Btw congratulations to all who shorted the FKLI for the past 2 days. Double the profit already

STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Aug 4 2020, 02:43 PM Aug 4 2020, 02:43 PM

Return to original view | Post

#81

|

Senior Member

2,282 posts Joined: Sep 2019 |

Btw congratulations to all who shorted the FKLI for the past 2 days. Double the profit already

|

|

|

|

|

|

Aug 4 2020, 02:46 PM Aug 4 2020, 02:46 PM

Return to original view | Post

#82

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(lowya @ Aug 4 2020, 02:44 PM) semiconductor growth intact, fund likely moving from glove to semiconductor. btw Harta is overvalued. The only thing I know is foreign fund keep flowing out of Malaysia Only local retailers and institution are tanking the market. Our government need to do something about this. We need more FDI |

|

|

Aug 4 2020, 03:16 PM Aug 4 2020, 03:16 PM

Return to original view | Post

#83

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Aug 4 2020, 03:17 PM Aug 4 2020, 03:17 PM

Return to original view | Post

#84

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Aug 4 2020, 03:34 PM Aug 4 2020, 03:34 PM

Return to original view | Post

#85

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Aug 4 2020, 03:36 PM Aug 4 2020, 03:36 PM

Return to original view | Post

#86

|

Senior Member

2,282 posts Joined: Sep 2019 |

Today V shaped rebound was a good show

|

|

|

|

|

|

Aug 4 2020, 04:16 PM Aug 4 2020, 04:16 PM

Return to original view | Post

#87

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Aug 4 2020, 04:25 PM Aug 4 2020, 04:25 PM

Return to original view | Post

#88

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(ry8128 @ Aug 4 2020, 04:14 PM) Yes, really mind blown. Even when it goes to 10, many ppl say its very expensive that time. Maybe, as long as people buy, it will go up. Still have few weeks until Sept 30, If all glove holders (and other counters of course) to switch to these stocks, easily limit up everyday because they are still no pricey.Just wondering will stocks like notion and adventa is the '4.65 tg' kind of stocks now. 1 unit TG holder when they sell can buy about 15 units in Notion. Just write a convincing article to lure ppl to support your counter. |

|

|

Aug 4 2020, 04:37 PM Aug 4 2020, 04:37 PM

Return to original view | Post

#89

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(key3hky @ Aug 4 2020, 04:24 PM) I PERSONALLY am expecting it to plauteau for a very short while 1st and then a fast sell down every month with people slowly cashing out for monthly loan repayment. The faster it climbs, the faster i drops. A counter value is not created by plowing fund into it, so that the price rises, but is created through time.UNLESS people only bought with their FDs, which they do not need for loan repayment. Look at our beloved largest market cap public bank 24.7 to 14 erased 43% from the peak in about a year time (they might have share split - so might be lower than 43% reduction, but I am too lazy to dwell into the details, just an example to show that once public is no longer confident in the counter, can say bye bye already) This post has been edited by HereToLearn: Aug 4 2020, 04:39 PM |

|

|

Aug 4 2020, 04:43 PM Aug 4 2020, 04:43 PM

Return to original view | Post

#90

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Aug 4 2020, 05:21 PM Aug 4 2020, 05:21 PM

Return to original view | Post

#91

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Rainings @ Aug 4 2020, 05:13 PM) what a rollercoaster day for glove counter, 20days ago catch bull run and holding Kossan sold all and gained 26% today. By covering all lost from AA still profit, not bad. Old news, March already have article published thisAltho realistically most of the glove counter really overpriced for now, but ppl just dont care. All the glove shareholder will not agree with this news https://www.thestar.com.my/lifestyle/health...revent-covid-19 LOL, luckily you post it, not in gloves specific i3 forum. If not, people there will curse your father mother. |

|

|

Aug 4 2020, 05:43 PM Aug 4 2020, 05:43 PM

Return to original view | Post

#92

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(skty @ Aug 4 2020, 05:26 PM) look at the value of the company. not compare pricing with each other. Good sharing. The only reason I do not dare to touch the gloves is because of unsustainable burst of earnings.for glove stock, because the burst of earning is not sustainable in the long run, look at short term future value of the company. With the increased ASP and pent up demand, short term value sure looks good. Since I cant time when will the biggest share holders leave the gloves, I choose not to participate and missed the huge rally However, this is a very good learning experience for me: looking at short term earnings and following the trend when it is still early is a very solid profitable strategy. This post has been edited by HereToLearn: Aug 4 2020, 05:56 PM |

|

|

Aug 4 2020, 11:33 PM Aug 4 2020, 11:33 PM

Return to original view | Post

#93

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(skty @ Aug 4 2020, 11:17 PM) manage well your portfolio and arrange it according to your risk tolerance. Exactly, I think my mistake was that I focused too much on fundamentals (which is within my comfortable area of expertise) and ignored the market sentiment (trading frenzy frend).when someone is new to Bursa, everything seems risky to him/her, and miss out opportunity. when someone is old timer in Bursa, everything seems not risky to him/her, and risk of stepping into mines. since our funds are limited, everything that we do has opportunity cost. The most stupid way is hold on to cash which guarantee at least losing 2% of its value every year. Whereas put into FD will cost your big opportunity cost. whenever you do something, always ask yourself, is there a better way of doing it based on your knowledge. always be grateful when you lose money in stock market and cherish the feeling of that moment because you are one step closer to be a good investor. Set principles from every mistake so you won't repeat it again. The feeling also will help you remember it forever. |

|

|

|

|

|

Aug 4 2020, 11:44 PM Aug 4 2020, 11:44 PM

Return to original view | Post

#94

|

Senior Member

2,282 posts Joined: Sep 2019 |

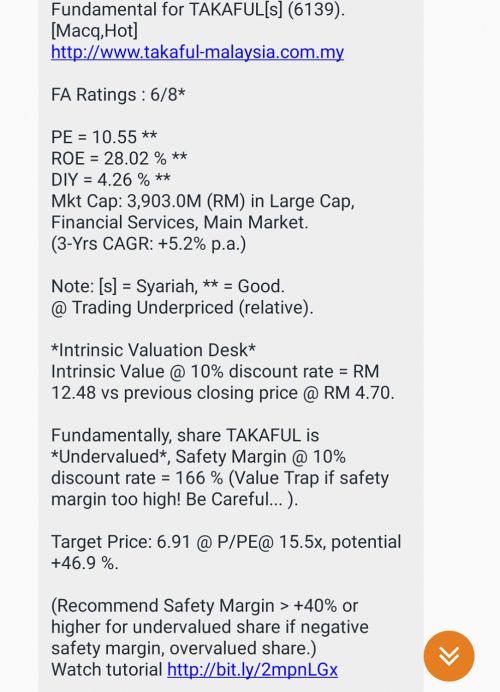

QUOTE(flashy4896 @ Aug 4 2020, 08:11 PM) https://www.youtube.com/watch?v=KoOEE8GI-KoTo go big, buy small cap stocks with good fundamentals. I am not too comfortable sharing my picks here because I am afraid that I might unintentionally bring you guys go holland. Here are the 2 very undervalued mid cap stocks that I own (at least these stocks are still known by some and has lesser chance to bring u guys go holland) 1. BIMB 2. Takaful I did my own calculations to value the stock but below images attached are the valuation made by a software   |

|

|

Aug 5 2020, 09:32 AM Aug 5 2020, 09:32 AM

Return to original view | Post

#95

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(eltaria @ Aug 5 2020, 09:30 AM) Hi guys, just wanna ask your opinions on Property stocks. Not yet, just look at the surge in auction properties. Too many property overhang unitsIt's not glove/covid play, which i guess is the hot topic right now, but if your looking at a 6-12 months investment horizon, it's probably a good buy, with 20++% returns? Most property stocks is still at a depressed price, although some like Mahsing have recently recovered back to their late '19 / early 2020 price. Fundamentally, assuming 18 year cycle for property, we're about time to exit the recession phase and could have already just started the recovery phase to a new property cycle. What do you think on Property stocks? Worth to buy? |

|

|

Aug 5 2020, 09:37 AM Aug 5 2020, 09:37 AM

Return to original view | Post

#96

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(AVFAN @ Aug 5 2020, 09:34 AM) imo, no recovery n sight - housing overhang, plenty unsold, many overgeared, in trouble. I was very shocked when i heard about this, not sure how they are going to pull it through. Maybe they are just trying to upsell their shares, like how they upsold their propertiesthose with gomen infra projects maybe ok. Mahsing - it is recovering due to announcement it is venturing into "healthcare plastics". |

|

|

Aug 5 2020, 10:06 AM Aug 5 2020, 10:06 AM

Return to original view | Post

#97

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(eltaria @ Aug 5 2020, 09:45 AM) Okay, i guess, the lelong side is true la, personally, I'm also looking at the lelong market now to get a unit. The 20% gain can be achieved from a rebound of current price to may/june 2020 prices, even if we exclude the possibility of recovering back to late 2019 prices (which could be ~50% gain) - pretty sure you hear this from property gurus.The 20% gain can be achieved from a rebound of current price to may/june 2020 prices, even if we exclude the possibility of recovering back to late 2019 prices (which could be ~50% gain) The HOC, lowering of foreign purchasing limit to 600k++ and low interest rate will not be effective in raising demand? I'm thinking it's really beaten up, any bounce can net u the 20% gain, and assuming the bottom has been achieved at the covid 19 panic/force sell in march period, downside is rather limited, no? I am not so confident about the prices rebounding soon (just like share, price is only as good as what the next buyer is willing to pay). With the property sentiment (this is not the gloves hype, where people will be happy to keep buying at higher prices like property boom back in 2012-2015) being so bad, I dont think it is wise to even buy one now as there are so overvalued (negative gearing properties: Rental yield (including SPA, loan, stamping fee) CANNOT cover loan interest + maintenance fee). Buying for investment is not recommended. There are still a lots of yet to be completed units. After MCO, they will return to work and there will be more supply in the near future (check NAPIC data). This will further suppress the rental yield. If you are aiming for urban properties, they will be worse. With WFH getting more popular and becoming the norm, the demand to stay in the urban area will be further suppressed, and the rental yield will get more fcked. Buying for own stay - I have no comment, as long as you and your family live happily This post has been edited by HereToLearn: Aug 5 2020, 10:06 AM |

|

|

Aug 5 2020, 10:54 AM Aug 5 2020, 10:54 AM

Return to original view | Post

#98

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Aug 5 2020, 11:05 AM Aug 5 2020, 11:05 AM

Return to original view | Post

#99

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Coup De Grace @ Aug 5 2020, 10:52 AM) Meaning many gambling loving people and aunties/unker are buying gloves Price already went far ahead of the fundamentals for a very long time. So the price will not follow the fundamentals..people expecting times 3-5 of last quarter profit Even some of colleagues started investing in gloves and tech If expectation is not met, the price will crash badly But the herd buying power is too strong, everyone is having unrealized profit with more ppl buying, and they then share to the others, finding more funds to push the profit even higher. Some people even sold their undervalued stocks because they cannot resist the possible 10-100% gain in a day via trading than investment, driving the undervalued stocks even lower. Quoting icemanfx, only when the new fund is exhausted, this frenzy can be stopped. So when will this new fund exhausted? IMO, very soon as NOW we are already seeing people are switching money from one glove stocks to another or from gloves to penny. The rate of new funds coming in are slowing down. But definitely, retailers fund OUTFLOW will increase at an increasing rate after the moratorium ends |

|

|

Aug 5 2020, 12:32 PM Aug 5 2020, 12:32 PM

Return to original view | Post

#100

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(lowya @ Aug 5 2020, 12:23 PM) with such a thin margin business of merely 2.7%, i would not buy either. Some more the vaccine is more like a hoax or fake news. Think first before u attack anyone blindly. Anyway if there are enough monkeys chasing after banana, banana price will go up. It's up to you to be a monkey or not. He himself know gloves price are only as good as what the next buyer is willing to pay for, need to find people to support his counter |

| Change to: |  0.0840sec 0.0840sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 11:13 PM |