the fund value (overall value, not part of the individual charges)

(1) & (2) are according to the fund and was reflected in the daily NAV value, so regardless of the platform or agents (citibank, maybank, fsm, eUT etc....), these are the implicit charges in the fund you invest

(3) only incurred when you switch to different funds.

Platform fee is the charges charged by FSM for fixed income funds. (this is different to sales charge)

The difference between citibank or bank agents or fund house agents and FSM is that the bank agents charged at normal sales charge (usually) due to human processing need

Whereas FSM, the platform is online, you can deal your investment there, so the sales charge are usually low or 0% (for fixed income fund)

p/s: the expense part is also one of the criteria you can assess when choosing a fund (i.e. if several funds perform similarly, lower expense cost signify efficient investment fund) (at least thats what i think

)

Dec 30 2016, 06:15 PM

Dec 30 2016, 06:15 PM

Quote

Quote

0.1251sec

0.1251sec

0.64

0.64

7 queries

7 queries

GZIP Disabled

GZIP Disabled