Outline ·

[ Standard ] ·

Linear+

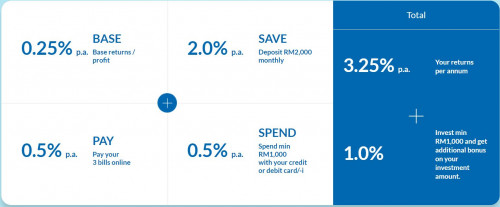

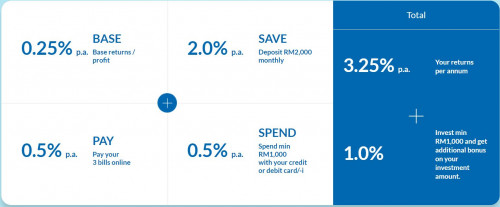

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

GrumpyNooby

|

May 22 2020, 11:16 AM May 22 2020, 11:16 AM

|

|

QUOTE(majorarmstrong @ May 22 2020, 11:15 AM) anyone know where is OCBC Credit Card Thread? I last month because want to meet the spending criteria for my ocbc 360 account i go ahead and spend RM500 on my credit card on Touch n Go ewallet but i never get RM5 cashback I normally dont spend on touch n go ewallet as i always manage to spend more than 500 but due to MCO i cant go out and cant spend so no choice but to top up RM500 into my touch n go and use it to pay bills inside tng ewallet. trying to earn RM5 from there yet i dont see they give me back the 1% rebate promise anyone here can point me to OCBC credit card thread? How you reload your TnG e-wallet? Via saved card without OTP being triggered? |

|

|

|

|

|

GrumpyNooby

|

May 23 2020, 08:58 AM May 23 2020, 08:58 AM

|

|

QUOTE(majorarmstrong @ May 23 2020, 08:57 AM) no otp trigger as it was saved I think that could be problem as some said they didn't receive cash back using PB credit cards. |

|

|

|

|

|

GrumpyNooby

|

May 23 2020, 11:26 AM May 23 2020, 11:26 AM

|

|

QUOTE(Ancient-XinG- @ May 23 2020, 09:15 AM) Now only 2.75? Might as well move to rub bonus saver. 2.75 with only 500 incremental amount per month. QUOTE(acejlsh @ May 13 2020, 09:11 PM) https://www.rhbgroup.com/others/highlights/..._may/index.htmlRHB revision. Bonus Saver Account get cut on one off basis, from 2.65% down to 1.40% |

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 04:23 PM May 28 2020, 04:23 PM

|

|

QUOTE(1wildcat1 @ May 28 2020, 04:21 PM) Hi all, Silly question, I’ve looked through the last 20 pages and gotten the following info, would like to double check if this is the best way to get max interest at the lowest cost: 1) base interest 0.05% 2) spend: BigPay/grab/boost RM500 3) pay: bank transfer to 3 different bank accounts (same bank is ok) - RM1 each x3 = RM3 4) deposit: RM500 fresh funds Could you guys please advice? Thanks so much. just opened the account today! 3) pay: bank transfer to 3 different bank accounts (same bank is ok) - RM1 each x3 = RM3 Why this one needs to pay RM 1? |

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 04:27 PM May 28 2020, 04:27 PM

|

|

QUOTE(1wildcat1 @ May 28 2020, 04:24 PM) Bank transfer needs to transfer some funds right? Or does 1 Sen work as well lol? That is still your money.  I was confused of being charged of RM 1 fee for each transfer!  QUOTE Pay Bonus Interest

A minimum of 3 Bill Payments must be made from your OCBC 360 Account within the calendar month to be eligible for the Pay Bonus Interest. This includes payment via standing instruction to your OCBC home loan facility and/or retail payment channel of OCBC Online Banking to:

(a) your OCBC/OCBC Al-Amin home loan facility; or

(b) any account with any bank or financing institution other than the Bank and OCBC Al-Amin Bank Berhad (Company No. 200801017151 / 818444-T); or

© any participating billing organisations; or

(d) payment by Interbank GIRO/Duitnow conducted through OCBC Online Banking, but excluding any payment by the Financial Process Exchange (FPX) platform.

