Outline ·

[ Standard ] ·

Linear+

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

GrumpyNooby

|

Oct 12 2020, 03:06 PM Oct 12 2020, 03:06 PM

|

|

QUOTE(!@#$%^ @ Oct 12 2020, 02:58 PM) maybe u can pay a day earlier next time. while u did nothing wrong, it only trouble urself more dealing with the bank He likes to have a chit chat with bank CS. It's not the first time he deals the similar the situation while he's aware of the system falw, he's flexing the credit card muscle to the last payment due date. This post has been edited by GrumpyNooby: Oct 12 2020, 03:08 PM |

|

|

|

|

|

GrumpyNooby

|

Oct 12 2020, 03:54 PM Oct 12 2020, 03:54 PM

|

|

QUOTE(rojakwhacker @ Oct 12 2020, 03:30 PM) Pay the credit card bill few days earlier save your hassle on time, cost, worrying thought, finance plan, emotion on anger and also the pain. The power of 50 days of interest free  |

|

|

|

|

|

GrumpyNooby

|

Nov 19 2020, 05:40 PM Nov 19 2020, 05:40 PM

|

|

QUOTE(tadashi987 @ Nov 19 2020, 05:34 PM) one thing i dont like about OCBC is it take so many steps to login to their web e-banking, so bad user experience. And their web and mobile app always hang But yet can still be hacked easily?  https://m.facebook.com/560282259/posts/1015...1764882260/?d=n https://m.facebook.com/560282259/posts/1015...1764882260/?d=n |

|

|

|

|

|

GrumpyNooby

|

Dec 26 2020, 10:06 PM Dec 26 2020, 10:06 PM

|

|

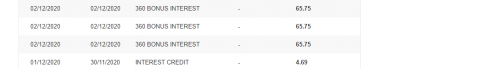

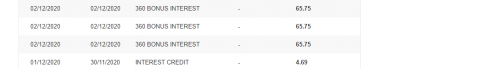

QUOTE(47100 @ Dec 26 2020, 10:04 PM)  hi all, is this what max we can get from 100k cap for the 360 account after fulfil all criteria? Yes. |

|

|

|

|

|

GrumpyNooby

|

Dec 29 2020, 10:22 AM Dec 29 2020, 10:22 AM

|

|

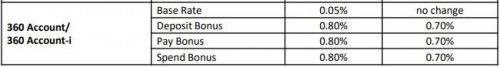

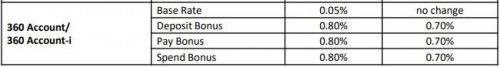

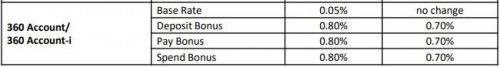

[28/12/2020] REVISION ON INTEREST RATES / PROFIT RATES FOR OCBC 360 ACCOUNT/-i, BOOSTER ACCOUNT/-i, PREMIER BOOSTER ACCOUNT/-i EFFECTIVE 1 JANUARY 2021We are revising Interest Rates/Profit Payments starting 1 January 2021 for the following accounts -  PDF link: https://www.ocbc.com.my/assets/pdf/Accounts...nt_28122020.pdfronnie Please change to 2.15% for thread title! This post has been edited by GrumpyNooby: Dec 29 2020, 10:24 AM

|

|

|

|

|

|

GrumpyNooby

|

Jan 2 2021, 02:41 PM Jan 2 2021, 02:41 PM

|

|

QUOTE(Tinkai @ Jan 2 2021, 02:14 PM) I tried to read Frank's TnC and have not found any mentions of maximum amount eligible for the 1.8% interest (or I've missed it). Anyone knows? It's a saving account and like other saving account, there shouldn't be any max amount. For PIDM protection, it's up to RM 250k. |

|

|

|

|

|

GrumpyNooby

|

Jan 2 2021, 02:50 PM Jan 2 2021, 02:50 PM

|

|

QUOTE(Tinkai @ Jan 2 2021, 02:47 PM) Yeah cause OCBC 360 has a 100,000 cap on amount eligible for bonus interest. That's good to hear  Banks are smart and they're not willingly to do losing business especially OCBC. If there's a upper limit, they'll express explicitly in their product T&C and PDS. |

|

|

|

|

|

GrumpyNooby

|

Jan 5 2021, 08:35 AM Jan 5 2021, 08:35 AM

|

|

QUOTE(GrumpyNooby @ Dec 29 2020, 10:22 AM) [28/12/2020] REVISION ON INTEREST RATES / PROFIT RATES FOR OCBC 360 ACCOUNT/-i, BOOSTER ACCOUNT/-i, PREMIER BOOSTER ACCOUNT/-i EFFECTIVE 1 JANUARY 2021We are revising Interest Rates/Profit Payments starting 1 January 2021 for the following accounts -  PDF link: https://www.ocbc.com.my/assets/pdf/Accounts...nt_28122020.pdfronnie Please change to 2.15% for thread title! Seems like the cut also happens to their SG product: OCBC again cuts interest rates on flagship 360 savings accountSINGAPORE (THE BUSINESS TIMES) - OCBC will again lower the interest rates on its flagship savings account, marking its fourth round of revisions since May last year. From Feb 1, balances up to $25,000 in the OCBC 360 account will earn 0.3 per cent in salary credit bonus interest, down from the prevailing 0.4 per cent established last October. https://www.straitstimes.com/business/banki...77Etb0LbwTOvFAM |

|

|

|

|

|

GrumpyNooby

|

Jan 18 2021, 03:23 PM Jan 18 2021, 03:23 PM

|

|

QUOTE(sabrina222 @ Jan 18 2021, 03:20 PM) this or SC privillege better ah? In term of interest rate, SC PSA is better but do note of the additional requirement to fulfill starting 1/2/2021 |

|

|

|

|

|

GrumpyNooby

|

Jan 18 2021, 03:35 PM Jan 18 2021, 03:35 PM

|

|

QUOTE(sabrina222 @ Jan 18 2021, 03:34 PM) ocbc indeed kinda easy to fulfill, but how does the credit card benefit compares with SC? Visit SC thread for details. Both most popular cards JOP and LFC have recent card benefits revision. |

|

|

|

|

|

GrumpyNooby

|

Jan 18 2021, 03:58 PM Jan 18 2021, 03:58 PM

|

|

QUOTE(sabrina222 @ Jan 18 2021, 03:57 PM) which CC from OCBC is gooding for local retail spending? or OCBC CC is trash lol Sorry I don't have OCBC credit cards. |

|

|

|

|

|

GrumpyNooby

|

Jan 18 2021, 04:12 PM Jan 18 2021, 04:12 PM

|

|

QUOTE(sabrina222 @ Jan 18 2021, 04:11 PM) i tot one of the requirements is to spend 500 using their CC? Yes. You nay try OCBC Titanium card. 360-i can or need to spend using debit card. This post has been edited by GrumpyNooby: Jan 18 2021, 04:12 PM |

|

|

|

|

|

GrumpyNooby

|

Feb 16 2021, 02:09 PM Feb 16 2021, 02:09 PM

|

|

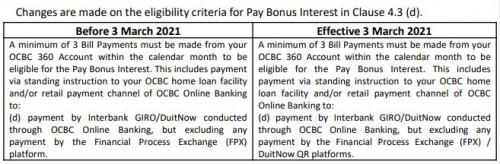

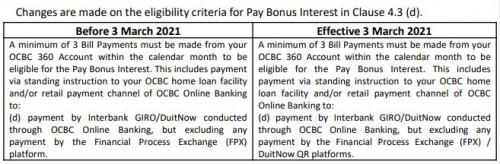

[11/02/2021] Revision of OCBC 360 Account/-i Terms and ConditionsThe Bank has revised the Terms and Conditions (T&C) for the OCBC 360 Account/-i.  This revised Terms and Conditions will take effect on 3 March 2021. Please refer to this document for a summary of the key changes. https://www.ocbc.com.my/assets/pdf/Accounts...nC_11022021.pdf

|

|

|

|

|

|

GrumpyNooby

|

Feb 16 2021, 08:41 PM Feb 16 2021, 08:41 PM

|

|

QUOTE(mamamia @ Feb 16 2021, 08:32 PM) So, it is just add on the exclusion for Duitnow QR.. I read for few times only manage to find the difference.. 😅 FPX + DuitNow QR right? |

|

|

|

|

|

GrumpyNooby

|

Feb 16 2021, 08:42 PM Feb 16 2021, 08:42 PM

|

|

QUOTE(mamamia @ Feb 16 2021, 08:42 PM) OK. Sorry, you're right. |

|

|

|

|

|

GrumpyNooby

|

Feb 16 2021, 09:07 PM Feb 16 2021, 09:07 PM

|

|

QUOTE(rocketm @ Feb 16 2021, 09:03 PM) Some bank will use instant transfer as DuitNow. Does it mean we cannot use instant transfer to non-ocbc account to qualify for the Pay bonus? Don't get confused between DuitNow and DuitNow QR. DuitNow QR is primarily for QR code scanning via banking app. |

|

|

|

|

|

GrumpyNooby

|

Mar 8 2021, 04:34 PM Mar 8 2021, 04:34 PM

|

|

QUOTE(cclim2011 @ Mar 8 2021, 04:31 PM) got got. i already explained somewhere July last year (playing maybank games la, earning interest in other banks la etc) and the lady seems ok). i think coz i still have FD then that they could not close it. That lady should be fired for saying OK. |

|

|

|

|

|

GrumpyNooby

|

Mar 8 2021, 04:57 PM Mar 8 2021, 04:57 PM

|

|

QUOTE(cclim2011 @ Mar 8 2021, 04:55 PM) ya bit shocking. coz last week one day before my fd mature a lady called say will close my fd account. or ask me go branch to close (i reluctant la). so i said what happened if i dont go, she said my fd account will be closed. I said ok la close la since it is online fd anyhow. then she said ok sure. like that only la for warning. 😅 That's not warning at all. |

|

|

|

|

Oct 12 2020, 03:06 PM

Oct 12 2020, 03:06 PM

Quote

Quote

0.1079sec

0.1079sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled