QUOTE(airtawarian @ Mar 25 2020, 06:21 PM)

Which bank?Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Mar 25 2020, 07:43 PM Mar 25 2020, 07:43 PM

Return to original view | IPv6 | Post

#41

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Mar 27 2020, 01:55 PM Mar 27 2020, 01:55 PM

Return to original view | IPv6 | Post

#42

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Micky78 @ Mar 27 2020, 01:52 PM) with the defer instalment of loan for 6 mth...bank will be short of cash flow. There's already a reduction in SRR.will we be seeing banks offering higher FD interest in coming days? Plus there could be also a potential of another OPR cut by May 2020. What would you think? |

|

|

Mar 27 2020, 05:04 PM Mar 27 2020, 05:04 PM

Return to original view | IPv6 | Post

#43

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(BLKH3 @ Mar 27 2020, 04:43 PM) Urgent help from SIFU. I am a noob. 2400/12 which is 200 on average.According to https://www.maybank2u.com.my/maybank2u/mala...ed_deposit.page, Interest Rate (% p.a.) for 1 month is 2.40%. I dumb dumb think that if I put let's say..... RM100k term 1 month (I chose one month in the Maybank2u website), I get (2.4/100)*100, 000, I get 2400 after one month. I was told I am wrong. Someone told me that, because I did not put in a total of 12 months, I only get 2400/12 which is 200. Who is correct? Don't laugh, please. I know I am noob in fixed deposit. The banks not are calculating down to days now. 2400/365 X number of days lapsed |

|

|

Mar 28 2020, 01:29 PM Mar 28 2020, 01:29 PM

Return to original view | IPv6 | Post

#44

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 29 2020, 06:29 PM Mar 29 2020, 06:29 PM

Return to original view | IPv6 | Post

#45

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(skyvisionz @ Mar 29 2020, 06:16 PM) Hi all sifu, if i dun have any rhb account but i want to aplly rhb efd do i need to walk to counter? Or can just do online? I saw this at their website.Maybe this could be helpful to you:  https://logon.rhb.com.my/pbw/ |

|

|

Mar 30 2020, 03:40 PM Mar 30 2020, 03:40 PM

Return to original view | IPv6 | Post

#46

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Mar 30 2020, 05:25 PM Mar 30 2020, 05:25 PM

Return to original view | IPv6 | Post

#47

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(rocketm @ Mar 30 2020, 05:09 PM) Is it for normal customers or priority customer? This is not FD but Conditional High Yield Saving Account.What is the tenure and is it online fd? Any link for the information on its website? Details: https://www.alliancebank.com.my/Alliance-Ba...us-Account.aspx |

|

|

Mar 30 2020, 09:13 PM Mar 30 2020, 09:13 PM

Return to original view | IPv6 | Post

#48

|

All Stars

12,387 posts Joined: Feb 2020 |

Salute you guys who still go to the branch despite the potential spread risk of COVID-19.

I'll try to avoid places with long queues or waiting time > 15 minutes. |

|

|

Mar 30 2020, 10:08 PM Mar 30 2020, 10:08 PM

Return to original view | IPv6 | Post

#49

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(kionglee @ Mar 30 2020, 10:08 PM) 30/4/2020https://www.pbebank.com/Personal-Banking/Pr...X-Campaign.aspx This post has been edited by GrumpyNooby: Mar 30 2020, 10:10 PM |

|

|

Mar 30 2020, 10:14 PM Mar 30 2020, 10:14 PM

Return to original view | IPv6 | Post

#50

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 1 2020, 07:26 PM Apr 1 2020, 07:26 PM

Return to original view | IPv6 | Post

#51

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(David_Yang @ Apr 1 2020, 07:25 PM) In the past ist was 10k at OCBC. I'm skeptical as World Bank has cut 2020 GDP forecast from 4.5% to -0.1%I find this very interesting! It looks like OCBC thinks that in 12 months the OPR will be higher than in 6 months. For looooooooooong time already the 12 month FD with them was worse than the 6 months. And the predictions about the brutal Bank Negara rate cuts were totally correct so far. A light at the end of the tunnel. Remember the old times when we were at 3.5 in 2009, then beaten down to 2.0 in 2009 and climbed back to 2.75 in 2010. Possibility for OPR hike is to tame inflation; possibly from uncontrolled surging of food price This post has been edited by GrumpyNooby: Apr 1 2020, 07:30 PM |

|

|

Apr 2 2020, 03:12 PM Apr 2 2020, 03:12 PM

Return to original view | IPv6 | Post

#52

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 2 2020, 09:21 PM Apr 2 2020, 09:21 PM