Multiple payments within the calendar month to the same merchant/payee/account/billing organization shall be deemed as one Bill Payment. For example:

(a) multiple payments to the same home loan facility account; or

(b) multiple payments to the same participating billing organisation, unless each payment is uniquely identified to a different

account; or

© multiple payments to the same account with any bank or financing institution. This post has been edited by GrumpyNooby: May 28 2020, 04:28 PM |

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 04:29 PM May 28 2020, 04:29 PM

|

|

QUOTE(1wildcat1 @ May 28 2020, 04:28 PM) Ah yes, I mean OCBC to 3 separate Maybank accounts for example. Is my maths correct? Correct. QUOTE(1wildcat1 @ May 28 2020, 04:29 PM) Ah yes, paying to my own account from OCBC (to Other banks) Is it still right? Yes. This post has been edited by GrumpyNooby: May 28 2020, 04:30 PM |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 09:06 AM Jun 2 2020, 09:06 AM

|

|

QUOTE(joshtlk1 @ Jun 2 2020, 08:58 AM) Anyone switched to SC recently? very tempted to do that as I some how for the last 2 months couldn't seem to get all 3 criteria fulfilled. It is always just 2, getting kinda frustrated with the platform, and also SC has a higher overall interest rate. 3.6% vs. 2.75% ocbc But some said OCBC 360 is easier to maintain (low maintenance) than SC PSA. |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 09:39 AM Jun 2 2020, 09:39 AM

|

|

QUOTE(joshtlk1 @ Jun 2 2020, 09:34 AM) haha yes, but the way I look at it, if I continue to miss 1 criteria, that would bring down my interest to only 1.85%. Whereas for SC just by fulfilling the save target would already give me an interest of 2.1%. What is the 1 criteria that you kept failing to meet? |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 04:21 PM Jun 2 2020, 04:21 PM

|

|

QUOTE(sl3ge @ Jun 2 2020, 04:16 PM) May i know rhb smart acc how many % interest? Thanks QUOTE(GrumpyNooby @ May 24 2020, 01:56 PM) https://www.rhbgroup.com/RHBOnlineDepositAc...nxoCbqsQAvD_BwEYes, realistically 3.25% pa as long as you meet all the Save, Pay & Spend requirements. |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 04:46 PM Jun 2 2020, 04:46 PM

|

|

QUOTE(saintmikal @ Jun 2 2020, 04:44 PM) Just called them. It is down to 3%. Still better than OCBC360 but slightly higher deposit (RM 2k vs RM 500) and spend (RM 1k vs RM 500). The pay 3 bills is the same. Good option. But why website is still showing up to 3.25% pa? https://www.rhbgroup.com/RHBOnlineDepositAc...nxoCbqsQAvD_BwE |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 05:17 PM Jun 2 2020, 05:17 PM

|

|

QUOTE(DarkknightDK @ Jun 2 2020, 05:12 PM) hi there, I just opened my OCBC account and wanted to ask some guidance on your "tips". 2) How should I do this? Only got debit card at the moment then. 3) I transferred via Favourites to 3 different maybank account. Is it legit? 2) Debit card be used to load RM 500 in BigPay/grab/boost 3) Yes. |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 06:29 PM Jun 2 2020, 06:29 PM

|

|

SG version of OCBC 360: OCBC to cut salary credit bonus interest on 360 account from July 1For balances up to $35,000, the salary credit bonus interest will be halved to 0.6 per cent, down from the current 1.2 per cent. Balances between $35,000 and $70,000 will earn 1.2 per cent interest, down from 2.4 per cent. The base interest is calculated at the end of each day, based on the daily balance and credited to the 360 account at the end of the month. The bank will also stop offering the credit card spend bonus interest - currently at 0.2 per cent for the first $35,000 and 0.4 per cent for the next $35,000 - on the 360 account from July 1. https://www.straitstimes.com/business/banki...obox=1590987331 |

