QUOTE(cybermaster98 @ Apr 17 2020, 12:08 PM)

I know we are all confused with the stock market movement this past 2 weeks. Let me put this into perspective.

Positive news driving the US stock market up now is:

1) US Federal Reserve stimulus plans

2) Trump opening up economy early

3) Potential new drug for Covid (not vaccine)

4) Daily infection rate in US is stable

Potential negative news (not happened yet):

1) Worse than expected impact to Q1 & Q2 corporate earnings

2) Unemployment rate >30% (current 22%)

3) Worsening of pandemic once lockdown is removed

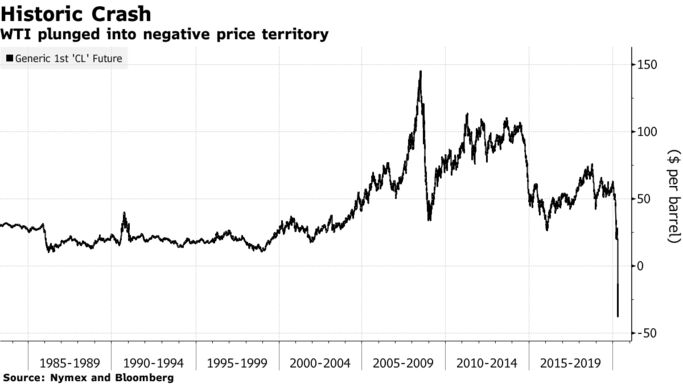

4) Crude oil prices drop <$16

The positive news is already happening while the negative news hasnt happened yet.

So of course stock market will go up. Its driven by current sentiment and the current sentiment is positive.

Simple logic.

yep.... all the big shocker -ve news are out, pretty much absorbed.... will need new big shockers to bring big angry bear. Positive news driving the US stock market up now is:

1) US Federal Reserve stimulus plans

2) Trump opening up economy early

3) Potential new drug for Covid (not vaccine)

4) Daily infection rate in US is stable

Potential negative news (not happened yet):

1) Worse than expected impact to Q1 & Q2 corporate earnings

2) Unemployment rate >30% (current 22%)

3) Worsening of pandemic once lockdown is removed

4) Crude oil prices drop <$16

The positive news is already happening while the negative news hasnt happened yet.

So of course stock market will go up. Its driven by current sentiment and the current sentiment is positive.

Simple logic.

meanwhile, with so much cash lying around, every small bit of +ve news will cause market to rally... becos people are dying to go back in!

crude... think little chance for WTI to go above $20 for some weeks/months.

unless the usual hiccups occur... terror bombings, big storms shutting down production, war skirmishes somewhere....

on the other hand, some opec+ members may cheat and not keep quota... even more crude flooding the market.

Apr 17 2020, 12:24 PM

Apr 17 2020, 12:24 PM

Quote

Quote

0.4479sec

0.4479sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled