QUOTE(cclim2011 @ Aug 23 2025, 12:36 PM)

the rate for TDT was reduced from 4% to 3.75% towards the end of the campaign due to OPR cut.Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Aug 24 2025, 05:20 PM Aug 24 2025, 05:20 PM

Return to original view | Post

#41

|

Junior Member

292 posts Joined: Oct 2007 |

|

|

|

|

|

|

Aug 24 2025, 05:21 PM Aug 24 2025, 05:21 PM

Return to original view | Post

#42

|

Junior Member

292 posts Joined: Oct 2007 |

no harm done. appreciate the questions. im hoping that they'll be another campaign as well towards the end of the year. makes my life easier to reach target. haha nexona88 liked this post

|

|

|

Sep 8 2025, 11:14 AM Sep 8 2025, 11:14 AM

Return to original view | Post

#43

|

Junior Member

292 posts Joined: Oct 2007 |

|

|

|

Sep 9 2025, 10:45 AM Sep 9 2025, 10:45 AM

Return to original view | Post

#44

|

Junior Member

292 posts Joined: Oct 2007 |

QUOTE(voc8888 @ Sep 9 2025, 10:39 AM) got. soon. Branches will be available soon. Be U lambat sikit (by a few weeks). voc8888 liked this post

|

|

|

Sep 9 2025, 01:14 PM Sep 9 2025, 01:14 PM

Return to original view | Post

#45

|

Junior Member

292 posts Joined: Oct 2007 |

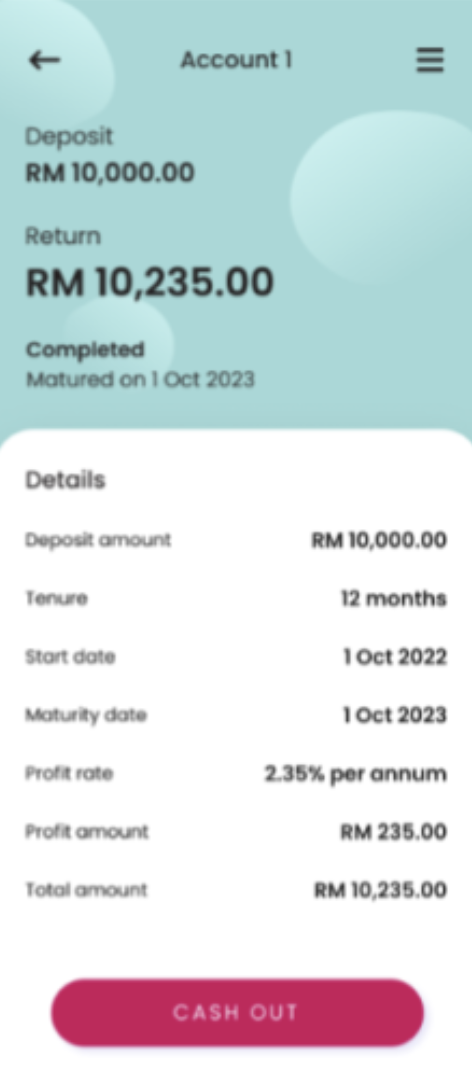

QUOTE(soulreap @ Sep 9 2025, 11:01 AM) @ikanez is there any way I can change the bank account to transfer out my BE U term deposit on the app? My mom's matured but because she registered it under Rize previously, now she cannot transfer it out. Calling BE U CS takes forever, she was in queue for like 5-10 mins and its always "high volume of calls" and the same position in queue hmm.. the system doesn't mandate for customers to have Be U QSA account for withdrawal. if you have setup a legit bank account elsewhere (in this case, Rize, and it's also proven to be the customer's own account and not 3rd party) - the system should be able to send the money out to that destination once matured.that being said, i've also just learned that if it's not Be U QSA account, the withdrawal will need to be done manually - via the click of a "CASH OUT" button (refer to pic). For customers who have setup Be U QSA as their withdrawal account, the transfer would've been done automatically upon TD maturity. to reiterate, if your withdrawal account is not within Be U, need to click "CASH OUT" once TD is matured. The "CASH OUT" button will only appear once TD has matured. Else it'll be a diff button.  This post has been edited by ikanez: Sep 9 2025, 01:16 PM |

|

|

Sep 9 2025, 02:01 PM Sep 9 2025, 02:01 PM

Return to original view | Post

#46

|

Junior Member

292 posts Joined: Oct 2007 |

QUOTE(soulreap @ Sep 9 2025, 01:34 PM) The problem now is that because Rize was taken back by Al-Rajhi, her account number also changed and the old one cannot be used anymore. And there is no option for us to change the destination bank account in the app itself which is frankly disappointing. What if "accidents" happen and we switch banks? So now the money is stuck in there UNTIL we can get through to CS and CS is taking FOREVER. She was waiting on the phone for 40 minutes and the queue NEVER MOVED. oh dear. sorry to hear that (both about rize, and the long queue). could you help log a ticket via the in-app form, and pass me the ticket num (via DM). will try to escalate and get our team to contact ur mom. just to preempt - the process to change withdrawal account is rather lengthy as it involves a lot of validation steps. so do bear with us for the time being. |

|

|

|

|

|

Oct 6 2025, 12:07 AM Oct 6 2025, 12:07 AM

Return to original view | Post

#47

|

Junior Member

292 posts Joined: Oct 2007 |

Be U just launched new TD promo Campaign Period: 6 October 2025 - 31 March 2026 Min deposit: RM10,000 Tenure/rate: 6 Month/3.55pa, 12 Months/3.65pa adele123 and CommodoreAmiga liked this post

|

|

|

Oct 18 2025, 04:07 PM Oct 18 2025, 04:07 PM

Return to original view | Post

#48

|

Junior Member

292 posts Joined: Oct 2007 |

QUOTE(adele123 @ Oct 18 2025, 01:18 AM) Instead of waiting until 11pm, i withdraw early at 5pm. Maturity was 12th oct. to summarize, you clicked on early withdrawal, got the full interest, but tht placement was still listed under premature withdrawal - am i understanding this correctly?Got my full interest. But since i click withdrawal myself, in the user interface, i have one FD categorised under premature withdrawal. The rest was automated, so it was in the completed deposit catgeory. I am not the 1st one here who tried and done. |

|

|

Oct 18 2025, 10:59 PM Oct 18 2025, 10:59 PM

Return to original view | Post

#49

|

Junior Member

292 posts Joined: Oct 2007 |

QUOTE(adele123 @ Oct 18 2025, 10:34 PM) thanks. im still trying to understand the behaviour of the bug that's been described by a few of the members here. will bring this back to the team for them to have a look. adele123 liked this post

|

|

|

Oct 21 2025, 09:32 AM Oct 21 2025, 09:32 AM

Return to original view | Post

#50

|

Junior Member

292 posts Joined: Oct 2007 |

QUOTE(cybpsych @ Oct 21 2025, 08:57 AM) the dev/product mgr need to correctly understand the ACTUAL/PROPER definition of MATURITY DATE agreed with your points there. will bring this back to our devs for them to have a look. definitely something's not right here.seems they assume customers doesnt withdrawal on maturity date itself (which already matured). however app doesnt react/display/handle "withdrawal date == maturity date" correctly. |

|

|

Dec 3 2025, 01:43 AM Dec 3 2025, 01:43 AM

Return to original view | Post

#51

|

Junior Member

292 posts Joined: Oct 2007 |

adele123 liked this post

|

| Change to: |  0.8099sec 0.8099sec

0.43 0.43

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 03:26 AM |