|

|

|

|

|

GrumpyNooby

|

Jun 3 2020, 06:23 PM Jun 3 2020, 06:23 PM

|

|

QUOTE(1wildcat1 @ Jun 3 2020, 06:19 PM) Hey grumpy, do you know if duitnow is counted for “pay”? YES. A minimum of 3 Bill Payments must be made from your OCBC 360 Account within the calendar month to be eligible for the Pay Bonus Interest. This includes payment via standing instruction to your OCBC home loan facility and/or retail payment channel of OCBC Online Banking to: (a) your OCBC/OCBC Al-Amin home loan facility; or (b) any account with any bank or financing institution other than the Bank and OCBC Al-Amin Bank Berhad (Company No. 200801017151 / 818444-T); or © any participating billing organisations; or (d) payment by Interbank GIRO/Duitnow conducted through OCBC Online Banking, but excluding any payment by the Financial Process Exchange (FPX) platform. |

|

|

|

|

|

GrumpyNooby

|

Jun 5 2020, 06:43 PM Jun 5 2020, 06:43 PM

|

|

QUOTE(1wildcat1 @ Jun 5 2020, 06:40 PM) Anybody getting this error now? "mastercard secure, system is temporarily unavailable" Trying to link my debit card but no apps is working at all. Have you done this? QUOTE Enable/disable overseas spend, overseas ATM cash withdrawal and online shopping via OCBC Internet Banking and OCBC branches. https://www.ocbc.com.my/personal-banking/Ca...debit-card.html |

|

|

|

|

|

GrumpyNooby

|

Jul 8 2020, 06:35 PM Jul 8 2020, 06:35 PM

|

|

QUOTE(nightpipper @ Jul 8 2020, 06:28 PM) ronnie please update the thread title. |

|

|

|

|

|

GrumpyNooby

|

Jul 14 2020, 06:09 AM Jul 14 2020, 06:09 AM

|

|

QUOTE(datolee32 @ Jul 14 2020, 12:07 AM) Just to confirm, in order to get maximum interest for RM 100k x 2 for both 360 account, i need to do: Fresh fund RM 500 into each account Pay 3 bills online instead of 6 bills Spend RM 500 on credit card instead of RM 1,000 Am I correct? HNWI spotted. RM 100k in PSA + RM 200k in OCBC 360 + 360i |

|

|

|

|

|

GrumpyNooby

|

Jul 14 2020, 11:31 AM Jul 14 2020, 11:31 AM

|

|

QUOTE(PSS2020 @ Jul 14 2020, 11:30 AM) If I have 300k, I will put PSA, Smart, 360 with 100k each respectively. Why put 200k all in OCBC? OCBC 360 and 360i have 2 separate quota. |

|

|

|

|

|

GrumpyNooby

|

Jul 14 2020, 11:41 AM Jul 14 2020, 11:41 AM

|

|

QUOTE(PSS2020 @ Jul 14 2020, 11:38 AM) But Smart interest higher than 360. Why not Smart first then only 360? That is convenient if I have already existing OCBC 360. Adding another OCBC 360i is much easier than opening a RHB Smart Account. Others prefer to manage everything under the same bank. To qualify for RHB Smart Account at 2.85% pa, there're a lot of efforts to complete. If you haven't have OCBC 360, of course opening RHB Smart Account could be more economically smarter. This post has been edited by GrumpyNooby: Jul 14 2020, 11:44 AM |

|

|

|

|

|

GrumpyNooby

|

Sep 1 2020, 12:53 PM Sep 1 2020, 12:53 PM

|

|

QUOTE(Sumofwhich @ Sep 1 2020, 12:51 PM) Wow, OCBC is so generous to give cash back for government and government related transactions. This post has been edited by GrumpyNooby: Sep 1 2020, 12:55 PM |

|

|

|

|

|

GrumpyNooby

|

Sep 2 2020, 12:25 PM Sep 2 2020, 12:25 PM

|

|

QUOTE(anonymous552235 @ Sep 2 2020, 12:23 PM) ocbc is one of the best card where theres literally NO exclusion to anything...albeit not the best rebate ...its world card gives 0.6% thereafter first 1k spend unlimited amount no capping ...cash flo 0.5% no capping too But why not popular at Credit Cards, Debit Cards, Prepaid Cards and Loyalty Cards section? |

|

|

|

|

May 22 2020, 11:16 AM

May 22 2020, 11:16 AM

Quote

Quote

0.0269sec

0.0269sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled