Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jun 13 2021, 02:30 PM Jun 13 2021, 02:30 PM

Return to original view | Post

#81

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

If BR within radius, can walk-in to renew/withdraw FD now during FMCO ? Thanks

|

|

|

|

|

|

Jun 13 2021, 02:54 PM Jun 13 2021, 02:54 PM

Return to original view | Post

#82

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

|

|

|

Jun 15 2021, 05:26 PM Jun 15 2021, 05:26 PM

Return to original view | Post

#83

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(kplaw @ Jun 15 2021, 10:57 AM) may i know the ws no and email addr that u used? i called the cc and talked to the branch (kuching) yesterday, both said have to go to branch for renewal with promotional rates. I overheard only those with >RM300k as exclusive customers will get this service. Maybe those who get this service can confirm ? |

|

|

Jun 30 2021, 10:21 AM Jun 30 2021, 10:21 AM

Return to original view | Post

#84

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(MUM @ Jun 30 2021, 10:12 AM) Looking back, has depositors ever lost their money in fd or saving a/c before due to banks having financial problem?... Like during Asia financial crisis or any sort of that? I recall yes, during the Ko-operasi Bank in late 80's or early 90'sThe FD rate at that time is super high like 8%+ I recall govt step in, and repayment back to consumers in installments over years. |

|

|

Jul 12 2021, 11:13 AM Jul 12 2021, 11:13 AM

Return to original view | Post

#85

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

|

|

|

Jul 14 2021, 01:35 PM Jul 14 2021, 01:35 PM

Return to original view | Post

#86

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(Nom-el @ Jul 14 2021, 12:30 PM) Anyone knows how the FD interest is calculated for CIMB? It seemed that all FD placements in 2020 that are maturing in 2021 are getting less interest than expected. Is is because of leap year calculation? But it should not matter for 1 year FD placement right? Should be standard FD calculation. If you can provide the start date, duration (or end date), amount and % , there are many experts here to calculate the exact amount expected for you. |

|

|

|

|

|

Aug 30 2021, 09:40 PM Aug 30 2021, 09:40 PM

Return to original view | Post

#87

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(steadypong @ Aug 30 2021, 09:24 PM) Typo on date* Using my own excel formula, 29. 30 and 31-Aug-2021 add 6 months all end at 28-Feb-2022 but will receive different interest based on the different number of days. Calculation using 10k @ 2.5% p.a.Seeking for any FD expert here to answer my curiosity. Given if I put a 6months FD on this 3 days (29/08/2021, 30/08/2021 & 31/08/2021), when will be the maturity date, 28/02/2022, 01/03/2022 or other date? 29-Aug = 183/365 days (Sunday, not possible) = RM125.3425 30-Aug = 182/365 days = RM124.6575 31-Aug = 181/365 days (Public holiday, not possible) = RM123.9726 1-Sep = 181/365 days (just extra calculation from me) = RM123.9726 Actual formula, depends on each individual banks whether to end at 28-Feb-2022 (Monday) or 1-Mar-2022 (Tuesday) |

|

|

Aug 30 2021, 11:05 PM Aug 30 2021, 11:05 PM

Return to original view | Post

#88

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

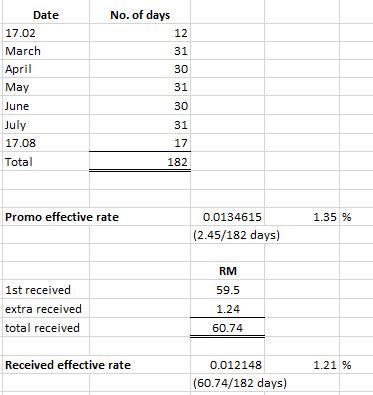

QUOTE(mamamia @ Aug 30 2021, 10:17 PM) Maybe my real life example can shown u that they didn’t round down for my interest crediting if the system is coreect, but the manual interest crediting is in round down method like what u said. n based on my spreadsheet, I notice that HLB didn’t do round down and I get exact amount of interest everytime: Just curious, for 18-Feb 2.4% 5k 6-months 181/365 Placement date: 25 Feb 6 months TIA @2.45% Mature date: 25 Aug Number of day: 181 5000 x 181 / 365 x 2.45% = RM60.7465 So, if based on your theory, I should get RM60.74 and not RM60.75, am I right? But I get RM60.75 for this. Hope my understanding on your explanation is correct.. for earlier 18 Feb placement, the system give 2.40% at RM59.50, and the manual profit credited is only RM1.24, instead of RM1.25 (RM60.75 - RM59.50) Please refer to attached screenshot on the amount I received without system error that I mentioned in my earlier post. = 59.5068 = 59.51 instead of 59.50 which gives a difference of 1.2397 = 1.24 |

|

|

Sep 2 2021, 06:53 PM Sep 2 2021, 06:53 PM

Return to original view | Post

#89

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(rocketm @ Sep 2 2021, 10:43 AM) Hi guys, just want to confirm on HLBB TIA-i calculation. Your FD is similiar to the earlier calculation few posts above.I chat with them and got my refund for the shortage of profit amount. Promo rate: 2.45% p.a Tenure: 6 months Principal: RM 5k Placement tenure: 17.02.21 - 17.08.21 Total profit received RM59.50 + RM1.24 = RM60.74 =================================== [url=https://pictr.com/image/B66QC2]  Does the amount that I received is still not based on the promo rate? 2.40% you will get 59.50684932 2.45% you will get 60.74657534 So, it looks like HLBB has erred in first calculation by giving you 2.40%, then add back the missing 1.239726027 for the 0.05% |

|

|

Sep 2 2021, 07:36 PM Sep 2 2021, 07:36 PM

Return to original view | Post

#90

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(rocketm @ Sep 2 2021, 07:31 PM) Just to confirm when calculate the effective rate for FD/TIA-i, we are using the formula below 181 days only, not 182(publish rate in p.a / 365 x number of tenure in calendar day For my case, (2.45/365) x 182 days = 1.221% Deal Hunter and rocketm liked this post

|

|

|

Oct 25 2022, 10:29 AM Oct 25 2022, 10:29 AM

Return to original view | Post

#91

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(leo99 @ Oct 24 2022, 11:40 PM) for BI FD, can make placement online? or must be done at counter? Must be OTC. Can be done on same day, unless system down.Also, I have no account with BI previously. Anyone can share their experience in opening basic savings account with BI before? Can do everything (open account + fd placement) within same day? |

|

|

Jun 2 2023, 04:21 PM Jun 2 2023, 04:21 PM

Return to original view | Post

#92

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(okuribito @ Jun 1 2023, 01:14 PM) So I went to BI just now and they said got another promo 5.9% 70:30 FD:SA deal. LOL coba nasib cabutan tuah win this & that. Effectively ~4.1x% + lottery ticket BUT the thing that screw up my day is EPF "promo" On the way to BI, saw EPF "roadshow" saying voluntary contributions increased to 100K wef 1/6 today As a jobless warga mas, that is very tempting news. Because iinm, **div is calculated yearly but takes into consideration the dates of contributions and withdrawals... not simply the balance at the end of the year. What that means is that we earn div penuh for everyday the money is with kwsp. And we can treat it like a supercharged savings account, masuk keluar sesuka hati vs zero int for premature FD withdrawal. Of course, warga mas only lah haha I think they are pretty concerned about the withdrawals - that's why raise to 100K from 60K. And I think also good news for FD rates becos now kwsp competing with the banks - surely the banks will respond with higher rates. So what do u think? PS: **Hopefully I am not mistaken about how div is calculated cos that's a major factor to consider It's hot discussion now in EPF - self contribution thread starting from this page. I'm already moving my FD allocation funds to EPF for years If more than 1M, can withdraw the excess like savings account any time via online, just takes 2-3 working days. |

|

|

Aug 19 2023, 10:56 PM Aug 19 2023, 10:56 PM

Return to original view | Post

#93

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(Efalex @ Aug 19 2023, 10:14 PM) Just want to ask, 1. Yes, I have FD with BR but without any account. I write a good old cheque, and the branch I goto give me cert on the same day OTC. Some others say you can bring over a bankers cheque.1. if I don't have a saving account with a particular bank, can I still take the promo FD via FPX? 2. What will happen to the proncipal at the end of the FD tenure? 3. Will it be transfer back or the FD will continue until it is redeem? 2. You will have a FD cert/receipt. Make sure redeem OTC manually on the exact maturity date. Your problem if you come late one day or weeks later, you may not get additional interest. 3. On maturity date, goto counter manually do IBG or RENTAS to your other local bank account for both principal + interest - bank transfer fee charge. |

| Change to: |  0.0664sec 0.0664sec

0.54 0.54

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 06:16 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote