QUOTE(Avangelice @ Dec 14 2016, 11:45 PM)

help me buy too bro. tapau satu lot. Thank you.

jokes aside we east Malaysians kena side lined again

jokes aside we east Malaysians kena side lined again

FundSuperMart v16 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Dec 14 2016, 11:58 PM Dec 14 2016, 11:58 PM

Return to original view | Post

#141

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Dec 15 2016, 11:38 PM Dec 15 2016, 11:38 PM

Return to original view | Post

#142

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 16 2016, 11:25 AM Dec 16 2016, 11:25 AM

Return to original view | Post

#143

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(voyage23 @ Dec 16 2016, 10:12 AM) Malaysia 2017 Outlook Short & nice......Will be heading into 2017 with this allocation: Ponzi 2.0 (25%) Amasia Reits (15%) KGF (10%) EISC (10%) CIMB Titans (20%) AH Select Bond (20%) I liked it Wanna cut 1- 2% off each fund and go into 5% each on india & ta global tech? For commandoes. 💪 |

|

|

Dec 18 2016, 03:36 PM Dec 18 2016, 03:36 PM

Return to original view | Post

#144

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(puchongite @ Dec 18 2016, 03:31 PM) Can some explain to me why it is necessary to have a Sg bank account ? How about just TT money and invest into money market and then later move to your target funds ? When selling, dump it back to money market. Wait a minute ,.... How to bring back the money later ? https://secure.fundsupermart.com/main/home/...strictions.svdo |

|

|

Dec 18 2016, 06:50 PM Dec 18 2016, 06:50 PM

Return to original view | Post

#145

|

Senior Member

5,143 posts Joined: Jan 2015 |

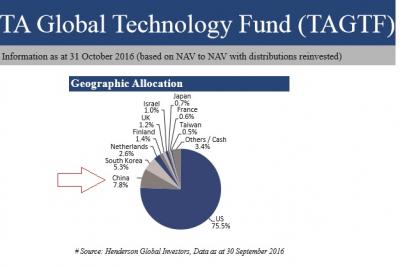

QUOTE(Ramjade @ Dec 18 2016, 05:10 PM) QUOTE(Avangelice @ Dec 18 2016, 06:42 PM) ......... TA Global fund fact sheets allocation is mostly Alphabet, Apple, Facebook and other US tech. Not the right fund to be approaching China. QUOTE(wodenus @ Dec 18 2016, 06:45 PM) as perTA global tech fund factsheetAttached thumbnail(s)

|

|

|

Dec 19 2016, 06:44 PM Dec 19 2016, 06:44 PM

Return to original view | Post

#146

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Dec 19 2016, 07:44 PM Dec 19 2016, 07:44 PM

Return to original view | Post

#147

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(shankar_dass93 @ Dec 19 2016, 07:36 PM) Wanted to call up FSM but was too late to do it today. Q:So here is my question, I invested RM1K into Manulife US Equity Fund and received an email later stating that each unit was purchased at RM0.5176. I realised that FSM has finally updated my holdings on their website and it shows there that the weighted cost of each unit is prices at RM0.5286. Feeling a little confused here. Or wait a second, weighted average cost includes the 2% sales charge and 6%GST right ? How do I calculate the amount of units? (Bid/NAV Priced Funds) Q: What is Weighted Average Cost (WAC)? How do you derive WAC? https://www.fundsupermart.com.my/main/faq/0...tribution--1083 |

|

|

Dec 19 2016, 07:45 PM Dec 19 2016, 07:45 PM

Return to original view | Post

#148

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(tapiritam @ Dec 19 2016, 07:40 PM) Hi Sifus, FAQsI am new to FSM and unit trust. I have just created account with FSM with the objective to save in PRS. Anyhow, I am also interested to invest UT in FSM as well. Where can i learn more about UT in FSM? Thanks. https://www.fundsupermart.com.my/main/faq/introduction.tpl If you're a novice investor -- or you're looking to brush up on a specific investing concept -- this is the place to start. We've tailored this section to give you the investment foundation that you need. We believe it is important that you first acquire this knowledge, because only then would you be able to take charge of your own financial planning and be great at managing your financial wealth. Those of us here at Fundsupermart believe passionately that unit trusts are the best investment instruments to help achieve our long term financial goals. So here, we'll show you the basics of financial planning, tutor you on the finer points of unit trust investing, and help you make better investment decisions! https://www.fundsupermart.com.my/main/school/school.svdo |

|

|

Dec 19 2016, 07:51 PM Dec 19 2016, 07:51 PM

Return to original view | Post

#149

|

Senior Member

5,143 posts Joined: Jan 2015 |

MOF: Don't panic, ringgit will bounce back

"Asked on the fair value for the local currency, he said: "It depends at what point you come in, if you come at 3.30-level you would want the ringgit to be at 3.30 and if you come at 3.80-level you want it to be at that level."said Second Finance Minister Datuk Johari Abdul Ghani." http://www.thestar.com.my/news/nation/2016...ll-bounce-back/ with that kind of response/reply from a MOF minister...I am REALLY Panic..... |

