QUOTE(Cookie101 @ Apr 1 2020, 01:43 PM)

QUOTE(MGM @ Apr 1 2020, 02:56 PM)

No. Grab food got own promo.

Discount purely for grab pay merchant only. Unless u can ask grab food delivery guy come with the merchant’s grabpay QR lol

Credit Cards Standard Chartered Bank Credit Cards V4, Everything About SC Credit Cards

|

|

Apr 1 2020, 02:59 PM Apr 1 2020, 02:59 PM

Return to original view | Post

#61

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(Cookie101 @ Apr 1 2020, 01:43 PM) QUOTE(MGM @ Apr 1 2020, 02:56 PM) No. Grab food got own promo. Discount purely for grab pay merchant only. Unless u can ask grab food delivery guy come with the merchant’s grabpay QR lol |

|

|

|

|

|

Apr 11 2020, 05:29 PM Apr 11 2020, 05:29 PM

Return to original view | Post

#62

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(maximillan @ Apr 10 2020, 11:09 AM) Depending whether there’s any promo when u applied. If you applied on their website or third party then most likely no. If u do it on roadshow and the sales guy say got this rebate that rebate then likely- of which they will circle the option on the application form and let u see that this is an one off offer for new applicant. QUOTE(shankar_dass93 @ Apr 11 2020, 10:34 AM) Sorry for popping up a dumb question, if my credit card gets approved from SC, what would my credit limit be ? Above that then the limit is subject to the bank. It can go as high as 60k. Whatever the limit is, don’t max it. Then you got ‘quota’ to apply for other banks cc. I am currently earning around 60k/yr with no loans taken previously and this would be my first card. I am given to understand for those who earn below 36k pa, their cl would be capped at x2 of their monthly income but nothing was mentioned about those who earn above 36k pa QUOTE(Tronoh @ Apr 11 2020, 11:39 AM) those who got your AF waived, are you a revolver or transactor? I suppose if you're the latter they die die won't give you Transactor. Why let bank earn from you when so many are offering for free. And no- I don’t believe this determines whether to waive or not to waive. But more of like your spending pattern and risk. This post has been edited by Cookie101: Apr 11 2020, 05:30 PM |

|

|

Apr 11 2020, 10:18 PM Apr 11 2020, 10:18 PM

Return to original view | Post

#63

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(shankar_dass93 @ Apr 11 2020, 09:17 PM) Alright There are a few ways to go around on this. Gesh, if it’s like that then I am better off with shelving the idea of getting one lol. So that brings me to my next question, I am given to understand that I may be rejected as I do not have any CCRIS record as I have never taken up any loans. But once again, if I am to apply for a loan, I could still be rejected in the basis that once again that I don’t have a CCRIS record. So the question that arises now is that in order for me to build up my CCRIS record, I need a CC or a loan but how do I go about securing one when they aren’t allowing me to build my record by providing me with any form of facilities lol. I asked SC if they would allow me to pledge and X amount of money against my CC and provide me with the appropriate credit limit based on my FD and they claimed that they don’t practise that anymore. Not necessarily from SC. You can apply other banks. But if u want SC, u need a pledge of min 50k which is not worth the value. And u need to know your earning + employment history. Is it over 6 months etc? |

|

|

Apr 12 2020, 03:18 PM Apr 12 2020, 03:18 PM

Return to original view | Post

#64

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(rhodon @ Apr 11 2020, 10:49 PM) The following categories of persons are NOT eligible to participate in this Campaign: You need to give the full tnc for clearer picture. existing Principal/Supplementary Cardholders who still holds any of Standard Chartered Credit Card within the past 6 months from the campaign start date; want to ask, the rule here is mean if i hold my new card within the past 6 months then is not eligible? The tnc given above sounds like second part of tnc which needs to be read together with the entire tnc to grasp its meaning. |

|

|

Apr 12 2020, 03:45 PM Apr 12 2020, 03:45 PM

Return to original view | Post

#65

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(rhodon @ Apr 12 2020, 03:42 PM) 4.The following categories of persons are NOT eligible to participate in this Campaign: You’re not eligible.4.1existing Principal/Supplementary Cardholders who still holds any of Standard Chartered Credit Card within the past 6 months from the campaign start date; 4.2and/or Cardholders whose credit card account(s) is/ are delinquent; 4.3permanent and contract employees of Standard Chartered Bank Malaysia Berhad and Jirnexu Sdn Bhd. 4.4Individuals below the age of twenty-one (21) years. https://media.ringgitplus.com/creatives/upl...3_187100298.pdf |

|

|

Apr 13 2020, 06:45 PM Apr 13 2020, 06:45 PM

Return to original view | Post

#66

|

Senior Member

1,616 posts Joined: Jul 2016 |

|

|

|

|

|

|

May 14 2020, 09:24 AM May 14 2020, 09:24 AM

Return to original view | Post

#67

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(ckweng @ May 14 2020, 09:14 AM) For SCB cards, if annual fee is charged and waiver request is not granted, can proceed to cancel card without paying anything right? Yes. As long u don’t use the card further and paid everything. I can't remember which bank is it that AF still needs to be paid after request to cancel. To those who’s unwilling to pay for sst / AF, call for waiver or just simply terminate the card if declined. No need to cling on it on and on since you’re unwilling to pay for it. Banks granting waiver is goodwill. Not charity. Not everyone gets same treatment. Life is unfair. #donerant |

|

|

May 20 2020, 08:25 AM May 20 2020, 08:25 AM

Return to original view | Post

#68

|

Senior Member

1,616 posts Joined: Jul 2016 |

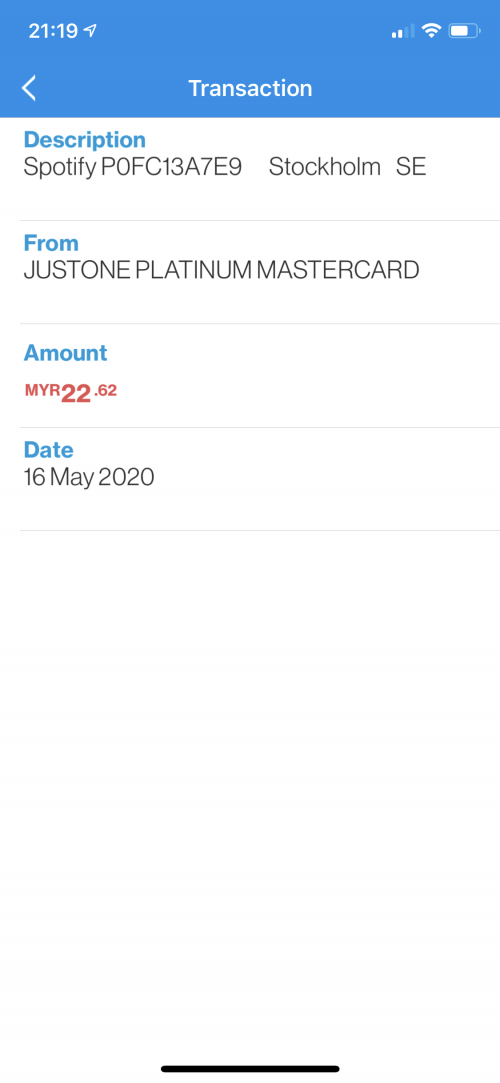

QUOTE(ChiaW3n @ May 19 2020, 09:25 PM) I don’t know if anyone encounter this problem as well, but this is my first time seeing this. I subscribe to Spotify premium and it will deduct RM22.40 from my cc every month, before this I was paid using another credit card. I got an email stated 22.40, but my cc it charged at 22.62. Just few cents difference, but I just wondering why... This is cross border charges. And only certain banks charge them like scb / CIMB and citi iinm. Use other bank cc to avoid that. |

|

|

Jun 2 2020, 09:59 PM Jun 2 2020, 09:59 PM

Return to original view | IPv6 | Post

#69

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(taiping... @ Jun 2 2020, 10:53 AM) It doesn’t matter whether you activate or not. You still need to pay sst unless you terminate the card. If you do not have that much expenses then it will be wiser to lower it down rather than purposely finding somewhere to spend for the cashback. If you must, there’s other e wallets around as well you can spend on. |

|

|

Jul 2 2020, 07:04 PM Jul 2 2020, 07:04 PM

Return to original view | IPv6 | Post

#70

|

Senior Member

1,616 posts Joined: Jul 2016 |

|

|

|

Jul 2 2020, 10:32 PM Jul 2 2020, 10:32 PM

Return to original view | IPv6 | Post

#71

|

Senior Member

1,616 posts Joined: Jul 2016 |

|

|

|

Jul 5 2020, 09:20 PM Jul 5 2020, 09:20 PM

Return to original view | IPv6 | Post

#72

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(cucikaki @ Jul 5 2020, 02:30 PM) SCB has no temporary increase in credit limit? They have but some clients are not entitled to it. I requested, they say they only have overlimit facilities for 30 days of which rm50 service fee will be imposed? Just like cash advance facilities. Not everyone is privileged. |

|

|

Jul 9 2020, 06:20 PM Jul 9 2020, 06:20 PM

Return to original view | IPv6 | Post

#73

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(Anangie @ Jul 9 2020, 08:29 AM) I used both sms and website registration, also did not received any acknowledment. Is it normal? Like pbb, will receive acknowledgment. Just go check. Your telco allows you to send sms to service number? If sms doesn’t work. Then follow the link and register on the website. Same registration. Heard a colleague mentioned about not getting confirmation etc but did not know his number can’t sms to service number. Kinda LULZ |

|

|

|

|

|

Jul 20 2020, 02:41 PM Jul 20 2020, 02:41 PM

Return to original view | IPv6 | Post

#74

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(procrastinator85 @ Jul 20 2020, 10:48 AM) Anybody get the 50% dining merchant cashback before using SC Priority Banking Visa Infinite? The campaign capping is 70k every month until until Dec 2020. Makes me wonder did anyone get it before since the amount is not much. Got it once for spending on 4th day of the month. Other spendings made on like second weeks onwards didn’t get any. |

|

|

Aug 11 2020, 09:49 AM Aug 11 2020, 09:49 AM

Return to original view | IPv6 | Post

#75

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(cucikaki @ Aug 11 2020, 08:32 AM) Don’t think so. Yesterday done 20 all zero Today done another 10 all zero For a moment thought I was just so bad luck these two days 😂 Turns out it wasn’t just me. Gonna max out fcb first become coming back to scb. At least that’s a guaranteed cashback. |

|

|

Aug 11 2020, 07:38 PM Aug 11 2020, 07:38 PM

Return to original view | IPv6 | Post

#76

|

Senior Member

1,616 posts Joined: Jul 2016 |

|

|

|

Oct 10 2020, 09:34 PM Oct 10 2020, 09:34 PM

Return to original view | IPv6 | Post

#77

|

Senior Member

1,616 posts Joined: Jul 2016 |

|

|

|

Oct 10 2020, 09:41 PM Oct 10 2020, 09:41 PM

Return to original view | IPv6 | Post

#78

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(#Victor @ Oct 8 2020, 03:47 PM) In case anyone is interested to know... NB is no longer the official sponsorship partner with LFC. So indirectly SCB And NB deal is being affected as well. Nike is the new co-partner. » Click to show Spoiler - click again to hide... « |

|

|

Oct 16 2020, 07:30 PM Oct 16 2020, 07:30 PM

Return to original view | Post

#79

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(winnie619 @ Oct 16 2020, 03:00 PM) Hi guys, Got full waiver. No jersey. SCB charged me RM175 annual fee and I failed to request for waiver. It said, Upon checking, we regret to informed that we are unable to waive your annual fee charges for Liverpool FC Cashback credit card. Upon your annual payment reflected, you will entitle to redeem the Liverpool jersey.. Anyone able to waive the annual fee? It’s dependant on each individual. Not everyone will get it. |

|

|

Nov 19 2020, 12:55 PM Nov 19 2020, 12:55 PM

Return to original view | IPv6 | Post

#80

|

Senior Member

1,616 posts Joined: Jul 2016 |

QUOTE(xuanchew @ Nov 19 2020, 12:36 PM) chat with CS, asked me to submit request and subject to approve. You can get full refund if the entire purchase is cancelled. What if I cancel the order and get refund from the merchant? Will I get refund only the item price, or including the 1% fee? Anyone got the same experience? |

| Change to: |  0.0458sec 0.0458sec

0.61 0.61

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 07:04 PM |