Return to original view | IPv6 | Post

#53

|

All Stars

12,387 posts Joined: Feb 2020 |

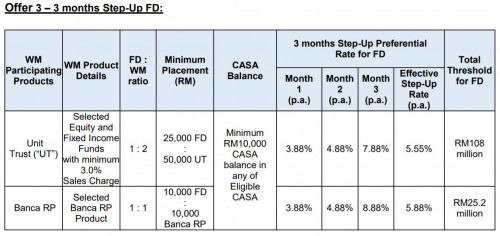

QUOTE(angalc557 @ Apr 2 2020, 09:11 PM)  15. To be entitled for the 3 months Step-Up FD as stipulated in Offer 3, the Eligible Customers must fulfill the following Campaign’s prerequisites: a.) Place Fresh Funds into FD with the minimum FD placement per transaction is RM25,000 and minimum subscription of RM50,000 UT OR minimum RM10,000 FD placement per transaction and minimum annualised premium payment of RM10,000 Banca RP. Placement amount made in the Eligible Accounts must follow the ratio as per Offer 3.; AND b.) Prerequisite of minimum RM10,000 CASA balance in any of the Eligible CASA is required per each FD placement. 16. For Offer 3, the FD will be based on rollover monthly interest or Profit Rate for the 3 months Step-Up Preferential Rate on the first 3 months. Upon maturity, the FD will automatically be renewed at the 3 months FD prevailing board rate. The WM Participating Products in Offer 3 are subject to change from time to time by the Bank at its discretion and customers should check with the branch staff on the WM Participating Products listing. 20. For Banca RP products, the eligibility criteria are: 20.1.1. Applications are to be submitted to and received by Manulife Insurance Berhad within the Campaign Period and accepted and/or issued on or before 15 calendar days from campaign end date or the day the stated FD threshold is reached. 20.1.2. Combination of multiple policies of the same policyholder to meet the minimum annualised premium amount as stated will not qualify for this Campaign. https://www.alliancebank.com.my/Alliance/me...BANNER-01042020 What is in the RP? It is looks like some insurance or annuity plan from Manulife Insurance. For further detials, please make an appointment at the nearest branch to speak to the bank staff (RM or WP). This post has been edited by GrumpyNooby: Apr 2 2020, 09:23 PM |

|

|

|

|

|

Apr 2 2020, 10:14 PM Apr 2 2020, 10:14 PM

Return to original view | IPv6 | Post

#54

|

All Stars

12,387 posts Joined: Feb 2020 |

Promo link: https://www.cimbclicks.com.my/efd-april20.h...%20April%202020 eFD placement link: https://www.cimbclicks.com.my/fdpromo  This post has been edited by GrumpyNooby: Apr 2 2020, 10:16 PM |

|

|

Apr 3 2020, 10:33 AM Apr 3 2020, 10:33 AM

Return to original view | IPv6 | Post

#55

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 4 2020, 11:04 PM Apr 4 2020, 11:04 PM

Return to original view | IPv6 | Post

#56

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(key91 @ Apr 4 2020, 11:02 PM) Hello all, I just placed FD in Maybank for the promotional rate of 3.05% last week. Sure, you can uplift it from M2U since it's an eFD.So anyone knows if I am able uplift now? Just lost if few days interest right? This post has been edited by GrumpyNooby: Apr 4 2020, 11:05 PM |

|

|

Apr 5 2020, 07:38 PM Apr 5 2020, 07:38 PM

Return to original view | IPv6 | Post

#57

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(angalc557 @ Apr 5 2020, 07:36 PM) For Am bank 3.5% promo, if my savings account is dormant. Now i transfer fresh funds to Ambank online, can i do that without the need to activate back my savings account with Ambank? Dormant account needs to be re-activated at the branch.If the placement allows source fund from FPX, then you can bypass the need to put the fund into CASA. This post has been edited by GrumpyNooby: Apr 5 2020, 07:39 PM |

|

|

Apr 6 2020, 12:27 PM Apr 6 2020, 12:27 PM

Return to original view | IPv6 | Post

#58

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 6 2020, 03:23 PM Apr 6 2020, 03:23 PM

Return to original view | IPv6 | Post

#59

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 6 2020, 03:26 PM Apr 6 2020, 03:26 PM

Return to original view | IPv6 | Post

#60

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Duckies @ Apr 6 2020, 03:25 PM) I don't have Ambank bank account. So I guess for this FD promotion I'll need to go to the branch, open an Ambank account and then proceed to do the fixed deposit online? Precautionary Measures at our BranchesPlease be informed that all our branches are still operating for your convenience. However, to contain the outbreak of COVID-19, we are taking the following precautionary measures: 1. New account opening will be deferred until the end of the Movement Control Order. 2. For social distancing measures, only five (5) customers will be allowed to be in the banking hall at a time. 3. Cheque processing cut-off time will be revised to 2.00 p.m. Any depositing of cheques after 2.00 p.m. will be processed on the next business day. 4. Our Self-Service Machines will be operating as follows: 7.00 a.m. to 10.00 p.m. daily at all states except Kelantan, Pahang, Perak and Johor; 7.00 a.m. to 7.00 p.m. daily at Kelantan and Pahang; 8.00 a.m. to 8.00 p.m. daily at Johor and Perak. 5. You are encouraged to conduct your banking transactions via AmOnline web or mobile app which is available 24/7. 6. We will continue to provide updates on new developments that emerge regarding the COVID-19 outbreak. You may also follow us on Facebook, Instagram and/or Twitter to receive regular updates Stay safe and take care, everyone https://www.ambank.com.my/eng/covid-19 |

| Change to: |  0.0524sec 0.0524sec

0.71 0.71

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 06:19 AM |