|

|

Dec 20 2016, 08:47 PM Dec 20 2016, 08:47 PM

Return to original view | Post

#150

|

Senior Member

5,143 posts Joined: Jan 2015 |

Paring Down the Exposure to Fixed Income

December 16, 2016 Author : iFAST Research Team "we believe a further decline in bond prices will take place in 2017 once the effect of rate hike expands beyond its current status. Last but not least, investor should pay attention to the currency risk associated with certain bond segments. Due to the disparity in economic development as well as exchange rates between the United States and China, we believe RMB depreciation will likely reduce the attractiveness of RMB bonds in the following year. The rising interest rate will also bring about a surge in US dollar, leaving emerging-market currencies exposed to downside risks. With respect to the aforementioned viewpoints, investors are suggested to take an overweight position in equity relative to bond. For our FSM Managed Portfolios, we have also increased the allocation to equities." http://www.fundsupermart.com.hk/hk/main/re...ed-Income-12916 This post has been edited by T231H: Dec 20 2016, 08:48 PM |

|

|

Dec 20 2016, 08:50 PM Dec 20 2016, 08:50 PM

Return to original view | Post

#151

|

Senior Member

5,143 posts Joined: Jan 2015 |

The heads of our four investment platforms identified the key themes they anticipate will guide investment decisions in 2017.

Author : Neuberger Berman Asia Limited SOLVING FOR 2017 http://www.fundsupermart.com.hk/hk/main/re...-for-2017-12922 |

|

|

Dec 20 2016, 09:16 PM Dec 20 2016, 09:16 PM

Return to original view | Post

#152

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(larisSa @ Dec 20 2016, 09:10 PM) I found an old article that gives "a brief explanation on what a REIT is, the benefits and the risks involved"https://www.fundsupermart.com.my/main/resea...-Nov-2012--2876 hope it can help abits.... |

|

|

Dec 20 2016, 09:27 PM Dec 20 2016, 09:27 PM

Return to original view | Post

#153

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Avangelice @ Dec 20 2016, 09:20 PM) so now what? Let go esther? Go full metal jacket? oh wait, this is from HONG KONG team. well we aint got much choice now do we? http://www.fundsupermart.com.hk/hk/main/re...endedFunds.svdo Now how many of those equities are open to us? Key Investment Themes and 2017 Outlook December 6, 2016 What should investors do? Overweight equities vis-à-vis bonds Seek out safer bonds for capital preservation in fixed income https://www.fundsupermart.com.my/main/resea...17-Outlook-7780 |

|

|

|

|

|

Dec 20 2016, 09:38 PM Dec 20 2016, 09:38 PM

Return to original view | Post

#154

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(GTA5 @ Dec 20 2016, 09:29 PM) Hi all, What are your thoughts on Manulife US Equity fund as an exposure to US equities market? Thanks! QUOTE(Avangelice @ Dec 20 2016, 09:37 PM) ill wait for the seminar thats happening next month then, you going bro? some of us have it. I just placed 5k into it one go. This post has been edited by T231H: Dec 20 2016, 09:41 PM |

|

|

Dec 20 2016, 09:49 PM Dec 20 2016, 09:49 PM

Return to original view | Post

#155

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Avangelice @ Dec 20 2016, 09:44 PM) what is your take on FSM Ifast team to go 0% in allocation in bond funds in the coming year chief? Lots of white noise While there is currently a lack of opportunities in the fixed income space that are attractive from a risk-return basis, we maintain that fixed income remains an integral and relevant part of an investor’s portfolio, and should be seen as a portfolio stabiliser.https://www.fundsupermart.com.my/main/resea...17-Outlook-7780 |

|

|

Dec 20 2016, 09:52 PM Dec 20 2016, 09:52 PM

Return to original view | Post

#156

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 20 2016, 10:34 PM Dec 20 2016, 10:34 PM

Return to original view | Post

#157

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(kevyeoh @ Dec 20 2016, 10:22 PM) hi all, yes, 0% SC as per their website....just a simple question, for PRS Fund, is it correct that FSM does not have any sales fee? i see from their website, shown 0% sales charge, then only 1.5% management fee, the management fee is annual right? Thanks! for other fees,...they are charged by the PRS providers and these charges are reflected in the daily NAVs...which means you don't see it. except the yearly PPA fees (if there are transaction for that year)...where they will deduct the money from yr a/c. for more details abt the charges.... http://www.ppa.my/prs/joining-prs/fees-charges/ This post has been edited by T231H: Dec 20 2016, 10:35 PM |

|

|

Dec 21 2016, 07:08 AM Dec 21 2016, 07:08 AM

Return to original view | Post

#158

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(imnotabot @ Dec 21 2016, 03:48 AM) Hi guys. Not sure if this is the right place to ask this, but it does have something to do with investment. My question: hypothetically, if I'm earning enough every month to save 30%-50% of my income, is it a good idea to contribute just enough to PRS and SSPN/SSPN-i (I have a child) to maximize the respective RM3,000 and RM6,000 tax reliefs every year? From what I understand, PRS and SSPN/SSPN-i are both tax-deferred investments right (same as EPF)? Do you mean income taxes and capital gains taxes (if any) are paid at a future date instead of in the period in which they are incurred?if you meant that..... where did you get that idea/understandings from? This post has been edited by T231H: Dec 21 2016, 07:53 AM |

|

|

Dec 21 2016, 09:09 AM Dec 21 2016, 09:09 AM

Return to original view | Post

#159

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 21 2016, 04:17 PM Dec 21 2016, 04:17 PM

Return to original view | Post

#160

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(frankzane @ Dec 21 2016, 01:55 PM) When To Take Profits? November 11, 2005 When should an investor consider taking profits? This article sheds light. Author : Mah Ching Cheng https://secure.fundsupermart.com/main/resea...?articleNo=1783 |

|

Topic ClosedOptions

|

| Change to: |  0.1101sec 0.1101sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 12:18 AM |