Outline ·

[ Standard ] ·

Linear+

STOCK MARKET DISCUSSION V150

|

PathofLife

|

Jan 1 2021, 09:15 AM Jan 1 2021, 09:15 AM

|

Getting Started

|

Hi seniors, may i ask are there any ETF in bursa malaysia like S&P 500? I research a bit that Bursa BHD dividend yield equal Top 30 companies in malaysia. Link : https://aseanup.com/top-30-companies-from-malaysia-klci/Thanks and wish you all a Happy New Year. |

|

|

|

|

|

PathofLife

|

Jan 1 2021, 09:46 AM Jan 1 2021, 09:46 AM

|

Getting Started

|

QUOTE(chromatino_hex @ Jan 1 2021, 09:23 AM) Many thanks for the info. Wish you have a nice day. |

|

|

|

|

|

PathofLife

|

Jan 1 2021, 01:25 PM Jan 1 2021, 01:25 PM

|

Getting Started

|

QUOTE(lowya @ Jan 1 2021, 11:52 AM) here you go for further discussion, which one will you invest in? | KLSE Funds | Stock | | Bond Fund | ABFMY1 | | Closed End Fund | ICAP | | Commodity Fund | GOLDETF | | Equity Fund | CHINAETF-USD | | Equity Fund | CHINAETF-MYR | | Equity Fund | PAM-C50 | | Equity Fund | MY-MOMETF | | Equity Fund | METFAPA | | Equity Fund | METFSID | | Equity Fund | FBMKLCI-EA | | Equity Fund | METFUS50 | | Equity Fund | MYETFID | | Equity Fund | MYETFDJ | | Equity Fund | AXJ-REITSETF | | Equity Fund | PAM-A40M | | Leveraged And Inverse Fund | FANG-2XL | | Leveraged And Inverse Fund | KLCI1XI | | Leveraged And Inverse Fund | KLCI2XL | | Leveraged And Inverse Fund | HSCEI-1XI | | Leveraged And Inverse Fund | HSCEI-2XL | | Leveraged And Inverse Fund | FANG-1XI |

Thanks for sharing, i need to do research first. Wish you have a nice day. QUOTE(Cubalagi @ Jan 1 2021, 12:17 PM) 0820EA is a crappy ETF.. Avoid. Out of this, I can only recommend the Affin Hwang etfs. The Leverage/Inverse ETF are interesting but not everyone can play. The bond ETF by AmInvest is also not bad. But at current interest rate level, I don't see much upside, unless the economy gets worse. Thanks for the advice, Wish you have a nice day. |

|

|

|

|

|

PathofLife

|

Jan 2 2021, 08:49 AM Jan 2 2021, 08:49 AM

|

Getting Started

|

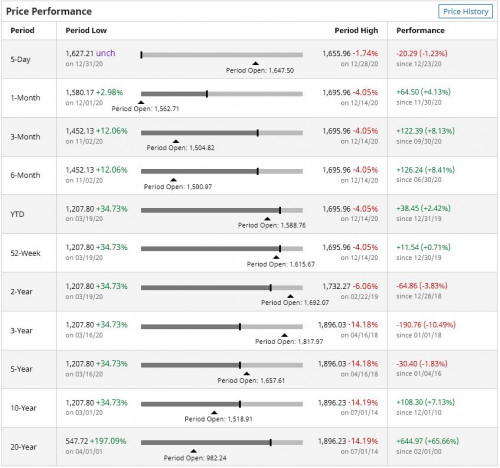

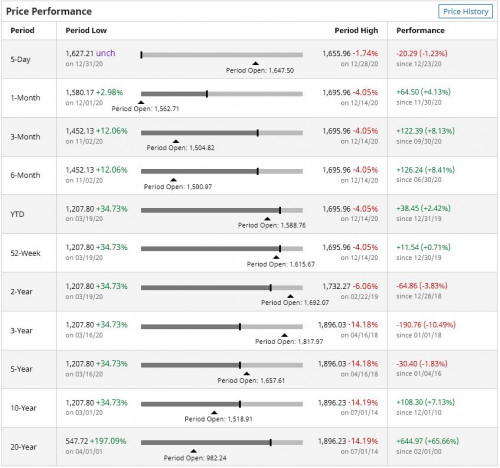

QUOTE(zstan @ Jan 1 2021, 11:13 PM) ETF in Malaysia has very very low volume and hard to trade. Better to use robo advisors like Wahed if you want access to Malaysia ETF. QUOTE(zacknistelrooy @ Jan 2 2021, 12:06 AM) Performance for FTSE Bursa Malaysia KLCI for the past 20 years:  Cubalagi has highlighted really good points. Depending on how much you buy, don't forget to take into account the brokerage fee on top of the total fee for the ETF which is around 0.6%. For context the robo advisors in Malaysia range from 0.70% to 1.00% and you get geographical diversification from them. Thanks for sharing, initially i thought of buying ETF is like the investment method propose by Buffett on S&P 500 for long term investment. My plan is to put money into it every month for 20 + years without need to check on it daily. Seem like i need to find other way for the investment... Thanks senior, i more knowledgeable today. Have a nice day. |

|

|

|

|

|

PathofLife

|

Jan 2 2021, 10:34 AM Jan 2 2021, 10:34 AM

|

Getting Started

|

Need to be more active and diversify globally n in different asset classes. [/quote] I just a have limited fund i can invest RM 500 hundred per month. At the moment not enogh capital to invest oversea. Hahaha |

|

|

|

|

|

PathofLife

|

Jan 2 2021, 01:56 PM Jan 2 2021, 01:56 PM

|

Getting Started

|

QUOTE(Cubalagi @ Jan 2 2021, 11:58 AM) Then u should consider robo advisor such as Wahed.. I am quite skeptical on this. One of it is due to i am new to this type of investment. Are they helping me to setup a portfolio or just a stake of their portfolio? |

|

|

|

|

|

PathofLife

|

Jan 2 2021, 03:00 PM Jan 2 2021, 03:00 PM

|

Getting Started

|

QUOTE(Syie9^_^ @ Jan 2 2021, 02:20 PM) just a stake in whatever you buy. miniature. What stake or STEAK or BEEF or cut do you wish on your plate.? Just wish to see how they do, after the research now i understand that they more like hedge fund and as trustee. |

|

|

|

|

|

PathofLife

|

Jan 2 2021, 03:08 PM Jan 2 2021, 03:08 PM

|

Getting Started

|

QUOTE(Syie9^_^ @ Jan 2 2021, 03:05 PM) yes, what is the collateral if all goes south?  From what i read is cap at 100 K max. Link : https://malaysiasupport.wahedinvest.com/hc/...-money-insured- |

|

|

|

|

|

PathofLife

|

Jan 2 2021, 03:52 PM Jan 2 2021, 03:52 PM

|

Getting Started

|

QUOTE(Syie9^_^ @ Jan 2 2021, 03:23 PM) cash? equity? assets which can be liquidated to pay investor cash out? OR another ponzi scheme like EPF, I cannot afford your mass cashout, so i`ll make "this for you" OR limit withdrawal take out.  I dont have an answer to that, Perhaps other senior at here have more knowledge on this. I share what i can find and understand. |

|

|

|

|

|

PathofLife

|

Jan 2 2021, 03:58 PM Jan 2 2021, 03:58 PM

|

Getting Started

|

QUOTE(Syie9^_^ @ Jan 2 2021, 03:53 PM) actually you dont, but they supposedly to have for you if you plan to go with any of them. Unlike stock market. Oh i see, thanks for advice. |

|

|

|

|

|

PathofLife

|

Jan 2 2021, 08:36 PM Jan 2 2021, 08:36 PM

|

Getting Started

|

QUOTE(Cubalagi @ Jan 2 2021, 07:16 PM) What is this research? Robo advisers are not hedge funds. Different model. As understanding so far robo adviser will help me created a profile regardless of my initial fund. If i have 2 k, surely they will have to purchase the value of the same value. Hence, they only way to do it isn't you need to buy a part of an existing fund in which is grouping a large sum of money in one investment fund? Correct me if i am wrong on this part as i am still new on this... |

|

|

|

|

|

PathofLife

|

Jan 2 2021, 10:10 PM Jan 2 2021, 10:10 PM

|

Getting Started

|

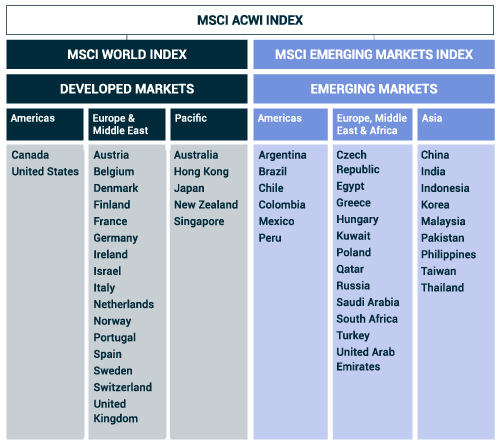

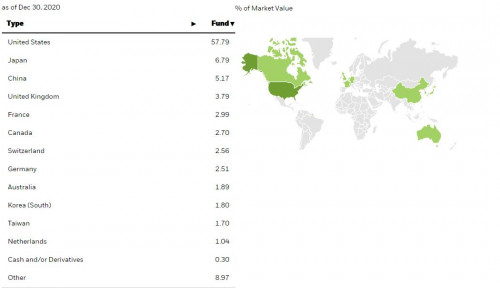

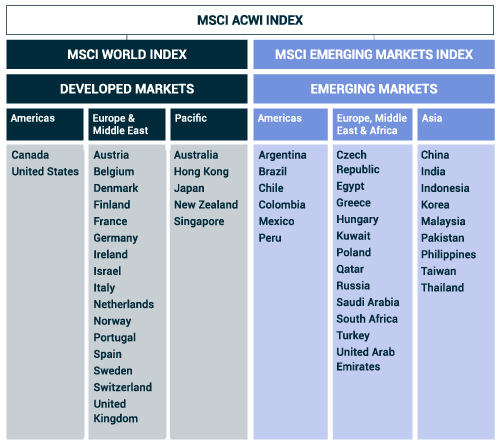

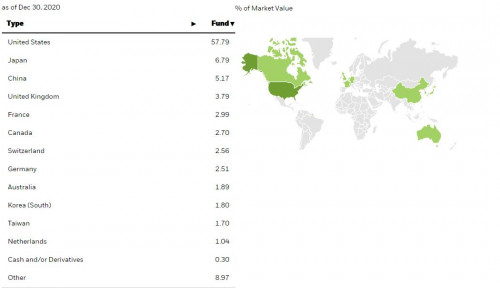

QUOTE(zstan @ Jan 2 2021, 07:48 PM) wahed doesn't have direct access to your funds. the funds will be held by a trustee company. wahed will just instruct the trustee to buy and sell. if wahed or stashaway goes bankrupt the assets held will be sold and liquidated. QUOTE(zacknistelrooy @ Jan 2 2021, 08:48 PM) Yes you can do what Buffet has recommended but one has to spread the risk. For context on how small Malaysia is based on the MSCI ACWI Index that has an allocation of around 0.21%.   If you already have investments in Malaysia then it would be best to get allocation close to the above and that can be achieved by robo advisors or doing it yourself which requires more work. If you would like to know more about Robo-advisors in Malaysia then the links below maybe helpful. https://www.comparehero.my/investment/artic...visor-to-investhttps://www.imoney.my/articles/robo-advisor-comparisonQUOTE(zstan @ Jan 2 2021, 08:49 PM) yes the entry point is very low. only need RM100. no brokerage fees for every transaction. only annual fees. First of all thanks for sharing all these info to help a newbie like me. Since it has low entry, i will give a try. Stay blessed. |

|

|

|

|

Jan 1 2021, 09:15 AM

Jan 1 2021, 09:15 AM

Quote

Quote

1.2993sec

1.2993sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled