Outline ·

[ Standard ] ·

Linear+

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

GrumpyNooby

|

Apr 15 2020, 09:35 PM Apr 15 2020, 09:35 PM

|

|

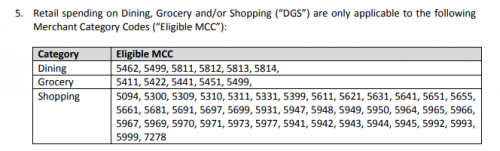

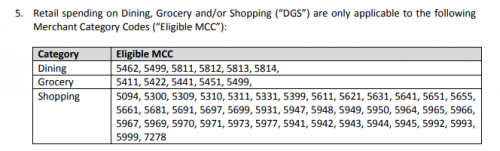

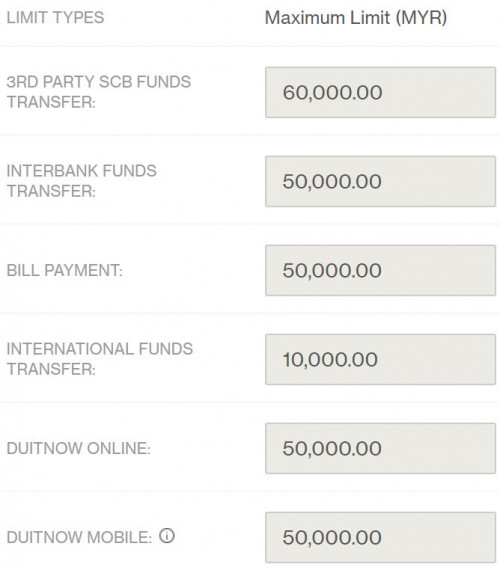

QUOTE(smartfreak @ Apr 15 2020, 09:27 PM) I have problem decoding MCC from OCBC. Does anyone know which MCC below belongs to online transaction if any?  Online is the mode of transaction and normally won't tied to MCC. It is normally differentiated by TAC/OTP input or merchant name suffix tagging such as EC/ECOM/E-COM MCC precedes mode of transaction and normally tied to merchant nature of the business. |

|

|

|

|

|

GrumpyNooby

|

Apr 15 2020, 09:40 PM Apr 15 2020, 09:40 PM

|

|

QUOTE(rocketm @ Apr 15 2020, 09:36 PM) Hi all, I have a OCBC Al-Amin saving account. Recently, I saw they have the eFD promo. May I know does my saving account is eligible to participate to the eFD and does the fund need to from our saving account or transfer from other bank? The T&C of the eFD promo didn't state the requirement of FF: https://www.ocbc.com.my/personal-banking/ac...0Promo%20TC.pdfPlacement guide: https://www.ocbc.com.my/personal-banking/ac...al_09042020.pdf |

|

|

|

|

|

GrumpyNooby

|

Apr 18 2020, 07:08 PM Apr 18 2020, 07:08 PM

|

|

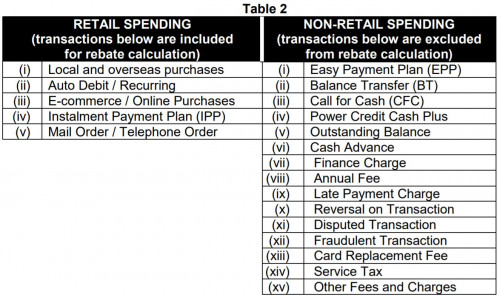

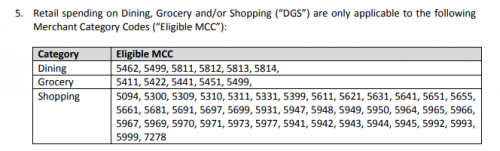

QUOTE(cclim2011 @ Apr 18 2020, 07:04 PM) hello. anyone tried blue/pink card for government online payment like pejabat tanah dan galian? considered part of the rm500 to spend for bonus interest? and conisdered online to get 0.1+0.9%? Thank you. Should be qualified as along as it is NOT made via OCBC internet banking portal: c) E-commerce and Online purchases are collectively known as “Online Purchases”. This refers to purchases made on an online merchant’s website, and excludes transactions made for payments on OCBC Internet Banking.  This post has been edited by GrumpyNooby: Apr 18 2020, 07:10 PM This post has been edited by GrumpyNooby: Apr 18 2020, 07:10 PM |

