sensible comments...

Does Two Days of Gains in Stocks Signal We've Hit the Market Bottom?

CONTRIBUTOR

Richard Saintvilus

PUBLISHED

MAR 26, 2020 7:56AM EDT

Abstract image of investing - man pointing to a graph

CREDIT: SHUTTERSTOCK

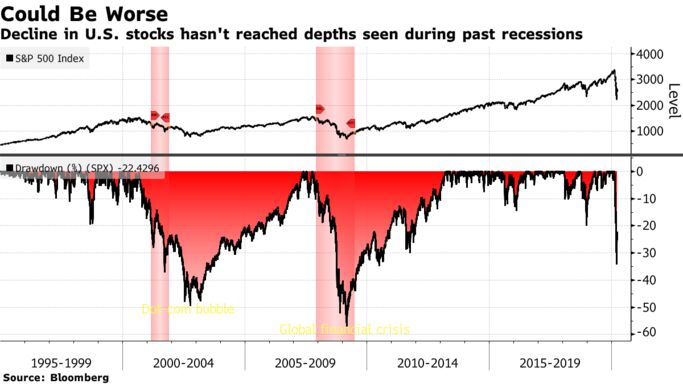

“Not one, but two….” The stock market has done something it has failed to do since February: produce back-to-back positive gains. This, of course, has sparked the obligatory question - have we bottomed? Coming from Monday’s low, it certainly looks like it. But I'm not ready to signal everything is clear.

I'm still crunching numbers related to economic growth and corporate earnings. And my math still tells me that the second half of the year is not going to be pretty — not by a long shot. And with earnings estimates on the decline, an argument can be made that stocks are more expensive now than they were two months ago. More on that in a moment.

But for now, a few things are clear: The market has made up its mind that some stocks have become just too cheap to ignore. And secondly, with the Fed providing liquidity support (a.k.a firing bazookas) investors have decided to “buy first and ask questions later.” The Dow Jones Industrial Average on Wednesday climbed more than 2%, or 495.64 points, to close at 21,200.55. Counting Tuesday’s rise, the Blue Chip index has now jumped more than 13% in two days.

The gains were in response to reports that the terms of massive $2 trillion stimulus bill aimed at combating the economic slowdown from the coronavirus pandemic had been agreed upon between the White House and congressional leaders. At one point the Dow had risen by as much as 6%, but regressed in the last 30 minutes of trading amid reports that Sen. Bernie Sanders might block the deal. “I'm prepared to put a hold on this bill until stronger conditions are imposed on the $500 billion corporate welfare fund,” Sanders said.

The fear that the agreement night hit a roadblock cost the Dow about 500 points. But in this environment, a win is a win. Boeing (BA) continues to surge, gaining 24% Wednesday after rallying 20% Tuesday. Nike (NKE) better-than 9% rise also powered the Dow. The S&P 500 rose 1% and closed at 2,475.56, while the Nasdaq Composite fell 0.5% to 7,384.30. The tech-heavy Nasdaq which has been an out-performer throughout the downturn lost ground due to weakness in the FAANGs - Facebook (FB), Amazon (AMZN) Apple (AAPL), Netflix (NFLX) and Google (GOOG , GOOGL) all closed lower.

Now, back to the main question on investors’ minds. After two green days in a row, where do we go from here? Two days does not qualify as a bull market. Indeed, the market was overdue for a big bounce. But seeing as how quickly and furiously Boeing stock has risen, not to mention the beaten-down cruise line stocks, there’s no question the machines (algorithms) are doing the buying here. In fairness, the machines were doing the selling too.

But before you get tempted to buy this “bottom,” ask yourself these questions, is this the peak of the pandemic? What’s the damage of the economic fallout? Is the Fed’s stimulus sufficient for the worst-case scenario of the shutdowns? What will the unemployment report look like? I’m asking these to say that it’s too soon to call the bottom on stocks. We don't what the “E” in P/E rations will be to determine what stock prices are worth. And assessing value solely by comparing where stocks are relative to where they were is asking for trouble.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

https://www.nasdaq.com/articles/does-two-da...ttom-2020-03-26

Mar 25 2020, 12:23 AM

Mar 25 2020, 12:23 AM

Quote

Quote

0.0347sec

0.0347sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled