---warning & disclaimer---

* this posting is for general knowledge only

*im not responsible for anything

* this method is banned by almost all brokers

* THIS IS NOT AN ENCOURAGEMENT FOR ANY NEWBIES TO TRY ON LIVE ACCOUNT.

----------------------------------------------

History

----------------------------------------------

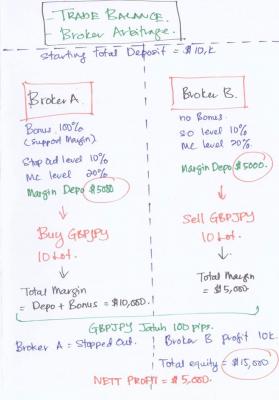

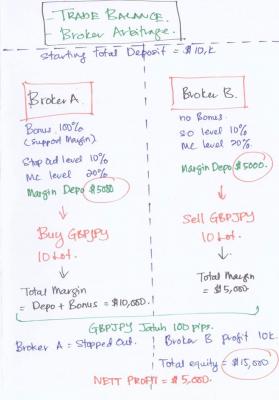

some groups of traders in indonesia begin this method back in 2008 when russian brokers started SPOILING THE REAL FX industry by giving Bonus that supported margin during trading drawdown. brought into malaysia by traders from eastcoast and slowly make its way all over malaysia.

it was kept secret until intelfx went under due to this "abusive" of bonus. EVEN NOW SOME TRADERS ARE STILL USING THIS METHOD. (im not responsible for anything, just sharing for general knowledge)

1. Assuming we pick NFP with average spike and movement of 50pips. it will take place next week.

2.Account A is 1000. account B is 1000. both getting bonus 50% and hence both has 1500 margin, and remember we have some small trades running which might take few dollars off the margin.

3.expected movement is 50 pips. we need to calculate what is the lot size that will make one of the account go bust in 50 pips for equity of 1500usd.

leverage of the account is 1:500

SO level is 10% of margin use.

means for every 1standard lot EURUSD, margin use is 200.

10% of 200 is 20usd.

10% margin call level and 20% stop-out level. Your balance is $1500 and you open a trading position with $400 margin = 2standard Lot. 10% of the margin is $40. If the loss on a position reaches $1460, your account equity becomes $1500 — $1460 = $40, which is 10% of your used margin, the stop-out level will be triggered and the broker will automatically close your losing position.

How many pips is 1450 for 2lots?

each pips worth $20 hence it will take 72.5pips to get to SO.... we need bigger lot.

for 3lot, margin use is 600 and 10% is 60usd.

max equity floating = 1500-60 = 1440.

each pip worth $30 hence it will take 48pip to StopOut.

now we need to calculate Take Profit.

Place the BUY and SELL at the same time.

take note of entry price.

Sell Price will take BID price and we need to include spread for TP.

Buy will take ASK price and we can use price appear on the chart (BID)

example Buy at 1.0500, add 48 pips become 1.0548. thats the TP.

Sell at 1.04980 (BID price no spread),deduct (48 pips + 2 pips spread) = 1.04480

(credit lukpayat)

This post has been edited by Johnhun: Apr 9 2017, 02:03 PM Attached thumbnail(s)

Apr 7 2017, 04:51 PM

Apr 7 2017, 04:51 PM

Quote

Quote

0.0332sec

0.0332sec

0.85

0.85

6 queries

6 queries

GZIP Disabled

GZIP Disabled