|

|

|

|

|

GrumpyNooby

|

Apr 23 2020, 11:30 PM Apr 23 2020, 11:30 PM

|

|

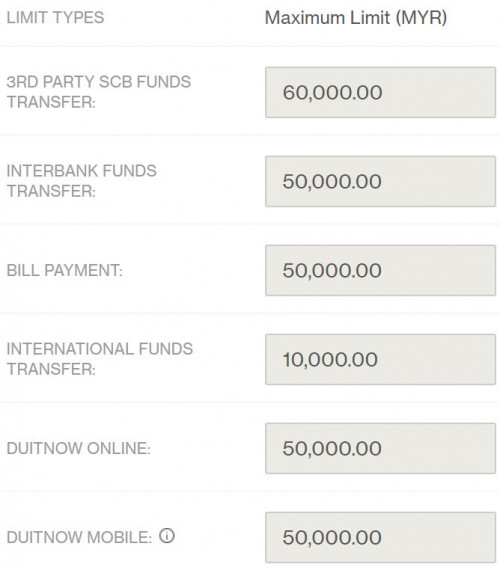

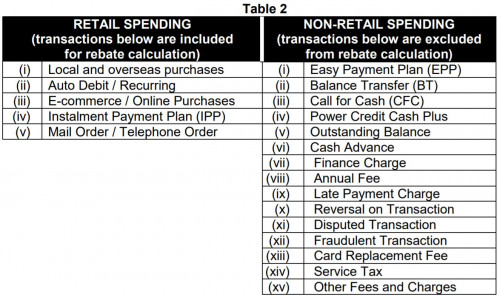

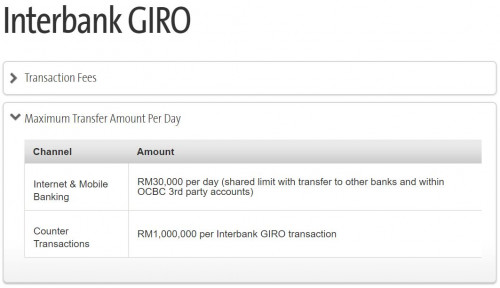

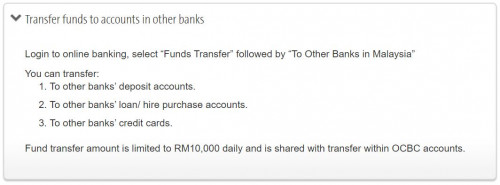

QUOTE(Sumofwhich @ Apr 23 2020, 11:26 PM) Yea 30k for ocbc, i have no idea how much for Scb PSA, i think 50k Should be RM 50k  |

|

|

|

|

|

GrumpyNooby

|

Apr 25 2020, 09:35 PM Apr 25 2020, 09:35 PM

|

|

QUOTE(Sumofwhich @ Apr 25 2020, 09:32 PM) 30K no problem, i still do it everydayEveryday?  |

|

|

|

|

|

GrumpyNooby

|

Apr 25 2020, 09:55 PM Apr 25 2020, 09:55 PM

|

|

QUOTE(Sumofwhich @ Apr 25 2020, 09:46 PM) Not at all. The amount is so small only. Cannot even qualified for private banking even if you do in everyday for whole month. |

|

|

|

|

|

GrumpyNooby

|

Apr 30 2020, 03:47 PM Apr 30 2020, 03:47 PM

|

|

QUOTE(zenquix @ Apr 30 2020, 03:28 PM) It will use the account current set to "Quick Cash" in the ATM card. if you did not change the tagging when you open the 2nd account, then it will be the first account. How to configure this? Tie which account to Quick Cash for the ATM card. |

|

|

|

|

|

GrumpyNooby

|

May 5 2020, 03:34 PM May 5 2020, 03:34 PM

|

|

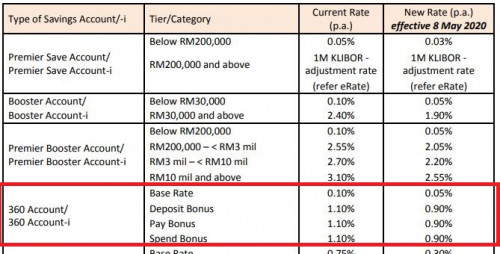

QUOTE(extinct_83 @ May 5 2020, 03:31 PM) BNM announce OPR slash 50 basis point. Guess 360 account interest rate will reduce to A) 3.15% B) unchanged 3.4% C) 2.9% Since base interest is already 0.1%, they may slash the bonus interest. I'm seeing: 1. 3.1% 2. 2.95% |

|

|

|

|

|

GrumpyNooby

|

May 5 2020, 04:57 PM May 5 2020, 04:57 PM

|

|

QUOTE(zenquix @ May 5 2020, 04:53 PM) it's a big 0.5% cut.. we would be lucky to get anything above eff 2.9% Agreed with you that 0.5% cut is a big deal. Well, they need to balance for customers (or cash) retention too. |

|

|

|

|

|

GrumpyNooby

|

May 6 2020, 04:36 PM May 6 2020, 04:36 PM

|

|

QUOTE(akafoz @ May 6 2020, 04:34 PM) 2.75%  0.5% is really a big deal! zenquix |

|

|

|

|

|

GrumpyNooby

|

May 6 2020, 08:45 PM May 6 2020, 08:45 PM

|

|

0.65% cut > 0.5% OPR cut Is OCBC anticipating another 25 basis point cut in July 2020 and they may not going to revise again in July 2020?  |

|

|

|

|

|

GrumpyNooby

|

May 6 2020, 10:07 PM May 6 2020, 10:07 PM

|

|

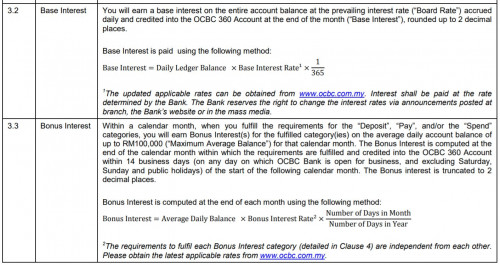

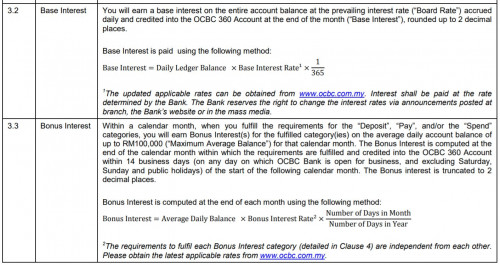

QUOTE(mamamia @ May 6 2020, 10:02 PM) With this, they still no need to give 21 days notice? They drop more than OPR drop rate.. really feel like this is not a bank, more like ah Loong Read their latest T&C: https://www.ocbc.com.my/assets/pdf/Accounts...unt_TnC_ENG.pdfI believe Clause 5.2: 5.2. The Board Rate and Bonus Interest Rates fluctuate from time to time and you may find the latest rates at the Bank’s website at www.ocbc.com.my. |

|

|

|

|

|

GrumpyNooby

|

May 6 2020, 10:10 PM May 6 2020, 10:10 PM

|

|

QUOTE(!@#$%^ @ May 6 2020, 10:08 PM) after so many complains, they became smarter Of course they're smarter. They keep asking you to refer to the latest interest rate at their website in the latest T&C:  |

|

|

|

|

|

GrumpyNooby

|

May 8 2020, 05:55 PM May 8 2020, 05:55 PM

|

|

QUOTE(MGM @ May 8 2020, 05:46 PM) Which RHB card gives 10% online cb? Did u save your RHB card in your foodpanda(FP) account, cos without otp it will clasified as offline? The MCC for FP is tricky. I used HL Mach card 16x last month, 1 under Dining, 2 under Retail, 13 under Online(without otp). I believe you're another guy who has a FOMO syndrome. Gotta catch em all right? The RHB card that he used is RHB Visa Signature:  Not sure if it comes in pair with RHB World Mastercard.  There's also RHB Cash Back that I found from RP website:  https://ringgitplus.com/en/credit-card/RHB-...html?filter=RHBThis post has been edited by GrumpyNooby: May 8 2020, 06:37 PM https://ringgitplus.com/en/credit-card/RHB-...html?filter=RHBThis post has been edited by GrumpyNooby: May 8 2020, 06:37 PM |

|

|

|

|

|

GrumpyNooby

|

May 19 2020, 09:03 PM May 19 2020, 09:03 PM

|

|

QUOTE(tiramisu83 @ May 19 2020, 09:02 PM) SCB promotion only until 31-Dec-2020 right? Quite troublesome to switch over for me..haiz.. It was extended to 31/12/2019. Then extended again to 31/12/2020. This post has been edited by GrumpyNooby: May 19 2020, 09:03 PM |

|

|

|

|

|

GrumpyNooby

|

May 19 2020, 09:08 PM May 19 2020, 09:08 PM

|

|

QUOTE(MGM @ May 19 2020, 09:05 PM) The 5.6%pa* by PSA is a promotional rate. Renewed yearly for a couple of years. This post has been edited by GrumpyNooby: May 19 2020, 09:08 PM |

|

|

|

|

|

GrumpyNooby

|

May 19 2020, 09:33 PM May 19 2020, 09:33 PM

|

|

QUOTE(FionTang @ May 19 2020, 09:31 PM) saving account but with interest? All saving account got interest. Whether it is extremely low close to negligible or matching/exceeding FD with conditional requirement(s) to meet. This post has been edited by GrumpyNooby: May 19 2020, 09:34 PM |

|

|

|

|

|

GrumpyNooby

|

May 19 2020, 11:48 PM May 19 2020, 11:48 PM

|

|

QUOTE(tiramisu83 @ May 19 2020, 11:46 PM) still thinking want to switch over or not..total interest is 3.6% (without the invest part 2%) compare to OCBC 360, 1% more..extra around RM600, for 6 months (for monthly RM100k), quite a lot too... The 3.6% pa is due for a revision since they haven't make any move after the 0.5% OPR cut. I'm expecting a revision will take effect starting 1/7/2020 and which will be announced 21 days prior to that. This post has been edited by GrumpyNooby: May 19 2020, 11:50 PM |

|

|

|

|

|

GrumpyNooby

|

May 20 2020, 04:18 PM May 20 2020, 04:18 PM

|

|

QUOTE(TheKid @ May 20 2020, 04:17 PM) According to the banker that helped me open my account, the interest is calculated *daily* Yes but credited accordingly as per PDS. |

|

|

|

|

Apr 15 2020, 09:35 PM

Apr 15 2020, 09:35 PM

Quote

Quote

0.1067sec

0.1067sec

1.24

1.24

7 queries

7 queries

GZIP Disabled

GZIP Disabled