QUOTE(ruudygh @ Feb 5 2024, 04:11 PM)

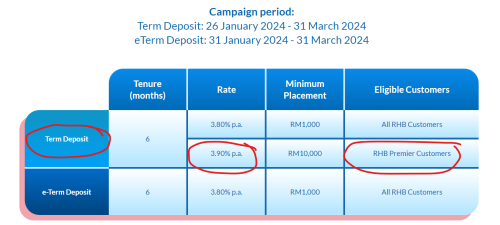

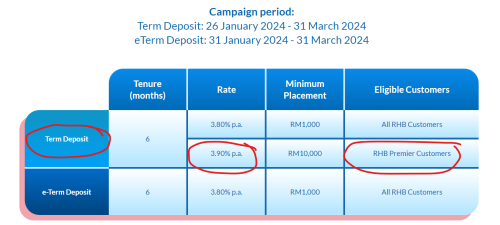

As a Premier customer, i gain extra 0.10% on interest rate, but I lost the conveniernt of doing it over the internet.

RHB wants me to go thru all the hassle by stucking in the traffic and expose to the sunlight for 30 minutes and then queue up for the counter for another 1 hour, just for the 0.10% extra?

How is this "Premier"? I dont get it

I feel cheated by becoming a premier customer

QUOTE(ruudygh @ Feb 5 2024, 05:06 PM)

What is personal RM?

The rhb pretty lady banker told me to apply for premier because i will get many priviledge/benefits.

The requirement is easy, i just have to maintain my savings/FD at least rm100k. And pay rm100 premier fee every year.

No need to be a big boss or manager.

And i have never gained any benefits after 3 years since i became premier customers

Hmm...premier/priority customer needs to pay meh? So far, my experience with other banks, no need to pay anything wor. I think it's ridiculous.

QUOTE(chinkw1 @ Feb 6 2024, 11:52 AM)

HLB, MBB got good fd promo now?

Usually where u guys get fd promo information? U call the bank direct?

Google internet, there are some good sites like this:

https://ringgitplus.com/en/blog/fixed-depos...n-malaysia.html

Jan 17 2024, 12:07 PM

Jan 17 2024, 12:07 PM

Quote

Quote

0.0565sec

0.0565sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled