QUOTE(icemanfx @ Apr 5 2023, 09:08 PM)

U.s spent over $2 trillions on war in afghanistan. believe u.s would be happy to spend over $3 trillions if could weaken russia for a few decades.

Unless there is a premature cease fire; either way the war end, russia will pay for the rebuilding of ukraine.

Yea the war is affecting the whole world. US currency being cheapened for spending so much in helping Ukraine. Unless there is a premature cease fire; either way the war end, russia will pay for the rebuilding of ukraine.

Russia exports oil, wheat, and other natural resources which is having their prices affected as well. Scalpers will come in to buy cheap from Russia and sell them at a higher price to other countries to avoid sanctions. This is making such goods more expensive. Another cause for inflation. Latest news is OPEC cutting oil production which will also jack up inflation if oil prices reach 100 a barrel.

Countries reopening everywhere now with people going crazy traveling.. Another source of spending making prices go up.

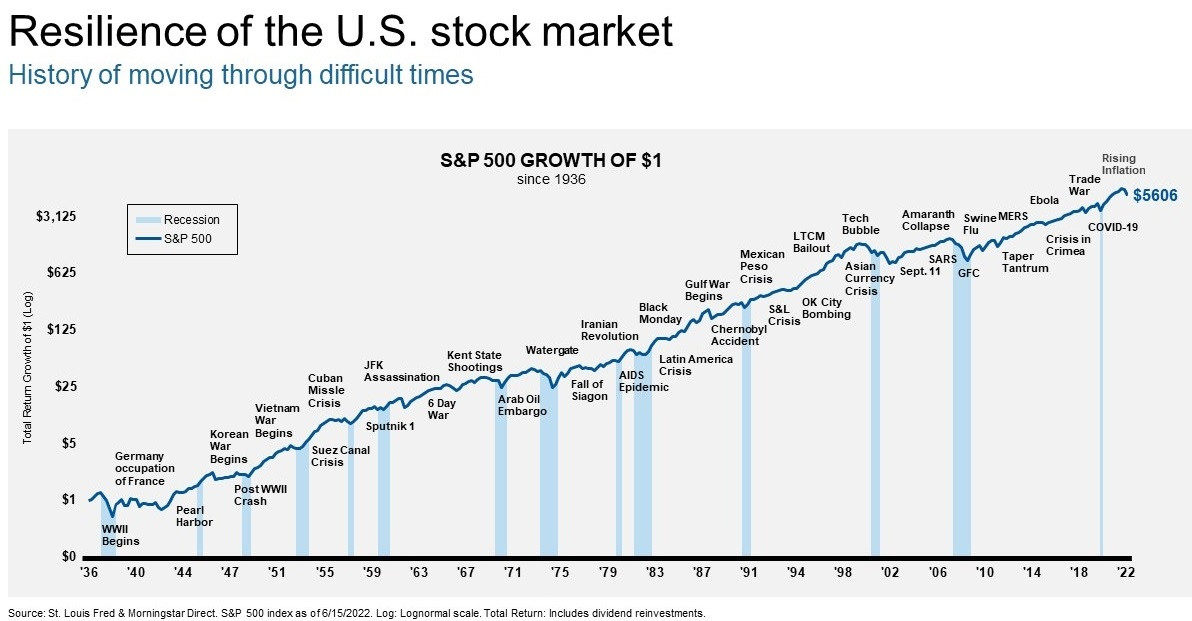

Hence Fed is not giving up on raising interest rates yet as long inflation doesn't go down. Hard to see it go down soon with the above factors. This is why some experts are predicting a recession soon.

When company growths get affected by recession (by too many jobless people, or people not earning enough to buy more of their goods or services), that's when their stock prices will tank. Can only confirm more as future earnings are revealed globally.

If only Putin stops his war and the world is back on peace again.. That alone will help so much.

Apr 5 2023, 11:39 PM

Apr 5 2023, 11:39 PM

Quote

Quote

0.3604sec

0.3604sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled