QUOTE(zacknistelrooy @ Dec 2 2020, 12:03 AM)

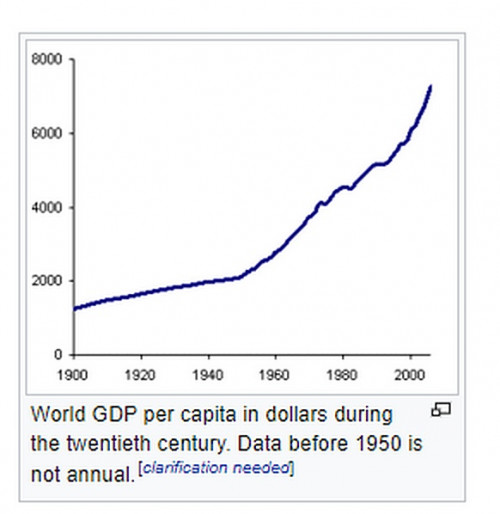

We often see people use rather short term statistic to support their views on stock market, which i think is not appropriate. In mankind history, there are only very few huge turning point on our civilization that made huge change to our lives (and of course, implies into economy). Here's a GDP graph that i found in Google that represents "only" 1900 to 2020 (which i think, is already too short to say anything). From this graph, we can see that GDP per capita in dollars grew from maybe 1400 to maybe 2100 from 1900 until 1950. 50 years, grew 50%.

Now, from 1950 to 1980, it went from 2100 to 4400, meaning around 110% in just 30 years.

Then, from 1980 to 2020, it went from 4400 to 7300, that's 66% in 40 years.

From the above, we can find that in 1950-1980, the growth was more than doubled of the before and after period of years.

Lets go back to today's world. Are we experiencing another huge turning point today? Well, some said yes, and some said no. This is normal, everyone see things differently. I can only express my own opinion, which is, I think we are. I think we are in a huge turning point of mankind's civilization towards high tech era, to AI, to new energy, to the outer space. It's huge, and we are just at the beginning of the journey. The upcoming 20 years could be another huge growth in future economic statistic, maybe a 200%, or 300% growth, bigger than what we experience in 1950 to 1980. And there you go, that was about the time the first modern computer was built (in 1948), a child in high tech life cycle. What we have today is a grown up, still young and fresh, like an 18 year-old, still quite a distance away from mature, and definitely far away from being old.

This post has been edited by yok70: Dec 2 2020, 06:21 AM

Dec 2 2020, 06:10 AM

Dec 2 2020, 06:10 AM

Quote

Quote

0.5656sec

0.5656sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled