More upside to come.

USA Stock Discussion v8, Brexit: What happens now?

USA Stock Discussion v8, Brexit: What happens now?

|

|

Jun 24 2022, 07:05 PM Jun 24 2022, 07:05 PM

Return to original view | Post

#161

|

Senior Member

3,520 posts Joined: Jan 2003 |

Amazon stock shot up to 112+. Bought mine at 109 two days ago. Looking good.

More upside to come. |

|

|

|

|

|

Jun 25 2022, 01:00 PM Jun 25 2022, 01:00 PM

Return to original view | IPv6 | Post

#162

|

Senior Member

3,520 posts Joined: Jan 2003 |

Market going up now these two days. Really hard to predict.

|

|

|

Jun 26 2022, 11:01 AM Jun 26 2022, 11:01 AM

Return to original view | IPv6 | Post

#163

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Jun 27 2022, 12:48 PM Jun 27 2022, 12:48 PM

Return to original view | Post

#164

|

Senior Member

3,520 posts Joined: Jan 2003 |

Positive video on those who DCA during these times. |

|

|

Jun 28 2022, 01:05 PM Jun 28 2022, 01:05 PM

Return to original view | Post

#165

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(TOS @ Jun 28 2022, 10:26 AM) could end up shorter or even longer than that.. it's all about inflation rate and the Ukraine War now:https://www.usinflationcalculator.com/infla...nflation-rates/ Wait every month 13th for good news / bad news. This post has been edited by Davidtcf: Jun 28 2022, 01:05 PM |

|

|

Jul 1 2022, 01:32 PM Jul 1 2022, 01:32 PM

Return to original view | Post

#166

|

Senior Member

3,520 posts Joined: Jan 2003 |

Many people say stock prices can go lower. Inflation will still spiral out of control, recession become worse, if no confident then dont buy first.

If follow optimistic crowd that things will recover soon, war will stop, inflation will under control soon then continue lump sum/DCA. Wanna know 100% which is the best thing to do for sure, build a time machine, go into the future, come back to present time and let us all know the answer!! This post has been edited by Davidtcf: Jul 1 2022, 01:33 PM |

|

|

|

|

|

Jul 3 2022, 12:29 PM Jul 3 2022, 12:29 PM

Return to original view | IPv6 | Post

#167

|

Senior Member

3,520 posts Joined: Jan 2003 |

CF Lieu hinting we should not miss out on this bear market. Estimate Q1 next year quantitative easing by the Fed will stop:

|

|

|

Jul 8 2022, 09:58 AM Jul 8 2022, 09:58 AM

Return to original view | Post

#168

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(AthrunIJ @ Jul 7 2022, 11:24 PM) next week got some important reports:https://www.marketwatch.com/economy-politic...r?mod=inflation Fed meeting on end of mth 26-27 Jul 2022: https://www.federalreserve.gov/monetarypoli...mccalendars.htm sgh liked this post

|

|

|

Jul 8 2022, 06:01 PM Jul 8 2022, 06:01 PM

Return to original view | Post

#169

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(sgh @ Jul 8 2022, 12:45 PM) Based on past months trend calm before a storm indeed. It is always bloody red when close to those important announcement. In fact it is red even before the actual date. After which market digest a while slowly climb up and then bloody red again. The time we truly see an upward trend aka bull run is when all such announcement has gone down I think. I have many paper losses since started investing end of last year when US stocks were at their peak. Read elsewhere once hit 5-10% of your average buy in price sell all to close position since later will go bloody red then buy again. Maybe that is the trend until end of this year indeed hmmm... Then another mistake I did was buying Google when it was high at 2.8k this year March. Should waited a bit longer first. Lesson learnt. Will just DCA small amount and diversified after this. For those paper losses will keep hold since I’m investing long term anyway. Right now really hard to see if ETF or stocks prices can drop even lower. Hope no more la. If really earning reports are terrible for companies then likely can drop more. This post has been edited by Davidtcf: Jul 8 2022, 06:03 PM |

|

|

Jul 8 2022, 07:00 PM Jul 8 2022, 07:00 PM

Return to original view | Post

#170

|

Senior Member

3,520 posts Joined: Jan 2003 |

Good video on analyzing if a stock is worth buying:

Google “p/e ratio Tesla” for example and you’ll get their info there easily. |

|

|

Jul 13 2022, 08:23 AM Jul 13 2022, 08:23 AM

Return to original view | IPv6 | Post

#171

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Jul 19 2022, 11:46 AM Jul 19 2022, 11:46 AM

Return to original view | Post

#172

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Lon3Rang3r00 @ Jul 19 2022, 11:37 AM) Depend on how you define "Best". US Stock is much more volatile but has higher growth potential compare to those in Bursa Malaysia. Rakuten... yes convenience as long as you don't mind their exchange rate. I'll wait until Rakuten implement accounts that holds USD when you buy and sell a stock, else no. I don't want to waste $$ on exchange rate every time i buy/sell a stock yes every buy sell will face exchange rate losses. buy = convert MYR to USD at Rakuten's rate (losses for you) sell = convert USD to MYR at Rakuten's rate (losses for you) so total x2 loss every buy sell. if you hold long maybe doesn't really matter... also some people will still like Rakuten since it is a broker in Malaysia and not based in US or elsewhere outside Malaysia. No need to hassle use Transferwise send money from CIMB MY to CIMB SG, then CIMB SG to IBKR (got some losses here also due to transfer). Up to you if you ok with this part. Imo still better than just investing in Bursa or Singapore. This post has been edited by Davidtcf: Jul 19 2022, 11:46 AM |

|

|

Jul 19 2022, 04:16 PM Jul 19 2022, 04:16 PM

Return to original view | Post

#173

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(RiriRuruRara @ Jul 19 2022, 02:11 PM) Damn listen to those financial experts that say google will shoot up after split bcs of new investors, instead it went down? aiya earlier also Amazon up and down what.. now stable at 110+ can't expect immediate results one.. time will show. They are big companies that are too big to fail. Will only grow in time. I bought 1 unit of Google at USD 2.8k earlier this year (split happened at USD 2.2k). I should be the one whining more Lesson learnt is after market red due to inflation and Fed rate hike, best wait 6 months and up before start any investing (if Fed continue to push to raise rates). Now is a good time.. you're buying at market's bottom. But yeah never know if prices will go down more.. gonna be hard for that to happen but still there is a chance. Continue to DCA small amounts to be safe. This post has been edited by Davidtcf: Jul 19 2022, 04:19 PM RiriRuruRara liked this post

|

|

|

|

|

|

Jul 19 2022, 11:10 PM Jul 19 2022, 11:10 PM

Return to original view | IPv6 | Post

#174

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(annoymous1234 @ Jul 19 2022, 09:35 PM) based on historical data, stock prices usually fall after the split. the same thing happen to tesla and apple. watch this to know why it happen. if u want to earn day trade/quick profit. u should buy once they announced the split, not AFTER the split. google shoot up to 3k USD after the annoucement, only to fall later on Now is bear market due to fed increasing interest rate due to high inflation and Ukraine war. So what you said doesn't really apply.. More for normal market time when stocks are going up steadily. For Google if buy at 2.2k or after split during these times.. Doesn't really matter. Now after split going up bit by bit only.. Might go sideways like Amazon later.. up then drop a bit then up a bit. Overall will still go up just that slow like turtle. Price of Google at 100+ definitely better than original price of 2k+. Hard for investors to buy if so expensive especially for those with smaller capital and wish to diversify. Also easier for traders to buy and do covered options if Google stock is cheap. This post has been edited by Davidtcf: Jul 19 2022, 11:14 PM |

|

|

Jul 20 2022, 08:52 AM Jul 20 2022, 08:52 AM

Return to original view | Post

#175

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(annoymous1234 @ Jul 19 2022, 11:30 PM) based on what the member above posted, he/she bought Google for the reason of quick profit, not based on fundamental. Thus should look at chart. And based on the chart, the price usually drop right after the split. Of course it will go back up but it takes time. Not what a day trader want. then too bad, wait longer to get back returns. can see Google and other US stocks start to rally up.. today has been a good day for US market. |

|

|

Jul 21 2022, 07:10 AM Jul 21 2022, 07:10 AM

Return to original view | IPv6 | Post

#176

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(danmooncake @ Jul 20 2022, 10:39 PM) Anything good to watch on NFLX lately other than Stranger Things? Disney owns Marvel and Star Wars, famous cartoons like Mickey, Donald Duck, and Pixar. + Disney parks everywhere across the globe for extra revenue.I unsub NFLX last month, and sub to Disney+ and HBOMax instead. Both together offer better content. Also, added some DIS stock to my portfolio after this pullback below 95. I think there's a lot of potential upside to DIS. Netflix best asset is? Stranger Things which is coming to a end in Season 5. + Squid game. Not sure both can hold viewership even if they keep add more content on them. Hard to expand them further. Many of their series are meh or just above average the most. Current Disney CEO is one of the issue people have less confidence on the company. But CEO come and go. If he fails badly he'll get sacked by the board. As long company keeps growing and earning in he long run. This post has been edited by Davidtcf: Jul 21 2022, 07:10 AM |

|

|

Jul 25 2022, 09:49 AM Jul 25 2022, 09:49 AM

Return to original view | Post

#177

|

Senior Member

3,520 posts Joined: Jan 2003 |

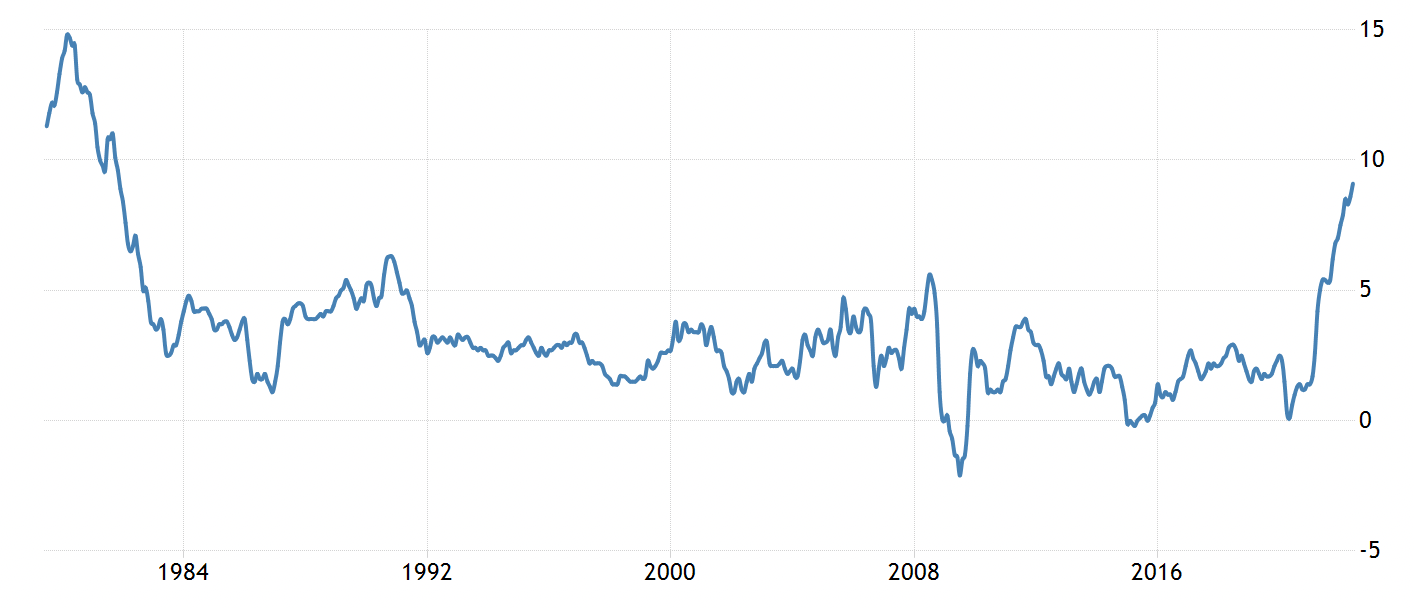

Market Insights: Inflation Now at 40-Year High and Still Going

https://simplywall.st/article/inflation-now...-going#comments one pic to explain the severity of it: U.S. Annual Inflation Rate 1979-2022 - Image Credit: Tradingeconomics.com  This post has been edited by Davidtcf: Jul 25 2022, 09:52 AM |

|

|

Jul 25 2022, 12:16 PM Jul 25 2022, 12:16 PM

Return to original view | IPv6 | Post

#178

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Jul 27 2022, 09:58 PM Jul 27 2022, 09:58 PM

Return to original view | IPv6 | Post

#179

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Jul 29 2022, 10:57 AM Jul 29 2022, 10:57 AM

Return to original view | IPv6 | Post

#180

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(ozak @ Jul 29 2022, 09:56 AM) When the market doesn't react too bearish to the Fed rate hike, it is a sign of reverse. signs of recession is there liao. Now just waiting US National Bureau of Economic Research to confirm:Time to load. https://www.washingtonpost.com/us-policy/20...ides-recession/ US GDP had dropped in two successive quarters. But need see other factors also to confirm it: https://www.cnbc.com/2022/07/28/gdp-q2-.html recession /rɪˈsɛ�(ə)n/ Learn to pronounce noun 1. a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters. "the country is in the depths of a recession" Stock prices can drop even lower once recession is announced: https://www.forbes.com/sites/jonathanponcia...sh=55e4a5646197 This post has been edited by Davidtcf: Jul 29 2022, 10:59 AM sgh liked this post

|

| Change to: |  0.3966sec 0.3966sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 04:49 PM |