Intel and Micron set to slash billions of dollars off capital spending despite Washington passing landmark law to increase production

After dealing with booming demand and global shortages since the start of the pandemic, the semiconductor industry is facing a sudden downturn.

But even for an industry accustomed to frequent cyclical slumps, this one has defied easy analysis and left researchers struggling to predict how the setback will play out.

The sudden glut in memory chips, PC processors and some other semiconductors has come at a time when manufacturers in many automotive and industrial markets still lack a reliable supply of chips.

It has also forced some of the biggest US chipmakers to slash billions of dollars off planned capital spending, at the very moment that Washington has passed a long-awaited law to subsidise a massive increase in domestic chip manufacturing capacity.

The speed of the turn, and the conflicting forces at work, have been unprecedented, said Dan Hutcheson, the veteran chief executive of VLSI Research who has analysed chip cycles since the 1980s.

“I’ve never seen a time when we had excessive inventory and we had shortages,” he said.

The immediate cause has been a rapid build-up in inventory in the chip supply chain since early this year. Compared with February, when there were enough chips on hand to support around 1.2 months of production, global inventory levels jumped to 1.4 months in June and then 1.7 months in July, according to VLSI Research.

Tumbling PC sales and weaker smartphone demand have been the main causes, as consumers retrench. But with fears rising of an economic slowdown, manufacturers of a wide range of equipment, which had been building inventory to make themselves more resilient to supply pressures, have reversed course. Meanwhile, it is unclear how much weakening chip sales reflect supply chain problems, rather than any fall-off in demand.

The suddenness of the turn has ricocheted through the sector since late July, when Intel stunned Wall Street with the news that revenue in its latest quarter had fallen $2.6bn, or 15 per cent, short of expectations. Chief executive Pat Gelsinger blamed it on the kind of inventory adjustment that only hits once in a decade, although Intel also admitted to errors of its own.

Nvidia, the biggest maker of graphics processing units, or GPUs, used in video graphics and machine learning systems, last week pre-announced an even bigger revenue miss, as sales of its gaming chips fell 44 per cent from the preceding quarter. And Micron, one of the largest makers of memory chips, said its free cash flow was likely to turn negative in the next three months, after averaging $1bn in recent quarters.

The stresses have also been felt through Asia. Late last week, the chief executive of Chinese chipmaker Semiconductor Manufacturing International Corporation said demand had slowed from smartphone and other consumer electronics markers, with some stopping orders altogether. A month before, Taiwan Semiconductor Manufacturing Company said it was expecting an inventory correction that would last until late next year.

The abrupt slide has left chipmakers in the US trying to manage a decline at the very moment that they were laying the ground for a massive increase in production because of the $52bn in government support provided by this month’s Chips Act.

On the same day that Congress passed the law, Intel, which is expected to be the biggest beneficiary of government grants, sliced $4bn from its capital spending plans for the rest of this year, although it said that it was still committed to a “strong and growing dividend” for its shareholders.

Meanwhile, Micron, which celebrated President Joe Biden’s signing of the legislation last week with the announcement that it planned to invest $40bn in the US by the end of the decade, was forced just a day later to say it would cut its capital spending “meaningfully” next year because of the downturn.

For now, most chip supply chain experts predict a relatively shallow downturn, provided that the global economy is heading for a soft landing. But the speed with which things have turned has left them scrambling to understand the complex dynamics at work.

Gartner, which had been expecting the growth in global chip sales this year to halve from 2021’s 26 per cent, took its forecast down further to 7 per cent, and is now predicting a 2.5 per cent contraction in 2023 to $623bn.

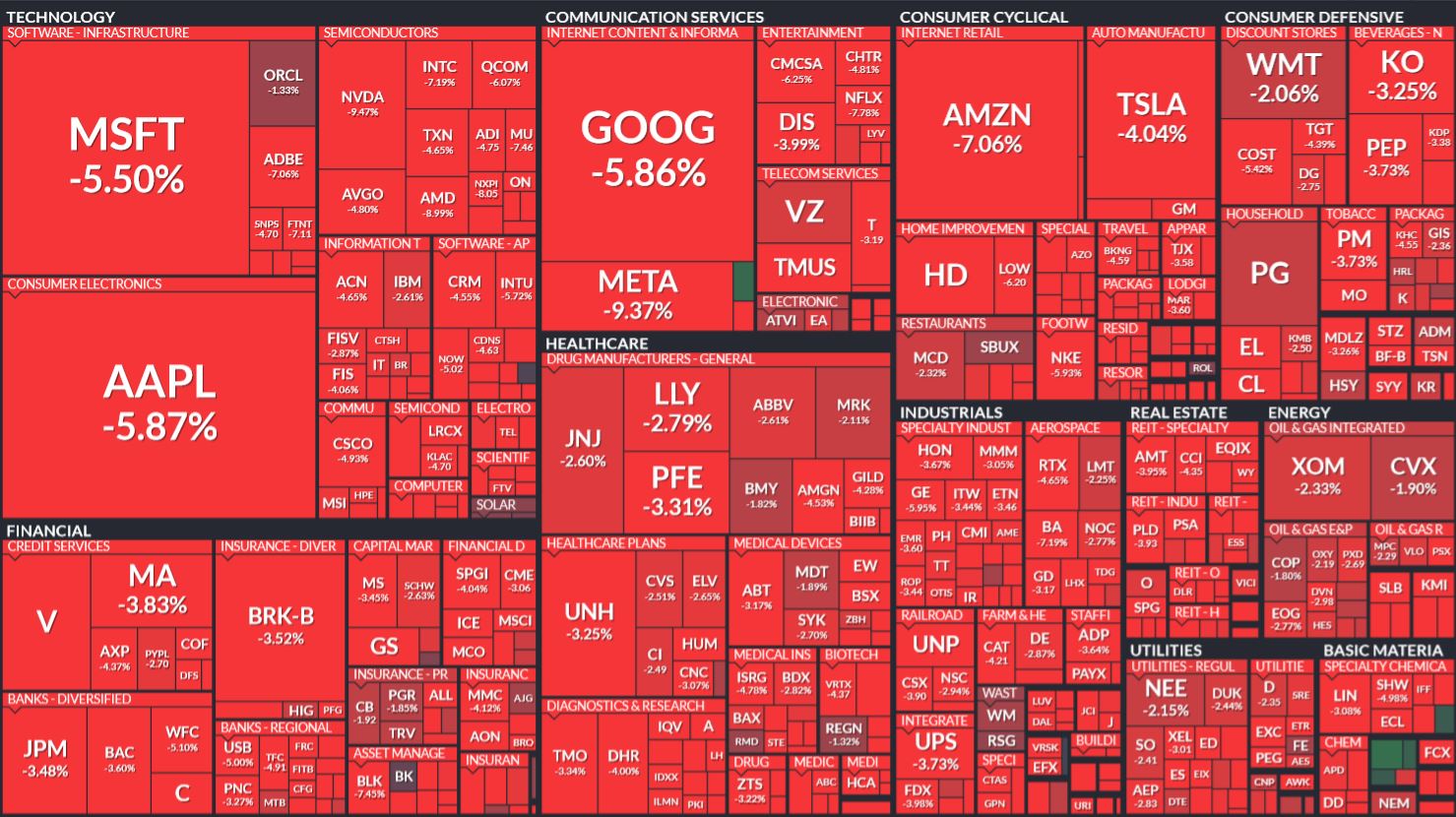

For now, Wall Street has taken the news in its stride. The Philadelphia semiconductor index, which comprises the 30 largest US companies involved in the design, manufacture and sale of semiconductors, fell back nearly 40 per cent as the stock market corrected this year after rising three-fold following the early pandemic stock market slump. But since early July, despite mounting evidence of the chip slowdown, the index has rebounded 24 per cent.

On Monday, Nvidia’s shares climbed back above the level they were trading at before its earnings disappointment, even though it disclosed a savage 17 per cent shortfall in revenue compared to earlier expectations.

But after the severe inventory and supply chain stresses of the past two years, few analysts are confident that they can judge how an economic slowdown will feed through the industry. Hopes that the slide would be largely restricted to the PC and smartphone markets have already been dashed.

While a collapse in demand in the gaming market was the main cause for Nvidia’s earnings disappointment, the US chipmaker also said its sales of data centre chips had only risen 1 per cent from the preceding three months, compared to Wall Street expectations of closer to 10 per cent. It blamed supply shortages rather than falling demand, although other indications, including a fall-off at Intel, have fed the suspicion that the booming cloud computing market has cooled rapidly.

In recent days, the signs of retrenchment have broadened. Micron finance chief Mark Murphy said last week that industrial and automotive customers were the latest to cut their chip purchases.

“It’s a very recent development,” he added, making it too early to tell whether these customers are simply making an adjustment after a rapid inventory build-up, or whether they are responding to falling demand from their own customers.

Either way, according to Murphy, the result has been the same: “We’re seeing clear signs of weakness in those markets.”

Aug 13 2022, 01:06 AM

Aug 13 2022, 01:06 AM

Quote

Quote

0.5098sec

0.5098sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled