QUOTE(wodenus @ Dec 12 2016, 07:14 PM)

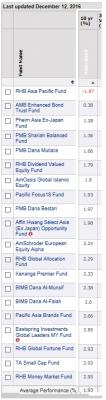

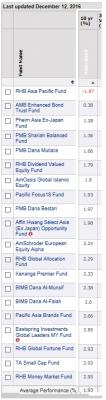

Another reminder - the definition of "high risk" depends on the person. Risk is not that easy to define, when something is classified as "low risk" what they usually mean is "low volatility". In mutual funds there's no such thing as "high risk" and "low risk", or more accurately, all mutual funds are low risk. This can be proven very easily.. look at FSM's list,

how many funds lost money after 10 years? almost zero. So what risk are we talking about here? if you spend money on food you don't know you will even like the taste of.. that is riskier investing in a mutual fund for 10 years

there is ONE that lose money....after 10 yrs

(yes you are right...almost ZERO number)

those that can see it will say...what the heck....the IRR is less than FD.....for so many funds after 10 yrs.

so this one would be talking about partly under "Management Risk" ??

Performance of the fund depends on the experience, expertise, knowledge and investment techniques of the fund manager. Poor management of a fund can cause considerable losses to the fund, which in turn may affect the capital invested.

https://www.fimm.com.my/investor/abc-of-uni...ng-unit-trusts/for those that wanted to be calculative in to it....

Quantitative Measures of Investment Risk

https://www.fundsupermart.com.my/main/resea...-Oct-2011--1723Measuring The Risks In Unit Trust Investing

http://www.sharesinv.com/articles/2012/08/...rust-investing/ Attached thumbnail(s)

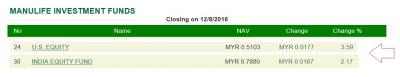

Dec 8 2016, 08:58 PM

Dec 8 2016, 08:58 PM

Quote

Quote

0.1119sec

0.1119sec

0.25

0.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled