during the early stages of cov19, the thinking process we all went thru was...

1. this is scary, markets are falling... so, sell, sell, sell.... pandemonium... most people sold, some held on.

2. 3 months into it... curve flattened, cure coming, vaccine coming, V shape... dun sell, buy if u can.

3. 6 months into it... some places contained, some not... curve not good, resurgence in many countries... but "vaccine soon" still a strong hope.

4. currently... we should realize this cov19 isn't going away anytime soon, mco might even return... it has killed many biz, helped others flourish.

5. near future... i don't see a cure, i dun see a vaccine... not for another year at least... a lot of hot air blown by politicians for own purpose.

now, if we look back... it was only obvious that sectors for tourists, travelers, shoppers, public entertainment will be the worst hit.... how come we didn't think of that earlier?!!

sectors with gadgets, services, delivery logistics that fit into home working, home entertainment, home biz will flourish.... how come we didn't think of that earlier?!!

now, we see apple, google, amazon all blowing past their earnings reports.. such glory.

airlines... boeing, airbus, sia, airasia, shell, bp... all going into the abyss... are we still surprised?

my own experience... i dumped all my reits (sg ones, not bursa).. now i see capitamall, suntec falling and falling... becos these are retail, shopping ones.

i see keppel dc (data center), mapletree ind (logistics) rising and rising. well, on hindsight i did something right, something else wrong.

at this time... what will we see that will continue to sell down, what will continue to rise, what will change course?

some may still think cure/vaccine will come tmr, everything returns to normal... so, buy oil/gas, banks, cheap mall/hotel/tourism reits?

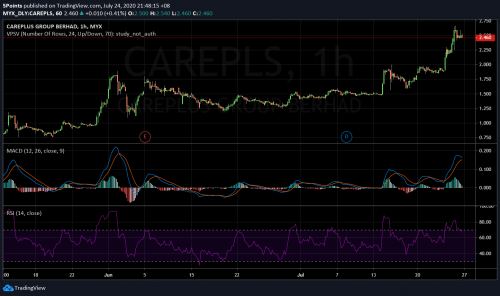

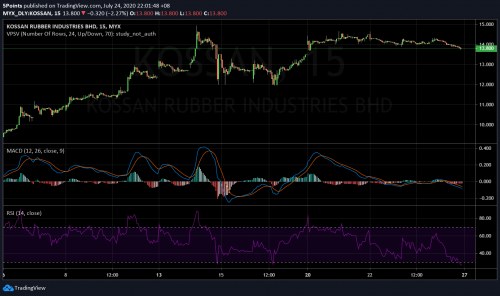

or should we go for more tech devices, more tech services, more home services, logistics, medical protective gear?

your direction is correct but you complicate things.

Jul 8 2020, 06:50 PM

Jul 8 2020, 06:50 PM

Quote

Quote

0.6207sec

0.6207sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled