Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

paramdav

|

Jan 24 2025, 10:10 PM Jan 24 2025, 10:10 PM

|

Getting Started

|

QUOTE(cybpsych @ Jan 24 2025, 03:21 PM) Thanks |

|

|

|

|

|

paramdav

|

Jan 29 2025, 10:41 AM Jan 29 2025, 10:41 AM

|

Getting Started

|

QUOTE(Chuffling @ Jan 29 2025, 12:39 AM) I see... thanks. RM told me min 10K. Yea the bank staff always try to "Scam"  They told me need to top up 10k else cant do new FD with rollover amt I said i can only top up 2k. They pretend to ask HQ approval then said ok can :-)  This post has been edited by paramdav: Jan 29 2025, 10:42 AM This post has been edited by paramdav: Jan 29 2025, 10:42 AM |

|

|

|

|

|

paramdav

|

Feb 24 2025, 09:15 PM Feb 24 2025, 09:15 PM

|

Getting Started

|

QUOTE(Syok Your Mom @ Feb 24 2025, 12:11 PM) Why UOB needs fresh funds for their FD ? Very hassle For us fresh fund means transfer out the money and in a day or 2 trans it back  |

|

|

|

|

|

paramdav

|

Apr 28 2025, 10:37 AM Apr 28 2025, 10:37 AM

|

Getting Started

|

QUOTE(gilabola @ Apr 28 2025, 09:05 AM) MBSB is currently 4% for 12 months? Or rate gone down to 3.9%? I did the FD last week at the shah alam branch it's still 4% But if you are renewing the fd need to add min 1K to enjoy the 4% rate else it 3.85% as informed by the bank person |

|

|

|

|

|

paramdav

|

May 1 2025, 08:18 PM May 1 2025, 08:18 PM

|

Getting Started

|

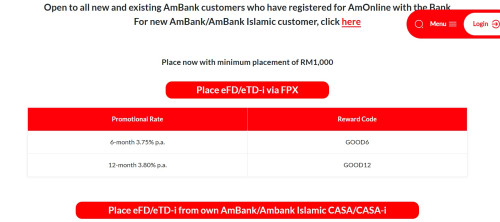

QUOTE(Dilz16 @ May 1 2025, 07:01 PM) Hi guys, so whats the best rate for OTC FD and eFD now? Ambank 3.85 12m ? OTC is MBSB 12Mths 4% - fresh fund |

|

|

|

|

|

paramdav

|

May 1 2025, 11:28 PM May 1 2025, 11:28 PM

|

Getting Started

|

QUOTE(Dilz16 @ May 1 2025, 11:21 PM) Anyone know if I just placed an eFD via FPX for AmBank, and decided to withdraw same day to transfer to another bank with better rate, will it reflect on my statement immediately or need wait 3 working days baru can withdraw? From what I know you can withdraw yr FD and it will be in yr saving acct immediately and u can withdraw |

|

|

|

|

|

paramdav

|

May 2 2025, 10:21 PM May 2 2025, 10:21 PM

|

Getting Started

|

QUOTE(Afterburner1.0 @ May 2 2025, 05:15 PM) No monthly Interest |

|

|

|

|

|

paramdav

|

May 2 2025, 10:22 PM May 2 2025, 10:22 PM

|

Getting Started

|

Bank Negara expected to cut interest rate to 2.75% in July https://www.freemalaysiatoday.com/category/...to-2-75-in-julyThis post has been edited by paramdav: May 2 2025, 10:23 PM |

|

|

|

|

|

paramdav

|

Jun 3 2025, 09:59 PM Jun 3 2025, 09:59 PM

|

Getting Started

|

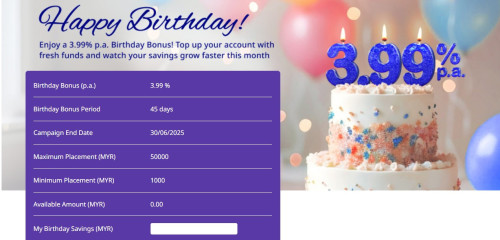

QUOTE(BWassup @ Jun 3 2025, 07:30 PM) Not everyone's birthday will fall within this 45 days, right?  What it means is that you will get this offer during yr birthday month In my case it's Jun, so I can place a max of 50K for 45 days for 3.99% (Annum) the month of Jun it depends on when is yr birthday month |

|

|

|

|

|

paramdav

|

Jun 5 2025, 10:03 PM Jun 5 2025, 10:03 PM

|

Getting Started

|

QUOTE(joice11 @ Jun 5 2025, 05:32 PM) you recieved this summary after deposit? the image i posted was before i made the deposit This post has been edited by paramdav: Jun 5 2025, 10:06 PM |

|

|

|

|

|

paramdav

|

Jun 9 2025, 09:22 PM Jun 9 2025, 09:22 PM

|

Getting Started

|

Std Charted just revised their 3.8% FD for 12 mths to 3.7% :-(

does this means FD rates are dropping ?

|

|

|

|

|

|

paramdav

|

Sep 6 2025, 09:24 AM Sep 6 2025, 09:24 AM

|

Getting Started

|

.

This post has been edited by paramdav: Sep 6 2025, 08:58 PM

|

|

|

|

|

|

paramdav

|

Oct 1 2025, 10:58 AM Oct 1 2025, 10:58 AM

|

Getting Started

|

QUOTE(TubeNRibbon @ Oct 1 2025, 10:28 AM) What you said is exactly what I’m experiencing, to the point that I don’t even want to speak with the RM anymore. Don’t bother with HSBC FD — it looks attractive at first to get you to place a deposit, but after 6 months they have nothing better to offer. The FD rate just reverts back to the normal bank rate. After 6 mths can withdraw and move to a diff bank, That is what the RM advise me too  |

|

|

|

|

|

paramdav

|

Oct 5 2025, 10:07 PM Oct 5 2025, 10:07 PM

|

Getting Started

|

hi All, what is the current FD promo at Bank muamalat

This post has been edited by paramdav: Oct 5 2025, 10:23 PM

|

|

|

|

|

|

paramdav

|

Oct 26 2025, 10:02 PM Oct 26 2025, 10:02 PM

|

Getting Started

|

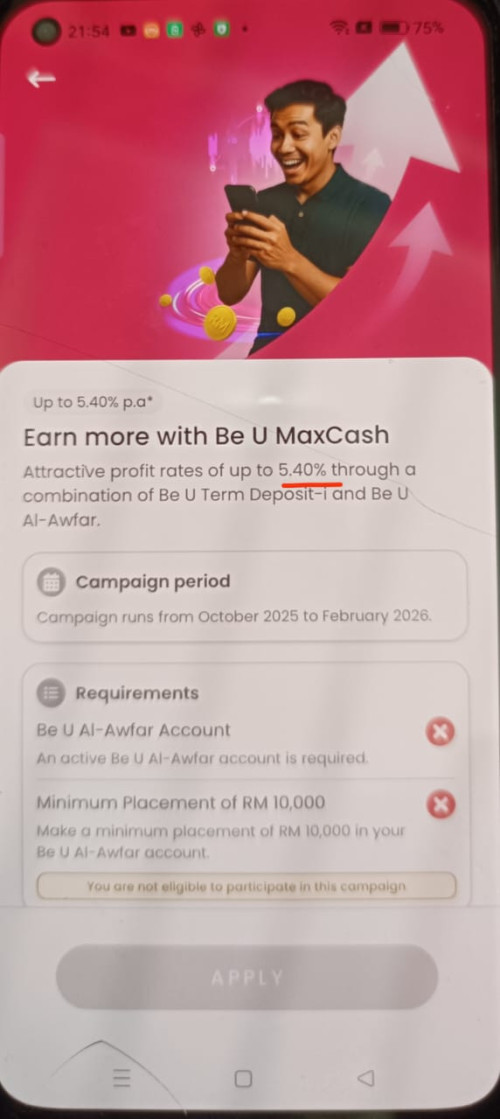

Hi Bros, Anyone tried the Maxcash option in BeU app. they seems to offer up to 5.4% Not sure if there is any catch anyone placed money on this option?  |

|

|

|

|

|

paramdav

|

Nov 1 2025, 10:11 PM Nov 1 2025, 10:11 PM

|

Getting Started

|

QUOTE(Human Nature @ Nov 1 2025, 11:40 AM) Those with maturiing Muamalat FD, do you still get sms or counter offer to retain the fund? I have not received any notifications from them, usually I will go to the bank and renew it at the current promo rate |

|

|

|

|

|

paramdav

|

Nov 11 2025, 07:53 PM Nov 11 2025, 07:53 PM

|

Getting Started

|

QUOTE(rahsk @ Nov 11 2025, 06:20 PM) Ihsbc has new account promo of 4.28 If I close my current HSBC account,open new ones, can I get the offer or 4.28%? HSBC is a bit strict on this, In my case my account was closed abt 4 years ago they still had to check with HQ and alot of drama and finally agreed for the 4.28% FD you can check with them |

|

|

|

|

|

paramdav

|

Nov 11 2025, 07:58 PM Nov 11 2025, 07:58 PM

|

Getting Started

|

QUOTE(Chonloo13 @ Nov 10 2025, 07:19 PM) Anyone place HSBC premier offer with 6 months 4.28% FD rates? I checked with banker this is pure FD and have to place 300k, going to open account and place it next month, attractive offer , i just worry is there any hidden terms or this is related to investment products etc… I did mine last mth, its pure fd only catch is you should not have closed a saving / current HSCB acct - Not sure of the period mine was like 4 yrs ago i had closed a HSBC acct and they had to get approval from HQ |

|

|

|

|

Jan 24 2025, 10:10 PM

Jan 24 2025, 10:10 PM

Quote

Quote

0.0594sec

0.0594sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled