QUOTE(guy3288 @ Aug 11 2016, 07:17 PM)

got some la, i see u very good at shares, share some tips la if buying .

must follow what you buy next.

i dont know how to use that, better follow you guys who have done alot of calculations, research etc..

thanks, i am keeping your views in mind.. the 3 Ut u singled out for sale.

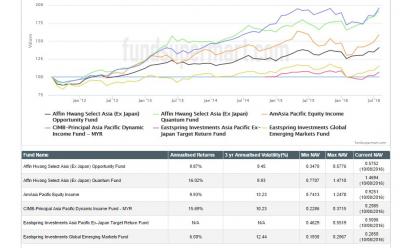

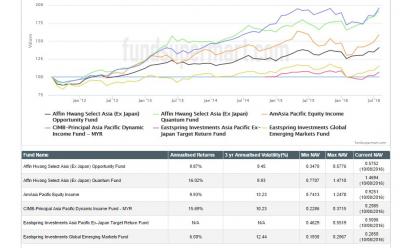

attached is the IRR table from polarsbearz's

But if i look at the IRR in there,

the Affin Hwang Asia opportunity is 7.64%, is this not good?

Pacific Globar star IRR also 6.25%

Eastspring Investment Global emerging market IRR 19.17%!,

now i really dont know how useful is this IRR ....

( i have bought and sold and bought back those UTs)

But if look at virgin UTs in my portfolio, the ones i bought once, never sell yet and no re-buy.

RHB Asian Total returns IRR 2.06%

Eastspring Investment Asia Pac Ex japan target IRR 2.66%

Am i right to conclude they are not productive? better sell off..

thanks

The IRR information is a lot more meaningful and I agree with ur conclusion to dump that 2 funds with low IRR while you can

I noticed you have the same funds that u put in both inactive and current holding. What I would do is as long as I still hold those funds, I'd put them all in active so that I can calculate the effective IRR for that fund. Kinda help to monitor if overtime u end up buying high n selling low also

In terms of diworsification that we spoke lately, you do have a lot of funds for a single segment. Consider to consolidate them, that for each segment you only put in 1 or 2 strongest performance funds. I'm guilty of that too actually

I would use chart center function and put all those funds in the same segment n compare their performance for mid-long term to decide which one to go for. IRR very much depends on your entry price but there may be better performance funds in the same segment

Edit: On laptop can show you the chart centre graph

Since you held most of the funds for quite a while, I used 5 years annualised for a comparison. Remember I say I don't like EI global emerging market fund? Look at the annualised return, only 6% compared to the rest mostly double digit returns.

As to HSAO, it's a lot less than ponzi1.0. I was cursing AmAsiaPac Eqt income earlier, but recently it's regaining lost grounds, so I'm playing 'wait and see' for now

You should do the same for your global and local funds to help you decide what to keep n what to dump

This post has been edited by dasecret: Aug 12 2016, 10:37 AM

Aug 6 2016, 12:20 AM

Aug 6 2016, 12:20 AM

Quote

Quote

0.0592sec

0.0592sec

0.67

0.67

7 queries

7 queries

GZIP Disabled

GZIP Disabled