QUOTE(bbgoat @ May 13 2020, 12:10 PM)

Received from CIMB RM this morning

*Latest update*

📣📣📣📣📣

*CIMB PREFERRED*

*Effective 13th May 2020*

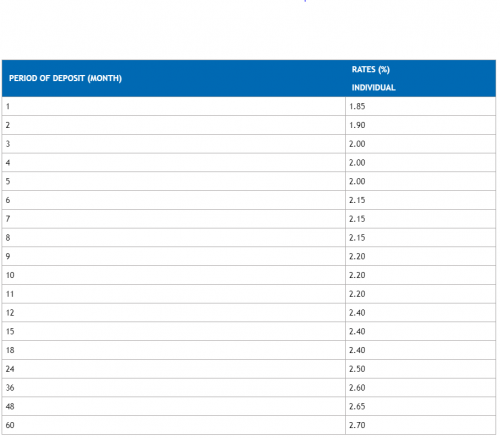

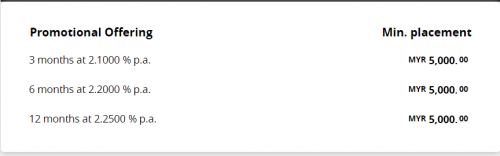

Latest Fixed Deposit rate as below:-

*🔹Conventional🔹*

1 month *TBC*

3 month *2.40%p.a*

*6 month 2.50%p.a*

*12month 2.55%p.a*

*🔹Islamic🔹*

1 month *TBC*

3 month *2.40%p.a*

*6 month 2.50%p.a*

*12month 2.55%p.a*

*🔊 Special rate offer for limited time only. Rate change at anytime without prior notice*

*The above rates are applicable for _Fresh Fund_ only*

💰Min deposit *RM10,000*

_*Terms & conditions apply*_

Luckily I placed some yesterday for 24 months 2.6%, is purely to maintain the preferred status.*Latest update*

📣📣📣📣📣

*CIMB PREFERRED*

*Effective 13th May 2020*

Latest Fixed Deposit rate as below:-

*🔹Conventional🔹*

1 month *TBC*

3 month *2.40%p.a*

*6 month 2.50%p.a*

*12month 2.55%p.a*

*🔹Islamic🔹*

1 month *TBC*

3 month *2.40%p.a*

*6 month 2.50%p.a*

*12month 2.55%p.a*

*🔊 Special rate offer for limited time only. Rate change at anytime without prior notice*

*The above rates are applicable for _Fresh Fund_ only*

💰Min deposit *RM10,000*

_*Terms & conditions apply*_

May 13 2020, 01:16 PM

May 13 2020, 01:16 PM

Quote

Quote

0.0673sec

0.0673sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled