QUOTE(river.sand @ Aug 4 2016, 12:03 AM)

Assuming there are two small cap funds, A and B.

Top 5 stocks of A: 1, 2, 3, 4, 5

Top 5 stocks of B: 5, 6, 7, 8, 9

Fund A bought stock 5 at 1.00;

Fund B bought stock 5 at 1.50;

Current price: 1.40

Question: Is owning 2 small cap funds a bad idea?

P/S The term diworseification was coined by Peter Lynch. It refers to scenarios whereby a company diversifies into segments it has no advantage, e.g. plantation firm enters into banking. Nothing to do with UTF portfolio.

I obviously do not read enough financial literature to be able to quote famous people

On your POV/argument, there are some merits, but in the basic economic theory, we learn that we have limited resources and therefore the idea is to deploy it to the area where we would gain the most (was it utility?)

So in this instance, you may get some advantages from having 2 small cap funds that may compliment each other a bit in terms of cushioning the fluctuation, but largely they would move in the same direction because they invest in the same market.

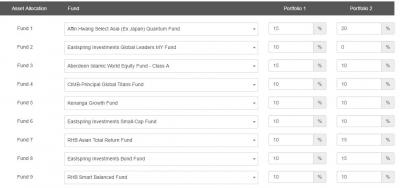

Based on what we've seen; the sharpe ratio is significantly more superior for EI small cap compared to CIMB small cap. So if you invest in these 2 funds equally instead of putting 100% in EI small cap, back test would show that you make a lot less. Of course no one can predict the future, but using historical data as a guide, the possibility of CIMB small cap performing at par or overperforming EI small cap is somewhat remote.

Then the question is, does the cost (lower returns) outweigh the benefit (fund house diversification)?

To me, the answer is no, not when both funds are in the same segment.

Diversification across different segment is a totally different topic though. Because the funds in each segment does not move in the same direction, in fact, some move in opposite direction. Then going back to the same cost benefit analysis, the cost is still lower returns, but the benefit is significantly lower portfolio volatility. The answer to me is, yes, it's worth the potentially lower returns, because the portfolio would be a lot more stable

They are useful for SOME stuff heeheh

They are useful for SOME stuff heeheh

Jul 21 2016, 09:47 PM

Jul 21 2016, 09:47 PM

Quote

Quote

0.0931sec

0.0931sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled