QUOTE(adele123 @ Feb 6 2018, 09:05 AM)

debit card is not a pre-requisite to internet banking but i believe there is more hassle in getting the internet banking.

or, even if you have the debit card, you can choose to cancel the debit card but maintain the CASA and the internet banking. that's what i did when my previous employer used HLB as banking in salary.

banks like cimb very stupid. I had CASA and credit card. when i closed the CASA, the internet banking account gone, need to create again so that i can check my cc details. now that my cc has been cancelled, the internet banking is still there.

sorry for off topic.

or, even if you have the debit card, you can choose to cancel the debit card but maintain the CASA and the internet banking. that's what i did when my previous employer used HLB as banking in salary.

banks like cimb very stupid. I had CASA and credit card. when i closed the CASA, the internet banking account gone, need to create again so that i can check my cc details. now that my cc has been cancelled, the internet banking is still there.

sorry for off topic.

QUOTE(nitehawk @ Feb 6 2018, 01:31 PM)

Some banks will issued virtual ATM so that you can create use it to create Internet banking. One such bank is AFFIN Bank.

You will need the card if you need to reset password or have login credential issues.

You will need the card if you need to reset password or have login credential issues.

QUOTE(acougan @ Feb 6 2018, 09:38 AM)

so a good idea will be to open a savings account, pay the Rm8.48, before next year renewal arrives, cancel the card and keep the internet access.

QUOTE(cybpsych @ Feb 6 2018, 09:42 AM)

for PBB, you can choose BSA without ATM/DC. however, they still issue you the booklet instead. no issue with Internet Banking.

for HLB, you can choose BSA. staffs tried hard NOT to give me BSA, but after much insistence and threats to them, they finally "figured" it out BSA is "available" in their system. no issue with Internet Banking either. they will issue a DC but without any fees attached.

most, if not all, banks claims you need ATM/DC for Internet Banking, with the reasons of creating temp PIN at ATM machine.

however, in both banks above, I created the Internet Banking account/profile at the branch after opening BSA.

for HLB, you can choose BSA. staffs tried hard NOT to give me BSA, but after much insistence and threats to them, they finally "figured" it out BSA is "available" in their system. no issue with Internet Banking either. they will issue a DC but without any fees attached.

most, if not all, banks claims you need ATM/DC for Internet Banking, with the reasons of creating temp PIN at ATM machine.

however, in both banks above, I created the Internet Banking account/profile at the branch after opening BSA.

QUOTE(drbone @ Feb 6 2018, 07:46 PM)

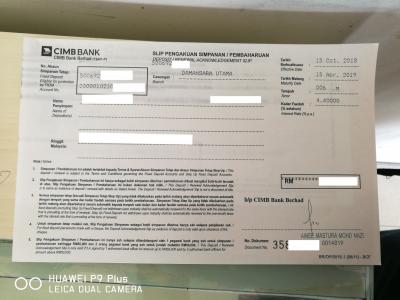

When I opened my CIMB account years ago, I was told that in order to use cimbclicks and make transactions, I will need to get a debit card. Any idea about this information?

I had try both banks online registration,

both also require ATM/CC number to proceed further..

*Sorry Mod, I know it's off topic, will focus back on FD instead

Feb 6 2018, 09:35 PM

Feb 6 2018, 09:35 PM

Quote

Quote

0.0489sec

0.0489sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled