QUOTE(lynnmouse @ Jun 24 2019, 08:45 AM)

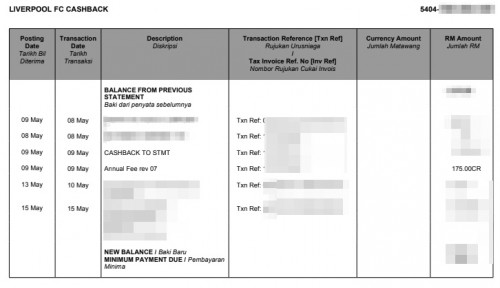

I cancelled my card, as I been late payment with the amount of RM 115.45.

Although I paid on the second day after due date, SC charged me for INTEREST of RM 41.98. I never late pay for three years with SC, and by the amount of <RM 150. It cannot be waived.

The calculation was based on the outstanding amount as of the day (included unbilled transaction). It was a good card, but i never been this kind of treatment from all credit card that i had ever!

As mentioned that is the standard way Credit Cards work. Some banks 'might" give additional 1 or 2 day grace from due date but I don't think it is compulsory, but that only saves you the LATE PAYMENT.

Once Card Interest is triggered,

1. all existing transactions in the statement will get charged interest from THEIR transaction date (not your PAY DATE - DUE DATE)

2. all unbilled transactions including new transactions incurred after PAY DATE will get charged interest from THEIR transaction

This only ends when you have SETTLED the entire balance (i.e balance =0) in FULL on the next statement. If you delay paying thinking you have interest free until DUE DATE, you are wrong cause you are already accruing interest. In this scenario make sure to pay on or close to STATEMENT DATE.

Want to pay less interest? SETTLE the entire balance and freeze/avoid using the card until the next STATEMENT DATE.

TLDR; Do not ever pay late, carry no balance. If you go into interest accruing mode, pay off entire card balance and stop using the card until next statement date.

This post has been edited by zenquix: Jun 24 2019, 07:52 PM

Jun 8 2019, 11:19 PM

Jun 8 2019, 11:19 PM

Quote

Quote

0.0429sec

0.0429sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled