QUOTE(zstan @ Jan 1 2021, 11:13 PM)

ETF in Malaysia has very very low volume and hard to trade. Better to use robo advisors like Wahed if you want access to Malaysia ETF.

QUOTE(zacknistelrooy @ Jan 2 2021, 12:06 AM)

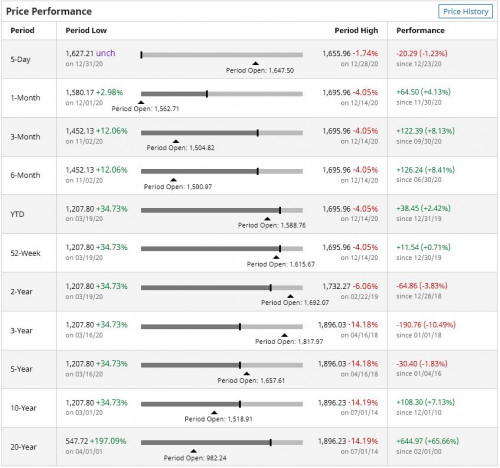

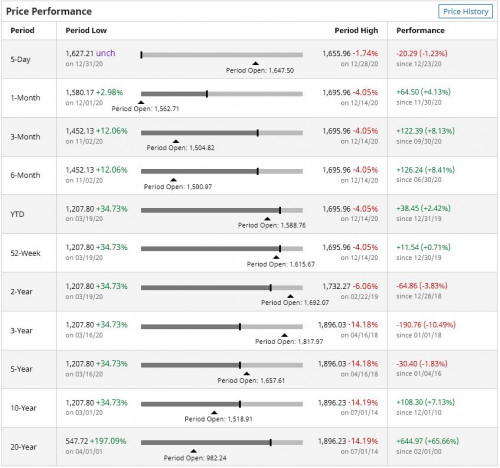

Performance for FTSE Bursa Malaysia KLCI for the past 20 years:

Cubalagi has highlighted really good points.

Depending on how much you buy, don't forget to take into account the brokerage fee on top of the total fee for the ETF which is around 0.6%.

For context the robo advisors in Malaysia range from 0.70% to 1.00% and you get geographical diversification from them.

Thanks for sharing, initially i thought of buying ETF is like the investment method propose by Buffett on S&P 500 for long term investment. My plan is to put money into it every month for 20 + years without need to check on it daily.

Cubalagi has highlighted really good points.

Depending on how much you buy, don't forget to take into account the brokerage fee on top of the total fee for the ETF which is around 0.6%.

For context the robo advisors in Malaysia range from 0.70% to 1.00% and you get geographical diversification from them.

Seem like i need to find other way for the investment... Thanks senior, i more knowledgeable today. Have a nice day.

Jan 2 2021, 08:49 AM

Jan 2 2021, 08:49 AM

Quote

Quote

0.0319sec

0.0319sec

0.86

0.86

6 queries

6 queries

GZIP Disabled

GZIP Disabled