Then also those that support DCA:

Follow what you think is right for you.

This post has been edited by Davidtcf: Jun 20 2022, 10:36 PM

USA Stock Discussion v8, Brexit: What happens now?

|

|

Jun 20 2022, 10:32 PM Jun 20 2022, 10:32 PM

Return to original view | Post

#141

|

Senior Member

3,520 posts Joined: Jan 2003 |

Chicken Genius is back with a short clip:

Then also those that support DCA: Follow what you think is right for you. This post has been edited by Davidtcf: Jun 20 2022, 10:36 PM |

|

|

|

|

|

Jun 21 2022, 03:53 PM Jun 21 2022, 03:53 PM

Return to original view | Post

#142

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jun 21 2022, 03:40 PM) Wahh.... using DCA left, right and center. DCA = Dollar Cost Averaging lahWhy cannot call it as it is meh? Average Down sounds terrible eh? and please if possible, show the math when Average Down la... every time fall, buy same quantity as per initial purchase? or buy double the quantity? Average Down so many letters.. DCA just need write 3 letters LOL yesterday market green a bit.. later mana tau drop back to square 1 or drop even more This post has been edited by Davidtcf: Jun 21 2022, 03:54 PM |

|

|

Jun 21 2022, 07:08 PM Jun 21 2022, 07:08 PM

Return to original view | Post

#143

|

Senior Member

3,520 posts Joined: Jan 2003 |

Risk with DCA is if you’re investing more than what you can afford. Do remember during recession it’s easy to lose job. Do set aside some money in KDI save or FD etc in case shit happens. Later desperate for money end up selling US stock with paper losses then really gg ownself.

|

|

|

Jun 21 2022, 09:03 PM Jun 21 2022, 09:03 PM

Return to original view | Post

#144

|

Senior Member

3,520 posts Joined: Jan 2003 |

If you have time and the company continue to do well.. will profit later on.

Nobody can predict what’s the actual bottom and when things will recover. So if wanna stay safe then keep wait. If prefer DCA then no wrong also.. If tomorrow Ukraine war is over, confirm will see some recovery. |

|

|

Jun 21 2022, 10:11 PM Jun 21 2022, 10:11 PM

Return to original view | Post

#145

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Jun 23 2022, 03:08 PM Jun 23 2022, 03:08 PM

Return to original view | Post

#146

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(ChAOoz @ Jun 22 2022, 10:48 PM) DCA works well during a bull run but then it will also amplify losses during a bear cycle. Long term play la.. if short term then ya might lose a bit.If the particular stock you dca in able to survive the bear market, you will be a big winner when the eventual bull market returns and the stock growth story is still intact This is why we set aside emergency funds (using KDI Save, normal savings account, FD, etc) and not investing 100% of our money inside. Best have a few months emergency funds at least (3-8 months). The more the better especially during bad times such as a recession. If DCA during peak end of last year or early this year then will hurt more since they starting to drop only during that time. So you'll need more years to have a profit from them. And now with prices at such low ranges, it is even safer to invest. But still don't lump sum (e.g. RM1 mil or few hundred k buy stocks).. who knows if might drop more right? each time buy small amount that you feel comfy (few thousand dollars or 10k+ each time). If kaya/rich and feel 100k/1mil small amount for your DCA.. then go ahead since that is what you can afford. QUOTE(Boon3 @ Jun 23 2022, 03:04 PM) » Click to show Spoiler - click again to hide... « So that was an example of Continious Buying Method (CBM - I like this better - no need use the other sensitive one) or AVERAGE DOWN killed the 'investor'. The investor bought 1,000 of the stock since 2015 and the buyer did a CBM - 1,000 shares of the same stock BUT at the lowest price each year (assuming the buyer possesses such skill. End result was terrifying to say the least. How about Nvidia. One of the better tech stocks. Let's assume the buyer manages to buy 1,000 shares of the stock at the lowest price each year since 2018. Okay? Wanna see the interesting result? 2018 buys 1,000 shares at 55.36 2019 buys 1,000 shares at 33.87 2020 buys 1,000 shares at 51.44 2021 buys 1,000 shares at 124.62 2022 buys 1,000 shares at 158.8 (lowest price so far) Starts of with 55.36 Due to the CBM, the investment exploded to 422.29 Average cost per chare becomes 84.45 Price of NVida now 163.60 Average winning per share is 79.14 Yes, with CBM the average winning per share is a nice 79.14. But get this, what if the buyer did not do CBM? The cost per share was 55.36 Which means the winning is actually 108.24 that's about 29 donated to the share heaven.... So is CBM good? (yalah... CBM no good - name no one. DCA name only Ong! LOL!) and just imagine if the buyer did not get the lowest price each year...  FAANG/FAAMG stocks also good picks (doubting Facebook and Netflix tho). Others are Berkshire, P&G, etc. Many in the US market. Wanna try with Europe or elsewhere also can as long good stocks. If lazy or want safer route then DCA into Indexes such as VUAA or VWRA. This post has been edited by Davidtcf: Jun 23 2022, 03:16 PM |

|

|

|

|

|

Jun 23 2022, 05:28 PM Jun 23 2022, 05:28 PM

Return to original view | Post

#147

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jun 23 2022, 03:41 PM) Davidtcf Ok I re-read and understand fully what you mean now. Here is Netflix using the same CBM, 1,000 shares each year at lowest price. 2017 buys 1,000 shares at 165.95 2018 buys 1,000 shares at 249.47 2019 buys 1,000 shares at 270.75 2020 buys 1,000 shares at 332.83 2021 buys 1,000 shares at 488.77 2022 buys 1,000 shares at 169.90 Buys 6,000 shares. Total investment is 1677.67 Average cost is 279.611 Unfortunately share closed at 178.89. Buyer using this CBM method would have lost big time in in Netflix! So CBM good? For first example the person still gained. You only show 5 years horizon. What if the person hold for 15 years? could you say the same they were bad investments if every year got grow (in 15 years time)? Also most people earn mthly salary and not some rich fag, so of course can't lump sum buy so much at one go. Need to spread it out. If near to the end of 15 years and I'm at the age of 50 for example. Would it still be wise for me to keep buy so many of Nvidia's stock? Or I would follow expert's recommendation to have at least 50% in safer investments such as FD, bonds, etc? That time for me I will reduce my exposure to growth stocks, likely won't be buying as much. Also if super rich the person can't foresee future how well a stock will do.. so definitely they will diversify out to reduce risk. They will likely buy 1k stocks here and there to profit after some time. A stock worth 50 could end up becoming 0 or worth 800 after 5 years. Just see Tesla, no one expected them to be this successful in the beginning? Many even fear to buy Tesla stocks when they were worth 50-100 USD. Would you dare to buy so much Tesla during those days? Or rather wait they proven themselves first? 2nd example show Netflix, for me I wouldn't buy them the first place as I read that they have very high debts and low profit margin. It is basically betting on a company to start making profit after tough beginnings. Hence not surprise when they get hit hard once investors realize their subscriber base have fallen together with reduced profits for the quarter. If one were to invest in such a riskier stock, they could set stop loss at certain price point. That way they would suffer less losses when prices starting bottoming. Some would even use covered options as a safeguard. This post has been edited by Davidtcf: Jun 23 2022, 05:32 PM |

|

|

Jun 23 2022, 07:30 PM Jun 23 2022, 07:30 PM

Return to original view | IPv6 | Post

#148

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jun 23 2022, 07:15 PM) WOW! Also remember it is impossible to time the market. People the most can just speculate whether market will go up or down depending on economic, inflation, political situation etc. When covid first hit everyone thought gonna be doomsday and started panic selling. The moment Fed announce stimulus and cutting of interest rates immediately every stock pump to the moon.Thanks for layan me. hehe... Yes, in short fundamentals is so important (and clearly Netflix is a good teaching example!!) when you buy a stock. CBM is just a method of how one does the buying. One which I feel has so much weakness in it. Think about it. If you stretch this method out on a stock on a longer time frame, what's the biggest risk? The biggest risk of course is fundamentals. Fundamentals do change over time. Sometimes the company can be better but there aren't many of them around. There are many that go bust in a time frame, such as 15 years. Think about it... 15 years collecting the stock... and when you finish collecting, the business economics of that stock collapses! How then? You might end up collecting a 'bad' stock for 15 years! Isn't it better in the simple NVIDIA case, the buyer does a proper due diligence? If 55+ is a damn good investment, ie as good as your own reasoning, why buy bit by bit? no? this is all I am saying. stock fundamentals is more important than the buying method. Then now correction is happening.. we already witness stocks fall so much in their price. Some people even paper loss up to 6 figures. Some lost 20% of their portfolio (esp if started last year). But we still DCA coz know good times will come back one day. Past shows that after one time of bear market/recession, there will be 4-5x period of growth after that. If choose safe route, you will lose also if just put money in bank as the value of your money will keep become smaller. Earning 3% also not enough to fight inflation these days. Also history has shown the best times to invest is during a bear market. If choose to avoid entirely and wait things start to show sign of improvement, then you’ll miss out on the best days to enter during that period. You won’t be the only one wait to jump ship into full throttle investing when recovery start to show. Other hedge fund, sea of investors, millionaires, billionaires will be throwing their money into the stock market at the same time. Some more we talking about the US, hottest stock market is found here. That time if you slow in taking out your money how? Or if you run out of money since they are put elsewhere? Only to see the prices leap from one high to another high. That time will start asking why didn’t enter the market when it’s at all time low. This post has been edited by Davidtcf: Jun 23 2022, 07:32 PM |

|

|

Jun 24 2022, 12:21 AM Jun 24 2022, 12:21 AM

Return to original view | Post

#149

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jun 23 2022, 08:10 PM) Fundamental strong as so many interpretations. you don’t trust DCA don’t need to preach to others to follow your style also.Especially if the company economics is cyclical. Take Harta. Local glove stock. So said that it's the best managed. Cash rich etc etc.. but business economics has now changed for the worst, the stock will be hit just as bad as others. Is like if one or Christian force u to become Christian.. but u strong Buddhist, u like or not? We can debate which and what is each about but no forcing please. In investing hard to say which is right or wrong since both ways also got strategy to make money. Here is US stock section.. very different compare to Bursa. Wanna discuss Bursa can discuss elsewhere more suitable. I personally only invest in banks and reits in Bursa as an alternative for my emergency funds. That is all what Bursa means to me. Dislike how our currency keeps getting weaker under stupid gov, hence can’t convince me to pump more money there. Also lack of foreign investors, much manipulation, and so much institutionalise control of the stock market (by EPF, Lembaga Tabung etc buy sell in bulk). This post has been edited by Davidtcf: Jun 24 2022, 12:22 AM wongmunkeong and esyap liked this post

|

|

|

Jun 24 2022, 09:33 AM Jun 24 2022, 09:33 AM

Return to original view | Post

#150

|

Senior Member

3,520 posts Joined: Jan 2003 |

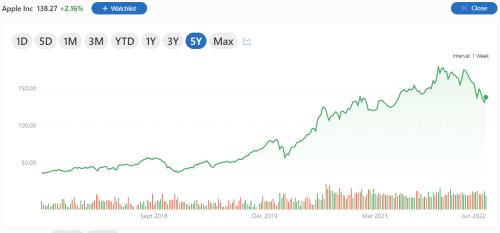

QUOTE(greyPJ @ Jun 24 2022, 08:10 AM) curious, if dca tsla goog appl or msft since 2017 do they yield the same result? Yea would prefer he use Google and Amazon as his analysis. Top stocks in the US market.if they all yield the same result then you have a strong hypothesis. if not, you just pick and choose a stock to suit your point. Or heck choose S&P 500 etf also ok! Boon.. 1,2,3 ready let’s go please! This post has been edited by Davidtcf: Jun 24 2022, 09:34 AM |

|

|

Jun 24 2022, 09:41 AM Jun 24 2022, 09:41 AM

Return to original view | Post

#151

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jun 24 2022, 09:39 AM) ok stocks why avoid Google and Amazon then.. ceh like this cheat la keep choose the stocks you like.don't get feedback from others pun. btw I have not bought Tesla, Netflix that you've listed Apple also another good example can use in your thesis. |

|

|

Jun 24 2022, 09:49 AM Jun 24 2022, 09:49 AM

Return to original view | Post

#152

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Jun 24 2022, 11:01 AM Jun 24 2022, 11:01 AM

Return to original view | Post

#153

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jun 24 2022, 10:11 AM) Nah... your 3 stocks. question is, no one force you to buy 1000 stocks for every DCA. Also depends whether you can afford or feel if that particular stock is too saturated in your portfolio or not?    I am lazy... but your CHOSEN 3 stocks will show the same result with TSLA, NVIDiA.... the average cost price would have increase significantly if one uses a CBM of buying 1,000 shares at the lowest price each year. You have the right not to believe.... and if you do not believe, feel free to check yourself. We not only see x number of stocks, but total value of that 1 stock in your portfolio. For diversification experts say not exceeding 5% of a stock would be just nice for a portfolio (value of a stock when bought to make up that 5%). Exceeding that amount means you are putting too much eggs into one basket. Stock splits would be good for this reason also. DCA also not just blindly k.. need to be smart about it too. This post has been edited by Davidtcf: Jun 24 2022, 11:02 AM |

|

|

|

|

|

Jun 24 2022, 11:18 AM Jun 24 2022, 11:18 AM

Return to original view | Post

#154

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(prophetjul @ Jun 24 2022, 11:08 AM) David mate. You are digressing from the discussion of CBM of individual stocks into portfolio management. because he keep bring up buying 1000 stocks of this and that. Without thinking about portfolio management. Managing portfolio is also important. Even if you are filthy rich, it's still easy to overinvest into the stocks that you like. Kelvin Learn Investing youtuber one of the, he put so much into Tesla.. now I facepalm when think about his paper losses after the recent crash Also all his stocks are either growth or tech.. This post has been edited by Davidtcf: Jun 24 2022, 11:19 AM |

|

|

Jun 24 2022, 11:24 AM Jun 24 2022, 11:24 AM

Return to original view | Post

#155

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(RayleighH @ Jun 24 2022, 11:16 AM) I think that the point which he raised about portfolio management complements DCA/CBM (why lah suddenly want to have new acronym AGREE. Can't just use DCA alone to manage your portfolio. In the end is how you manage your money overall.At the end of the day, I think it is just that DCA shouldn't be a stand alone approach, just like Fundamentals can't stand alone. One will need to use other methods to supplement their preferred strategy. If DCA blindly into an individual stock, there is the risk of the company going bust. If one just insist on purely Fundamentals and saying a historically low price is the only right price for the stock, what do you do with new money then even when that particular company still have solid and strong fundamentals? Ignore or DCA? We all want our money to grow. Not only grow but need to do in a strategic and safer method. Can take some risks, but need to be calculated risks without overexposing one self to danger. If we don't care about risks can just dump money into TFXI - Triumph FX already. There's a thread here in finance page. Can earn up to 7% one week. Dare or not? But got so much talks that it is a SCAM. If one is crazy and doesn't see all the red flags can just go here instead. But sound people will sure calculate all the risks and avoid it. Can earn 7% sure, but what if all your capital gone after that? This post has been edited by Davidtcf: Jun 24 2022, 11:25 AM |

|

|

Jun 24 2022, 12:50 PM Jun 24 2022, 12:50 PM

Return to original view | Post

#156

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(RayleighH @ Jun 24 2022, 12:35 PM) So basically the conclusion of these discussion is buy only once in a company stock with solid foundation. Whether it is only in one company, or diversified to a hundred companies or a thousand companies, up to you. Don't buy when price goes up because of minimizing potential returns. Don't buy when price goes down because potential Netflix. Don't DCA at all. Put the rest of your money in FD/EPF. Yea that’s what I got from his replies. Maybe he just pro Bursa and started shitting at all of us here who’s into US stocks. Ask us don’t DCA, don’t buy when stocks are priced low, don’t buy when priced high. So basically means don’t buy at all? lol no idea what point he’s trying to say. esyap liked this post

|

|

|

Jun 24 2022, 03:06 PM Jun 24 2022, 03:06 PM

Return to original view | Post

#157

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jun 24 2022, 02:04 PM) That's your conclusion. You write and reply so many posts, in the end all no point. No conclusion on what you're trying to emphasis.Said all I want to say in that post you are replying already. anything else, everything else, all I dunno also. there.... habis cerita la Reminds me of an action movie I watched in the past.. it was pretty hyped that time. So much special effects boom here and and there, with sword fighting, robots somemore.. but the whole movie no plot, no character development.. as I watched it halfway decided I have enough and switched off the TV. Yea.. your posts remind me of that movie. esyap liked this post

|

|

|

Jun 24 2022, 03:53 PM Jun 24 2022, 03:53 PM

Return to original view | Post

#158

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(RayleighH @ Jun 24 2022, 03:50 PM) I've been asking this question in many replies earlier but Boon gor finally says that I am asking him about birds and bees. Then kena ghosted. I sad. he is a troll la.. lazy layan liao. So now I don't know anything new. Keep DCA only lor. What choice do I have. the more you feed him the more syok sendiri he becomes. |

|

|

Jun 24 2022, 04:08 PM Jun 24 2022, 04:08 PM

Return to original view | Post

#159

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jun 24 2022, 04:00 PM) Yaloh. Damn troll that showed up with exact numbers showing why simply DCA does not work. Internet trollHow about me not spoon feeding? From Wikipedia, the free encyclopedia In Internet slang, a troll is a person who posts inflammatory, insincere, digressive,[1] extraneous, or off-topic messages in an online community (such as social media (Twitter, Facebook, Instagram, etc.), a newsgroup, forum, chat room, online video game, or blog), with the intent of provoking readers into displaying emotional responses,[2] or manipulating others' perception. This is typically for the troll's amusement, or to achieve a specific result such as disrupting a rival's online activities or manipulating a political process. Even so, Internet trolling can also be defined as purposefully causing confusion or harm to other users online, for no reason at all.[3] for me it fits the bill of a type of trolling.. This post has been edited by Davidtcf: Jun 24 2022, 04:09 PM |

|

|

Jun 24 2022, 06:38 PM Jun 24 2022, 06:38 PM

Return to original view | Post

#160

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jun 24 2022, 06:02 PM) Oooolalala.... this one sure big big win! You trader won’t understand investor’s boat. Everyday you main main beli jual while us here holding for years until need the money baru sell. Or if it is good time to sell at their peak. but DCA how long into it? 10 years? 15 Years? If like that average cost for the share just eats big time into the profits. No need mock us la. We have full time jobs.. not like you whole day sit at home watch stock market screen. This post has been edited by Davidtcf: Jun 24 2022, 06:39 PM |

| Change to: |  0.4456sec 0.4456sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 10:04 AM |