QUOTE(C-Note @ Sep 22 2020, 10:20 AM)

isnt 30% corrections rare like they statistically happen once every 5 years. one happened early this year and another 20+% correction happened last year. then again anything can happen

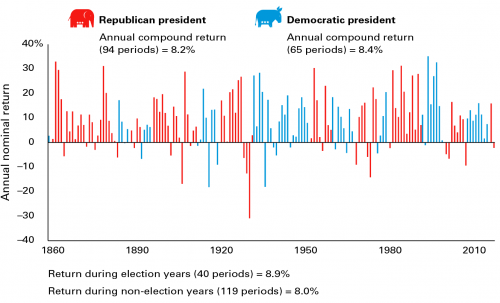

Excluding the 1929 to 1940 there hasn't been many 30% down markets

From 1946 there has only been 7 times the S&P 500 was down more than 30%.

Until a certain person with his gang took over, it was more common for 10 to 20% corrections and also mini 5 to 10% mini corrections but right now it is extreme on both ends with peak and troughs higher than average.

QUOTE(lamode @ Sep 22 2020, 09:59 AM)

Elon Musk twitted something not so positive.

those looking to load at lower price, tonight may go down little more.

Hopefully he is realizing to manage expectations also

Not really helpful to the market if the stock moves 5 to 10% multiple times in a week.

This post has been edited by zacknistelrooy: Sep 22 2020, 08:31 PM

Sep 18 2020, 11:15 PM

Sep 18 2020, 11:15 PM

Quote

Quote

0.5851sec

0.5851sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled