Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

babysotong

|

Dec 25 2023, 10:29 AM Dec 25 2023, 10:29 AM

|

Getting Started

|

Affin - Invikta customer

No promotion leaflet but was told verbally

4.15% pa for 12 months FD (OTC)

4.06% pa for 6 months CASA promo. Meaning money put in CASA and locked-in for 6 months. Works like FD. Maybe for the bank to improve it's CASA to FD ratio

|

|

|

|

|

|

babysotong

|

Dec 30 2023, 02:22 PM Dec 30 2023, 02:22 PM

|

Getting Started

|

QUOTE(N9484640 @ Dec 28 2023, 09:53 AM) I went Sri Petaling branch they only give 4% for one year May I know what branch gave 4.15% I believe the branch gave you the FD promo rate for mass market; i.e. normal banking. The 4.15% is for Invikta customers |

|

|

|

|

|

babysotong

|

Mar 7 2024, 06:05 PM Mar 7 2024, 06:05 PM

|

Getting Started

|

QUOTE(ASoulNamedLeo @ Mar 7 2024, 04:35 PM) Goodbye MYR 🫡, it's been nice knowing ya Not goodbye... In fact, MYR has been strengthening to about 4.70 now from a high of 4.78 earlier this week. MYR is expected to keep strengthening |

|

|

|

|

|

babysotong

|

Mar 8 2024, 08:26 AM Mar 8 2024, 08:26 AM

|

Getting Started

|

QUOTE(ASoulNamedLeo @ Mar 7 2024, 09:27 PM) You think when USD interest rate is 5.25% while MYR interest rate is 3.00%, people would still want to keep MYR for their FD? Well, one can always transfer the money out. No one stopping that. Yes, the difference in both US and MYR rate might affects the currency rate but it is not the only factor. Latest news that US will cut rates this year and the gap will be reduced. Government didn't increase the OPR just to "protect" the MYR currency. I am sure they also consider the other group of the Rakyat, where increase in OPR will cause their bank borrowing like loan to increase. Yes, some of us would like to see the FD rates increase. There is always two sides to a coin. is more of a balancing act for the Government |

|

|

|

|

|

babysotong

|

Mar 8 2024, 09:41 AM Mar 8 2024, 09:41 AM

|

Getting Started

|

Anyway, an update on BI FD-I for 6 months at 4.15% pa

Placed on Wednesday with a cheque. Placement effective date is 6 March but can only collect the certificate on this coming Monday. Nevertheless, it is updated in the Internet banking also immediately. Very fast service, all in all, less than 20 minutes.

Got 3 diaries as gift 😂

Bank officer said promo still valid but subject to quota being reach, which might be soon.

With the OPR remain yesterday, not sure whether there is any changes to the promo.

|

|

|

|

|

|

babysotong

|

Mar 8 2024, 11:49 AM Mar 8 2024, 11:49 AM

|

Getting Started

|

QUOTE(nexona88 @ Mar 8 2024, 11:15 AM) This new rates offered is lower?? Or better than the last one 🤔 Because I see banks all lowered their rates starting March... That's why I'm asking Seems to be lower slightly, maybe 5 to 10 basis points |

|

|

|

|

|

babysotong

|

Mar 12 2024, 01:05 PM Mar 12 2024, 01:05 PM

|

Getting Started

|

QUOTE(Yamy @ Mar 12 2024, 11:52 AM) Can i use cheque for the FD placement? Yes, can use personal cheque. The effective date is the date of you placed the FD, assuming cheque is current date. However, you can only collect the FD cert 3 working days later. At Bank Islam. Bank officer says the promotion still ada at 4.15% pa for 6 months till end April or quota met or revised by BI with a day or two notice |

|

|

|

|

|

babysotong

|

Apr 6 2024, 06:47 PM Apr 6 2024, 06:47 PM

|

Getting Started

|

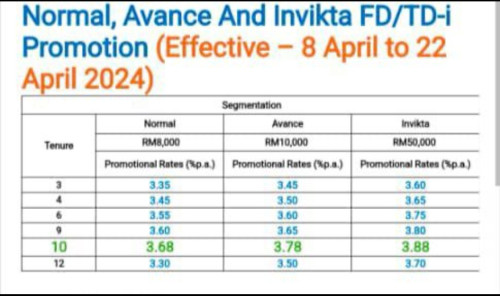

Affin Invikta

Effective Monday, 8 April 2024

12 months - 3.7% pa

10 mths 3.8% pa

|

|

|

|

|

|

babysotong

|

May 31 2024, 07:39 AM May 31 2024, 07:39 AM

|

Getting Started

|

QUOTE(Human Nature @ May 30 2024, 03:59 PM) Anyone know what is the cut off time to place eFD with Affin? Should be banking hours |

|

|

|

|

|

babysotong

|

Nov 28 2024, 12:54 PM Nov 28 2024, 12:54 PM

|

Getting Started

|

Bank Islam

TDT - 12 months at 4%

Till 31/12/2024 or quota finish, whichever is earlier

|

|

|

|

|

|

babysotong

|

Dec 7 2024, 11:59 AM Dec 7 2024, 11:59 AM

|

Getting Started

|

QUOTE(akhito @ Dec 7 2024, 11:35 AM) Today i kena again money out ald but not receive in MBB  If there is no plan to fix, maybe should just close down the acc. If inward transactions also can have problem unfix for almost 1 year ald. How can people trust MBB with their money. With all the issue with FPX into MBB for FD placement shared, why want to try in the first place? Should have avoid the MBB FD FOX like a plague |

|

|

|

|

|

babysotong

|

Apr 2 2025, 01:33 PM Apr 2 2025, 01:33 PM

|

Getting Started

|

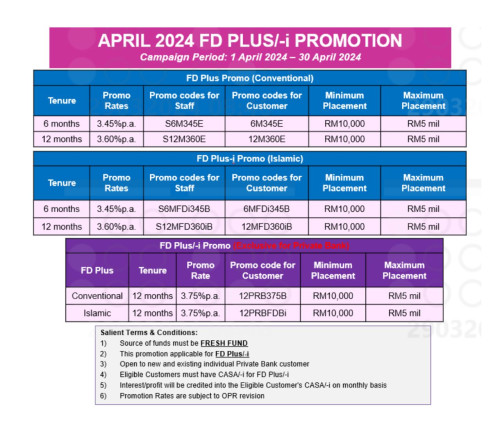

Affin Bank As per table Fresh fund, can get 3.8% pa for 12 months placement This post has been edited by babysotong: Apr 2 2025, 01:33 PM Attached thumbnail(s)

|

|

|

|

|

|

babysotong

|

Apr 6 2025, 11:27 PM Apr 6 2025, 11:27 PM

|

Getting Started

|

Bank Islam Got the info from their website 5 months - 3.65% pa 9 months - 3.75% pa 12 months - 3.85% pa This post has been edited by babysotong: Apr 6 2025, 11:28 PM Attached thumbnail(s)

|

|

|

|

|

|

babysotong

|

Apr 15 2025, 12:12 AM Apr 15 2025, 12:12 AM

|

Getting Started

|

Bank Islam - term deposit 11 April to 31 May 2025 6 months @ 3.90% pa 9 months @3.95% pa 12 months @ 4.00% pa Attached thumbnail(s)

|

|

|

|

|

Dec 25 2023, 10:29 AM

Dec 25 2023, 10:29 AM

Quote

Quote

0.0675sec

0.0675sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled