QUOTE(guy3288 @ Sep 6 2022, 01:15 PM)

ini betul kah??

mana ada FD effective rate above 5% that time??

misleading la veteran mixed up ER and GR

That was a flat 5.50% no strings attached FD in Jan 2020 at MBSB with interest already paid on maturity in 6 months. Maybe MBSB or other FD placers at MBSB could answer your doubts.

Do you really expect readers of this forum or other financial websites to even be aware of all the promos? Are you even aware that there were good promo offers that were never even mentioned in this forum or other financial websites?

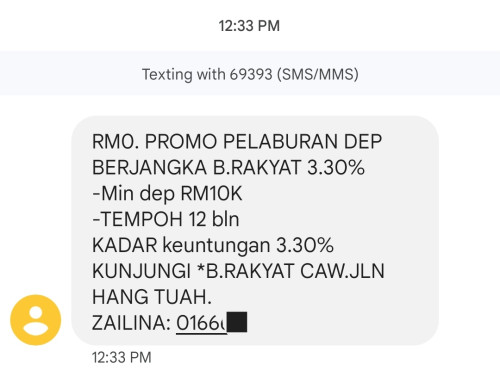

It had been complained before about the lateness, lack of website info, adverts and ignorance of bank staff about their own bank promos.

Even now, we have posters posting a fraction of the offers from various banks. Maybe they did not know, got wrong/incomplete info from bank staff and did not countercheck, did not go online to the bank eFD placement sytem, did not understand/differentiate between the general advertising and online banking bank websites in their incomplete search, not interested in that particular tenor, or withholding the info so that they have time to collect enough money to place before others rush in and take up the fund before they do.

On the otherhand, sometimes posters even post special conditions rates or nego rates eventhough usually not applicable to readers.

The 2 rates were found because the searcher already expected when the rates should change to cater for the situation and the EPF situation. Searching blindly incidentally or according to a timetable, or depending on info messaged from bank, or published sources, have its weaknesses - the most vital being missing out totally.

Another thing to note, is the assumption that FD should be about 12 months, so even posters and bank staff miss out the good ones at other tenors.

This post has been edited by oldkiasu: Sep 6 2022, 02:59 PM

Aug 6 2022, 02:39 AM

Aug 6 2022, 02:39 AM

Quote

Quote

0.0830sec

0.0830sec

1.14

1.14

7 queries

7 queries

GZIP Disabled

GZIP Disabled