QUOTE(aaron1717 @ Jun 3 2022, 12:19 PM)

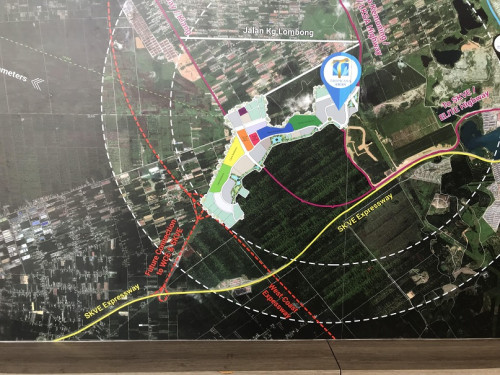

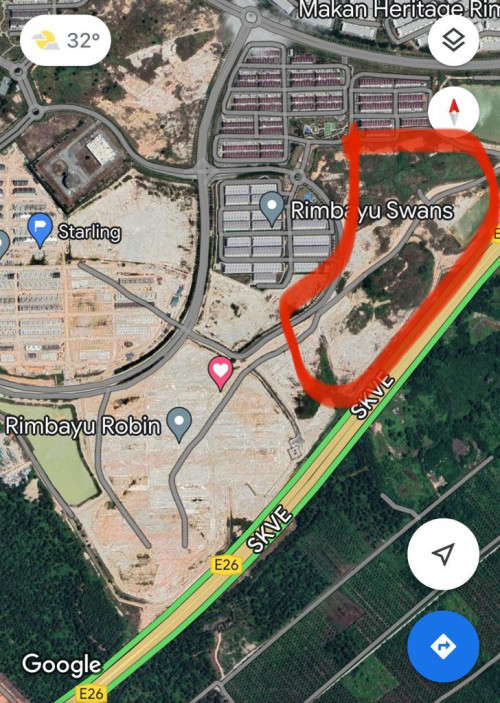

not really, bukit jelutong has been quite stagnant for long time already, and the commercial vibrantness kinda give the buyers that kind of non performing vibe, same applies to Glenmarie as well, my fren's 3 storey landed didnt really appreciate since he bought it 10 years ago... kinrara also depends on which phase... the phase that's nearest to BJ (the vibrant part) has the most appreciation compared to the later phases (albeit still appreciate overall)... for Rimbayu or TPG as a whole, the self sustainability and 'vibrant-ness' of the township will determine alot in the appreciation of your property value...

Temasya glenmarie 10 years ago, say Suria glenmarie, launch at median 1mil, I'd say its looking at a min of 70-80% caps.

But if same area built by other small players, I doubt so it will be performing as good. The product itself plays an important part.

For Kinrara its a good case of pure location play as Kinrara access in my opinion isn't the greatest. Take away latest SPS launches, lets go to old phases. Mahajaya has a small presence in Kinrara, Kinrara residence. Leasehold product in the midst of freehold. 100% caps, not really near to BJ.

Bukit jelutong agree, just purely because price point alone has gone to a high absolute value. Imagine you buying 15 years ago.

On the other hand, setia alam, I wouldn't go in there despite the commercials.

Mar 24 2022, 04:10 PM

Mar 24 2022, 04:10 PM

Quote

Quote

0.1356sec

0.1356sec

0.97

0.97

7 queries

7 queries

GZIP Disabled

GZIP Disabled