Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

babysotong

|

Jul 31 2022, 11:19 AM Jul 31 2022, 11:19 AM

|

Getting Started

|

QUOTE(drifters @ Jul 31 2022, 10:42 AM) Anyone placed FD in Ambank recently? Did you find any peculiarity in the placement date and maturity date? Eg. 12 months FD placed on 22Jul matures 24Jul 2023? Is this normal for Ambank? For other banks, its usually same day/month next year. Have you checked whether 22 Jul 2023 is a weekend or weekday? Some banks "moved" the end date to a weekday as people might withdraw via OTC and not internet banking. |

|

|

|

|

|

babysotong

|

Aug 1 2022, 09:12 AM Aug 1 2022, 09:12 AM

|

Getting Started

|

QUOTE(CommodoreAmiga @ Aug 1 2022, 09:06 AM) Arghh! I have just put a 2.4% for 3 mths yesterday to some other bank. Calculate to determine whether worth to withdraw and place with this promotion rate |

|

|

|

|

|

babysotong

|

Aug 27 2022, 09:41 PM Aug 27 2022, 09:41 PM

|

Getting Started

|

QUOTE(WaCKy-Angel @ Aug 26 2022, 10:43 PM) Afaik ALL OTC fixed deposit provides certificate. I dont think the banks provide FD certificate. If you look carefully, it is just an acknowledgement of receipt for placement in FD. It is not a FD certificate |

|

|

|

|

|

babysotong

|

Aug 28 2022, 01:07 AM Aug 28 2022, 01:07 AM

|

Getting Started

|

QUOTE(WaCKy-Angel @ Aug 28 2022, 12:57 AM) Afaik CIMB, Affin, and MBSB does have cert for OTC placement. Didnt go other banks for OTC recently so not sure. Unless your "FD certificate" refers to another thing. This is a CIMB sample taken from internet. Is this what u mean?  This mean CIMB issue FD cert. From what I know UOB, Affin and Ambank don't issue FD cert. Only acknowledgement of placement. Apparently, banks got into issue with FD certs in the past when there are duplication in withdrawal. Not too sure the full story |

|

|

|

|

|

babysotong

|

Sep 14 2022, 12:47 PM Sep 14 2022, 12:47 PM

|

Getting Started

|

QUOTE(xSean @ Sep 14 2022, 10:54 AM) Now confusing. Some is 3.4 and some 3.15 for invikta 6 months No need to be confused - it is 3.15% pa for 6 months for Affin invikta That is the latest promotion |

|

|

|

|

|

babysotong

|

Sep 14 2022, 06:45 PM Sep 14 2022, 06:45 PM

|

Getting Started

|

QUOTE(BladeRider @ Sep 14 2022, 03:03 PM) Ambank Malaysia day promo, 12 months 3.5%pa, min 10k This is the highest rate I see recently without the bundle bundle condition. AFFIN already announced 3.5% pa for 12 months since last Friday la |

|

|

|

|

|

babysotong

|

Sep 15 2022, 01:21 AM Sep 15 2022, 01:21 AM

|

Getting Started

|

QUOTE(xSean @ Sep 14 2022, 08:02 PM) You mean affin change the rate to 3.15 for 6 months. I asked my RM on Monday is 3.4 Strange as both RM and the branch manager told me it is 3.15% pa for 6 months when they shared the FD rates to me on Monday. |

|

|

|

|

|

babysotong

|

Nov 24 2022, 01:17 PM Nov 24 2022, 01:17 PM

|

Getting Started

|

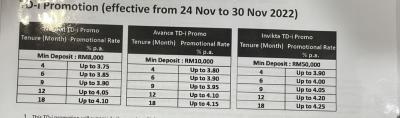

Fresh from the oven Affin Bank new promo Attached thumbnail(s)

|

|

|

|

|

|

babysotong

|

Nov 24 2022, 01:18 PM Nov 24 2022, 01:18 PM

|

Getting Started

|

Affin bank Savings promo with lock in period. Rate better than FD promo Attached thumbnail(s)

|

|

|

|

|

|

babysotong

|

Nov 24 2022, 01:53 PM Nov 24 2022, 01:53 PM

|

Getting Started

|

QUOTE(coolstore @ Nov 24 2022, 01:37 PM) hi, counter or online? i checked online no such promo OTC |

|

|

|

|

|

babysotong

|

Nov 24 2022, 02:03 PM Nov 24 2022, 02:03 PM

|

Getting Started

|

QUOTE(Human Nature @ Nov 24 2022, 01:52 PM) Hmm, why 'up to'  Up to means the max the branch can go up to. The BM or sales person might try to give a bit lower and than, if customer nego, slowly move the rate up. The pictures I shared are what I got from my RM that was supposed to be internal docs 😂 |

|

|

|

|

|

babysotong

|

Nov 24 2022, 09:33 PM Nov 24 2022, 09:33 PM

|

Getting Started

|

QUOTE(coolstore @ Nov 24 2022, 02:09 PM) so today branches may not even receive this notice yet, right? and available in general affin bank? regular customer can sign up the invikta fd? was planning going to bank mualamat for the 3mth 4%, but troublesome need banker cheque (bank fees incurred) bla bla and wait 3 days to clear, better stick back with affin 3.9% All branches should receive this promo already. If not, show the screeshots to them 😂 Yes, all Affin bank. The invikta is their priority banking segment. Just need AUM of rm250k and opened an invikta current account with rm1k in it for the principal and/or interest to be credited. By the way, the invikta current account is interest bearing |

|

|

|

|

|

babysotong

|

Dec 11 2022, 08:29 PM Dec 11 2022, 08:29 PM

|

Getting Started

|

QUOTE(MattSally @ Dec 9 2022, 10:36 PM) And other financial commentators see OPR stable at around 3.5% in 2023. I have no crystal ball but I will be surprised if there is not at least two more 25 point rises to OPR before the rate stabilises. https://themalaysianreserve.com/2022/11/04/...in-2023-to-3-5/The article was dated 4 Nov 2022 and since then, there are new developments. US had soften its stance, their inflation rate is under controlled, Malaysia got new government and MYR has strengthen from 4.70 to 4.40 as at today. So, the 1st MPC meeting in January 2023 will be interesting. If MYR keeps strengthening, then unlikely to see a hike. This post has been edited by babysotong: Dec 11 2022, 08:30 PM |

|

|

|

|

|

babysotong

|

Jan 20 2023, 12:57 PM Jan 20 2023, 12:57 PM

|

Getting Started

|

QUOTE(fabu8238 @ Jan 20 2023, 11:08 AM) Sentiments change. Why FD rates drop when OPR unchanged? Is this justified? My guess is if banks drop their FD rates too much and fast I may not be convinced if ringgit weakens, inflation stays high and 3M KLIBOR rate stays unchanged. That's my humble take now. Think because banks were expecting the OPR to go up yesterday and this, did a pre-emptive move. Now, it is confirm that OPR stays put, the banks are revising their strategy and hence, the rates |

|

|

|

|

|

babysotong

|

Jan 26 2023, 10:36 AM Jan 26 2023, 10:36 AM

|

Getting Started

|

Doesn't look like OPR going to increase anytime soon. MYR has appreciated against the greenback and is strong at 4.24 at the point of writing. At the same time, the cost of living will be a burden to the rakyat if OPR is increase as loan interest will increase too.

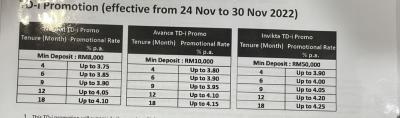

So far, for long term (12 months FD), Affin is giving up to 4.2% pa. Anything better than this?

|

|

|

|

|

|

babysotong

|

Feb 8 2023, 10:26 AM Feb 8 2023, 10:26 AM

|

Getting Started

|

Affin Bank Attached File(s) FD_TDi_Campaign_Up_To_4.20__4_February_2023.pdf

FD_TDi_Campaign_Up_To_4.20__4_February_2023.pdf ( 72.13k )

Number of downloads: 309 |

|

|

|

|

|

babysotong

|

Feb 15 2023, 01:39 PM Feb 15 2023, 01:39 PM

|

Getting Started

|

Affin bank New rates, slight increase from the old one  This post has been edited by babysotong: Feb 15 2023, 01:40 PM

This post has been edited by babysotong: Feb 15 2023, 01:40 PM |

|

|

|

|

|

babysotong

|

Feb 17 2023, 01:38 PM Feb 17 2023, 01:38 PM

|

Getting Started

|

QUOTE(elea88 @ Feb 17 2023, 12:19 PM) I posted earlier in the brochure for Affin promotion effective 15 Feb. Search the post |

|

|

|

|

|

babysotong

|

Feb 28 2023, 09:41 PM Feb 28 2023, 09:41 PM

|

Getting Started

|

QUOTE(BoomChaCha @ Feb 27 2023, 09:38 PM) March, Bank Negara meeting, OPR most likely will go up? or maintain? [attachmentid=11426771] FD mature tomorrow.  Or put in KDI first? If put in KDI: (A) If OPR maintain in March, I lose (B) If OPR increase, I win Unfortunately, nobody has a crystal ball This post has been edited by babysotong: Feb 28 2023, 09:41 PM |

|

|

|

|

Jul 31 2022, 11:19 AM

Jul 31 2022, 11:19 AM

Quote

Quote

0.7852sec

0.7852sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled