QUOTE(Boon3 @ Jun 16 2022, 01:57 PM)

Yes, it's the assumption that for a stock like Tenaga, which had a monopolistic business, should be a good stock.

An assumption.

But how true is this assumption?

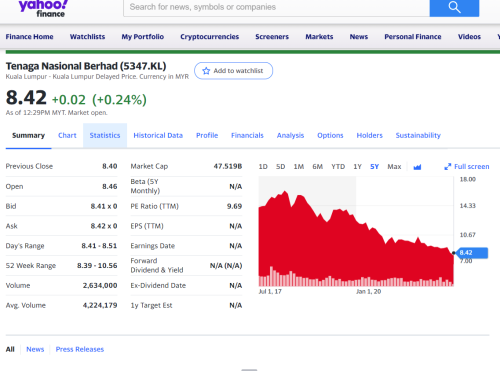

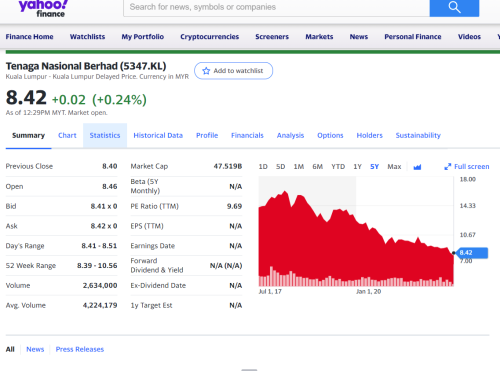

How about a quick look see at the stock's 5 year performance?

Reasoning is... if the stock performance for the last 5 year had been shit, that logically tells that the assumption that a stock with monopolistic business, makes good investment is flawed. Something is wrong here with that assumption.

well here it is...

Using Yahoo finance, that's the quick snapshot of how Tenaga has fared the past 5 years...

One can clearly see that Tenaga had been a horrible stock for it's investors.

It was trading as high as rm16++ in 2018. It's now only 8.42!!!

Yup, if Tenaga is so good and what not... why is the stock in a strong downtrend the past 5 years? (this needs to be answered!)

And clearly, using simple logic, investing a stock solely for its dividends is NOT RISK FREE!!

Tenaga showed it very clearly. You can get the so called 'good' dividends (DY) but yet, you 'could' still lose money....

ps... this stock had been discussed many a times before. Searchable.

Leaving the past / historical data behind, lets future look at whats ahead for malaysia..... assumption that its still the only monopolistic business in malaysia.... do u think it will grow with all of us using so much energy everyday? from your airconds, multiple gadgets, etc.... who else if not Tenaga to supply us electricity? Maybe u can provide another same size player as Tenaga? i hear crickets..... Tenaga share price may be down now.... but nothing last forever .... then again i can only guesstimate that tenaga will rise again.... welcome to share ur tots.An assumption.

But how true is this assumption?

How about a quick look see at the stock's 5 year performance?

Reasoning is... if the stock performance for the last 5 year had been shit, that logically tells that the assumption that a stock with monopolistic business, makes good investment is flawed. Something is wrong here with that assumption.

well here it is...

Using Yahoo finance, that's the quick snapshot of how Tenaga has fared the past 5 years...

One can clearly see that Tenaga had been a horrible stock for it's investors.

It was trading as high as rm16++ in 2018. It's now only 8.42!!!

Yup, if Tenaga is so good and what not... why is the stock in a strong downtrend the past 5 years? (this needs to be answered!)

And clearly, using simple logic, investing a stock solely for its dividends is NOT RISK FREE!!

Tenaga showed it very clearly. You can get the so called 'good' dividends (DY) but yet, you 'could' still lose money....

ps... this stock had been discussed many a times before. Searchable.

Jun 17 2022, 04:45 PM

Jun 17 2022, 04:45 PM

Quote

Quote

0.0765sec

0.0765sec

0.60

0.60

6 queries

6 queries

GZIP Disabled

GZIP Disabled